Global market volatility strikes again!

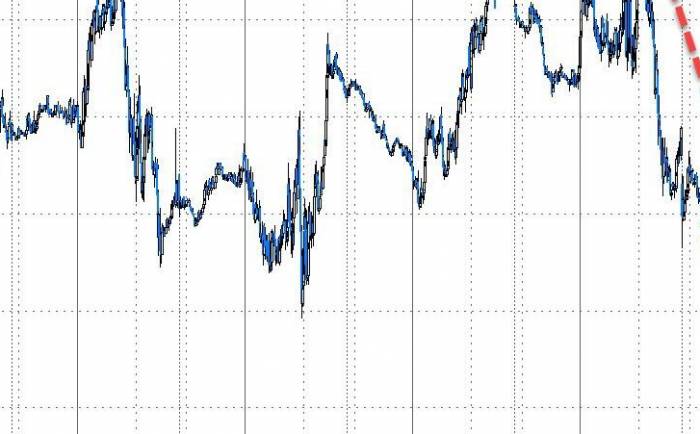

In today's early session, the Nikkei 225 index fell more than 3% at one point, with Toyota Motor and Mitsubishi UFJ Financial Group dropping over 4%. The South Korean stock index KOSPI fell more than 2%. Subsequently, the declines in these indices narrowed. It is worth mentioning that the Egyptian stock index, which opened first yesterday, closed down more than 2.4%, along with the Saudi stock index, marking the largest single-day drop in nearly a month.

On the funding front, there is also a continuous stream of bad news. Goldman Sachs recently stated that global hedge funds sold stocks for the fifth consecutive month in August, at the fastest pace since March 2022. Meanwhile, Bank of America reported that in the week ending last Wednesday (4th), investors injected $6.1 billion into cash-like money market funds in anticipation of the Federal Reserve's first interest rate cut in four years. This is completely contrary to market expectations.

So, what kind of logic is the global market playing out?

Plunge

In today's early session, the Nikkei 225 and the Topix indexes opened 1.6% and 1.7% lower, respectively. The South Korean stock market opened 1.8% lower. Shortly after the opening, the Nikkei 225 index's decline expanded to 3%, and the South Korean stock index's decline expanded to 2%. The Australian stock index S&P/ASX fell 1.2%. The MSCI Asia-Pacific index fell 1%. Subsequently, the declines in the major indices narrowed, but all operated at lower levels.

It is worth mentioning that the Middle East stock market, which opened first on Sunday (September 8th) Beijing time, was also bleak. The Saudi Stock Exchange All-Share Index closed down 0.97%, marking the largest single-day decline since August 5th, at 11,982.30 points, approaching the closing position of August 18th at 11,981.40 points. It broke through the 200-day moving average and the 100-day moving average, approaching the 50-day moving average (these three technical indicators are temporarily reported at 12,044.29 points, 12,011.77 points, and 11,965.58 points, respectively). Saudi Aramco (ARAMCO.AB) closed down 0.91%, falling for several consecutive days. The Egyptian Stock Exchange EGX 30 Index closed down 2.44%, also marking the largest single-day decline since August 5th, at 30,273.73 points.

So, what exactly caused the market sell-off? Analysts believe that the main reason is still the expectation of a U.S. interest rate cut. The 142,000 new non-farm employment in August fell short of the market's expectation of 160,000. There is no doubt that the Federal Reserve will cut interest rates in September. However, historically, this kind of preemptive rate cut by the U.S. is difficult to push the equity market upward at the beginning. Michael Hartnett, Chief Investment Strategist at Bank of America, said that the market is "selling the first rate cut," and risk assets have taken the lead over the Federal Reserve, and are no longer focusing on lower growth.

On the other hand, Asian traders will assess the revised GDP data for the second quarter of Japan to be released on Monday. Japan's second-quarter GDP annualized quarter-on-quarter rate was 2.9%, lower than the 3.2% expected by economists surveyed by Reuters and the estimated 3.1%. After the surge last Friday, the yen against the U.S. dollar also fell 0.2% to 142.55 today, moving away from the nine-month low set last Friday. In addition, due to Japan's inflation-adjusted real wages rising 0.4% year-on-year in July, nominal wages increased by 3.6%, and have been increasing for 31 consecutive months. Coupled with events such as Japan's rice shortage, Japan's inflation expectations are rising rapidly. This also means that the necessity for the Bank of Japan to raise interest rates is increasing.Unexpected Capital Flows

It is noteworthy that previously, many investment fund managers hoped that interest rate cuts would reduce the returns of money market funds and drive a significant amount of cash into stocks and bonds. However, global capital did not flow into the stock market following the Federal Reserve's rate cut; instead, risk-aversion sentiment has surged significantly.

The latest data from Bank of America shows that in the week ending last Wednesday (the 4th), investors poured $6.1 billion into cash-like money market funds in anticipation of the Federal Reserve's first interest rate cut in four years. Contrary to intuition, large investors tend to shift towards money market funds because the series of short-term fixed-income assets they hold typically offer higher long-term returns than short-term Treasury bills, which are highly sensitive to Federal Reserve rates.

In its weekly Flow Show report, Bank of America cited EPFR data, indicating that in the week ending last Wednesday, investors put $6.08 billion into cash funds, with a cumulative inflow of $23.1 billion over the past five weeks, the largest amount since December 2023.

Currently, U.S. interest rates are within the range of 5.25% to 5.5%, and the yield on money market funds has reached its highest level since before the 2008 financial crisis. Data from the Investment Company Institute shows that the current size of U.S. money market funds has exceeded $6.3 trillion, up from $3.6 trillion at the onset of the pandemic.

Furthermore, the latest data from Goldman Sachs shows that at the beginning of August, influenced by concerns over a U.S. economic recession and the unwinding of large-scale yen carry trades, a global stock market crash occurred, prompting global investors to shift to a risk-averse mode. According to weekend reports, the bank stated that the accelerated selling was mainly due to an increase in short-selling of individual stocks and a moderate sell-off of long positions. The selling was primarily led by sectors such as technology, industry, and non-essential consumer goods. Regionally, North America and Japan led the decline, with the Japanese stock market experiencing the most severe sell-off since December 2018. However, the bank did not disclose the scale of the sell-off. On August 5th, the Nikkei index in Japan fell by 13%, setting the record for the worst one-day sell-off since 1987, prompting Bank of Japan officials to reduce the likelihood of a near-term interest rate hike.

From a global macro perspective, there have indeed been some pessimistic expectations. According to the latest forecast from the United Nations Conference on Trade and Development, global economic growth is expected to decline to 2.6% in 2024, slightly above the 2.5% threshold usually associated with recession. Inflation is expected to continue cooling, although the easing of price pressures in many countries will take longer than their emergence. The most recent forecast from the Organisation for Economic Co-operation and Development also shows that global economic growth will slow to 2.7% in 2024, the lowest annual growth rate since the global financial crisis.

Analysts believe that, given the current macroeconomic conditions, it will not be easy to quickly emerge from a recession if one occurs. A recession will pose severe challenges to governments around the world, who must choose between high inflation and robust economic growth.

Share Your Experience