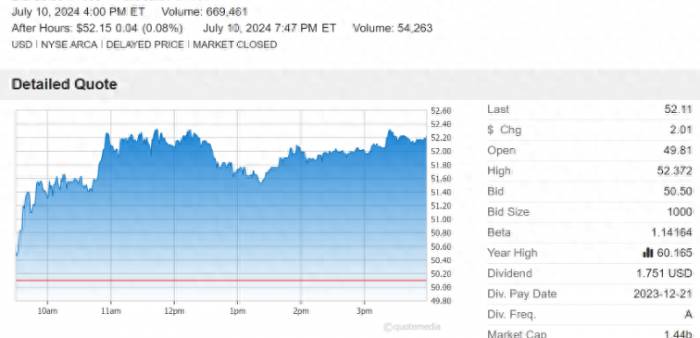

The market at present is simply not leaving any room for retail investors to survive, with a continuous downtrend that's like a dull knife cutting flesh, causing a slow death for retail investors, which is truly disappointing and heartbreaking. Today, the Shanghai Composite Index closed at a new low for this phase, seemingly about to break through the 3000 point mark, but it was pulled back. From historical experience, the defense of the 3000 point level rarely succeeds, it might as well break through early and let the stone fall to the ground, so that everyone won't be so entangled. Today's lowest point during the session was 3001.77 points, and the half-year moving average for today happened to be at 3001.77 as well, whether this support is effective or just a smokescreen by the main force? What is the current trend of the market? How should retail investors respond? Next, we will analyze in detail so that friends can see the direction clearly and not fall into the traps set by the main force.

Shanghai Composite Index daily trend

If you follow the market trend closely, this round of sharp decline can be well avoided.

From the top of 3174 points to 3001 points, it has already fallen more than 170 points, and most individual stocks have fallen by about 25%-30%, which is very destructive, close to the stock disaster during the Spring Festival. Seeing so many friends who are deeply trapped being tortured by this ruthless market every day, it does make one feel sympathy, but the stock market is so ruthless, never believing in tears, if you want to survive for a long time, you still have to respect the objective reality and not go against the market trend.

From the closing reminder on May 22, when the market broke through 3156 points, it was necessary to choose to leave and wait and see. Every day in between, we repeatedly reminded everyone that the market is still in a downtrend, do not be impulsive and blindly intervene. Now looking back, our kind reminder is extremely correct, and we are sincerely doing our best to help everyone avoid the market's sharp decline. During this continuous decline, there have also been rebounds, so what, is there any room for operation? Is there a profit effect? How many K lines have left long upper shadows, directly trapping you in the market, followed by several consecutive days of sharp declines, not giving any opportunity to untie the knot. You won't realize it in one or two days, only our old friends who have been following us for a long time know how we are not manipulated by the main force.

Closing article on May 22

Before breaking through and standing firm at key points, the downtrend will not change, and I have clearly told everyone the key points every day. Yesterday's closing article asked everyone to focus on the competition at 3028 points today, and the highest point today was 3028 points, but it just touched it slightly and quickly fell back, indicating that there is still pressure, and it has not stood firm at the key point we mentioned, so there is no basis for the reversal of the downtrend at present, so we also warn everyone to continue to be cautious and wait and see. I hope everyone can understand that the points we mentioned are not said casually, they are key points that affect the trend, so they must be taken seriously enough.

Closing article on Wednesday

Today's market situation

1. Although the Shanghai Composite Index did not fall much today, the Shenzhen Component Index and the ChiNext Index fell significantly, and the short-term trend further weakened. Before the Shanghai Composite Index fully recovers, it will be difficult for these two indexes to have a sustained market. Today's total trading volume of the two cities is still in a state of extreme contraction, with a total of only about 725.9 billion, and before the trading volume effectively increases, combined with the current market trend, we don't need to have any expectations.2. From a financial perspective, the domestic capital main force has once again revealed its fierce teeth today, with a total outflow of around 33.9 billion yuan at the close. It's no wonder that more than 4,400 stocks fell in the market.

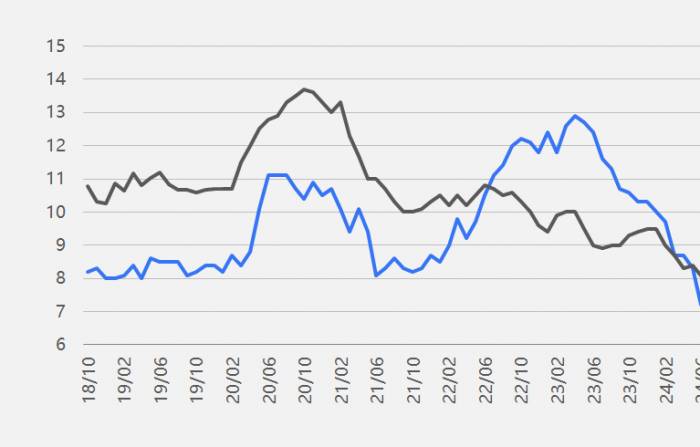

3. Performance of Specific Indices

The data above indicates that today was another day of a complete rout, with significant declines across the board. Only the Shanghai 50 Index slightly outperformed the broader market. Small and micro-cap stocks fell more than 1.4%, significantly underperforming the market, and the loss effect today was very pronounced. Without a genuine stabilization of the broader market, although there have been some rebounds in small and micro-cap stocks recently, as I have mentioned, their sustainability is questionable. Without a stable environment, it is unrealistic to expect them to stage a completely independent rally. Therefore, despite the distortion of the Shanghai Composite Index, we still have to study it.

4. In terms of sectors, only five sectors ended the day in the green, which are Education, Semiconductors, Precious Metals, Medical Services, and Coal Industry. We have been analyzing the Semiconductor sector for you for three or four consecutive days, and it has been following our trend. Today, it continued its upward momentum, and its popularity is currently very high. Since everyone is currently concerned about the trend of this sector, we will continue to analyze it for you.

At the daily level, it rose by 1.72% with increased volume, closing at 1062.46 points. The index is currently above all trend lines, and the short-term upward trend remains unchanged. However, as you can see, today's intraday fluctuations were quite intense, with a phenomenon of rising and then falling back, leaving a relatively long upper shadow on the K-line, which has made many friends wary. Is the short-term top approaching? As we always say, there is no need for subjective speculation; just follow the market. Tomorrow, the line of attack will move up to around 1050 points. As long as the index does not effectively break below this level, the trend will not undergo a substantial change, and there is no need for blind worry.

Daily Level Trend

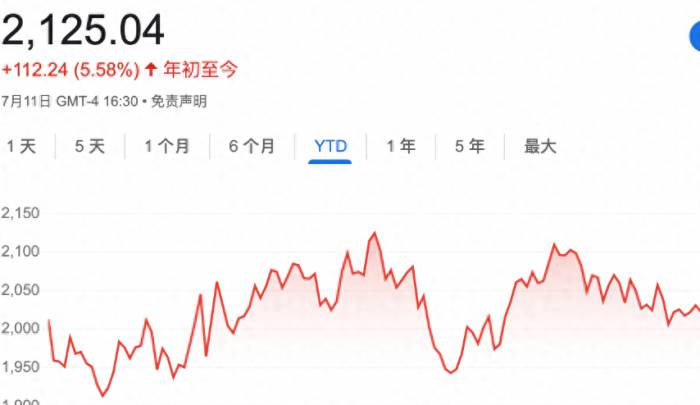

Will there be a rebound in Friday's market trend analysis?

The current continuous volume contraction and slow decline are the most tormenting, and I believe that most retail investors have been worn down and have lost their temper. They either cut their losses and leave or choose to lie flat. We all hope that the market will improve, quickly bottom out, and usher in a rebound. However, the market will not operate according to our subjective desires, so we must return to the market itself and analyze the current trend rationally and objectively in order to make the correct trading decisions.

At the daily level, the index is currently below all trend lines, and the downward trend is obvious, with no change. Since it is still in a downward trend, there is nothing more to say. Everyone should remain cautious, and those who have not yet entered the market are advised to continue to keep their hands off. Tomorrow, the line of attack will move to around 3019 points. Only by standing above this level can the market have the possibility of continuing to strengthen. Without breaking through and standing above this level, the downward trend does not have the basis for a reversal, and the ineffective fluctuations during the day can be directly ignored.Trend of Small-cap Stocks

The CSI 2000 Index plummeted by 2.34% today, closing at 1,887.07 points, once again breaking below all trendlines, indicating a negative short-term trend. Yesterday's article alerted everyone to pay attention to the contention at the 1,930 point level; a valid break below this level requires caution in the short term. Today, the highest point during the session was 1,934.46 points, which was precisely suppressed by the yellow short-term trendline above, and it quickly fell back after a brief struggle. Since the trend for small-cap stocks has turned negative, everyone should also treat the short term with a cool head. Tomorrow, the line of attack will move to around 1,913 points; if it cannot reclaim the position above this level, there is no possibility of reversing the downward trend.

Wednesday's Closing Article

Daily Chart Trend

The market is now within a hair's breadth of the 3,000 point level. To be honest, whether it breaks or not is no longer that important. In my view, it's better if it breaks, as there can be no establishment without destruction. Although today it temporarily found support near the half-year moving average, historical experience suggests that it is hard to sustain. The downside space is relatively limited. At this stage, those who have not cut their losses and are deeply entangled can only tough out this difficult period, waiting for the moment of change. The second half of the year's market is worth looking forward to. Life must go on, so please continue to maintain a positive and optimistic attitude.

Share Your Experience