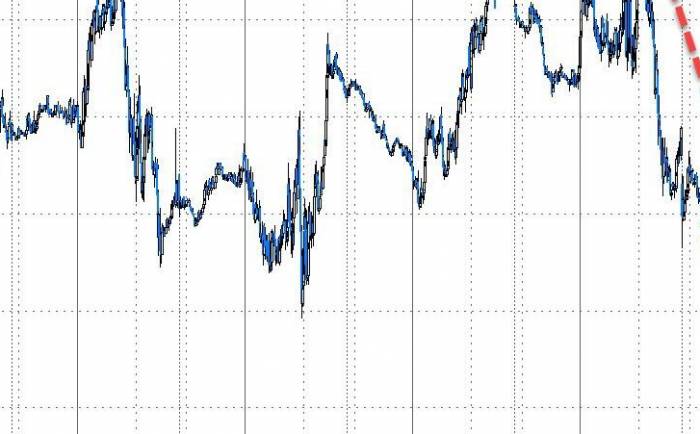

The global capital market is currently facing significant changes. Following the sharp decline in the U.S. stock market last Friday, the Japanese stock market experienced another plunge on Monday. In the early trading session on Monday, both the Nikkei 225 and the TOPIX indices fell by more than 7%, with the TOPIX futures even triggering the circuit breaker mechanism, suspending trading for ten minutes. Since the Nikkei 225 and TOPIX indices peaked last month, the decline has now exceeded 20%, entering a technical bear market. The significant drop in the Japanese stock market is partly due to the Bank of Japan's second interest rate hike this year, raising the benchmark rate from 0~0.1% to 0.25%, leading to a rapid appreciation of the yen, which has impacted Japan's export trade industry. Additionally, the slowdown in the U.S. economic growth and the sharp decline in the U.S. stock market have also increased the magnitude of the Japanese stock market's drop.

As I have previously discussed, over the past three years, the stock markets in Europe, America, and Japan have been continuously setting new highs, with increasing signs of bubble formation. A substantial amount of capital has been chasing these markets, leading to significant asset bubbles. Recently, there have been clear signs of a peak in the U.S. stock market. One indicator is the significant volatility in the leading U.S. technology stocks, especially after some tech companies reported second-quarter earnings that fell short of expectations, leading to substantial declines. On Friday, some U.S. tech stocks fell by more than 24%, and many have seen declines of over 30% from their peaks. On the other hand, Warren Buffett recently disclosed his second-quarter financial report. During the quarter, Berkshire Hathaway significantly reduced its holdings in Apple by half, amounting to more than $80 billion, which far exceeds the amount Buffett typically reduces his U.S. stock holdings each quarter. In addition, Buffett reduced his holdings in Bank of America, the second-largest position, by more than $3 billion. In the second quarter, Berkshire Hathaway increased its cash reserves by nearly $90 billion. As of June 30, Berkshire Hathaway's cash on hand had reached over $270 billion, with its stock position further reduced to only about 50%.

Buffett has always insisted on overcoming human greed and fear. His well-known saying is "Be fearful when others are greedy, and be greedy when others are fearful." While many global investors are frantically chasing the U.S. stock market, Buffett has quietly withdrawn. When others are greedy, Buffett has already sensed fear. He keeps $270 billion in cash on hand, hoping to bottom-fish when the next stock market crash occurs. It can be said that Buffett's ability to remain invincible for the long term is related to his unwavering commitment to value investing. On one hand, the good companies he holds long-term are all high-quality leading stocks in their respective industries. On the other hand, he does not mechanically hold long-term. Once the prices of these good companies deviate from their value or even show significant bubbles, Buffett will also reduce or even liquidate his positions without hesitation, which is something we can all learn from. Buffett's reduction of 50% of Apple does not mean he is pessimistic about the company's prospects. It is because Apple's stock has risen too much in the past few years, contributing tens of billions of dollars in unrealized gains to Berkshire Hathaway. Buffett's decision to reduce half of his Apple holdings is also to take profits. Perhaps when the prices of these good companies fall in the future, Buffett may buy back in. Therefore, value investing should not be mechanically understood as long-term holding.

Buffett once said, "Before I buy a company, I do a lot of work, so it's not easy for me to make a decision. I hope the companies I hold can be held forever, and it's best never to sell. However, if three conditions are triggered, Buffett will also decisively sell. The first is when the invested company's fundamentals deteriorate. For example, a few years ago, when Buffett invested in the top five U.S. airline stocks, he decisively sold them after the pandemic, losing 50% at one point, and he also decisively cleared them. The second is when the invested company shows a significant bubble, and he will decisively reduce or even liquidate his position when the bubble is significant. His current reduction in U.S. stocks actually reaffirms this iron rule. The third is when he encounters a better company in the same industry, Buffett will decisively switch positions. Just like before, he invested in tech stocks in IBM, but later found that IBM did not have a good application in mobile terminals, while Apple is the new king. So he decisively sold IBM and switched to Apple, and Apple has been the company that has contributed the most profits to Buffett in recent years.

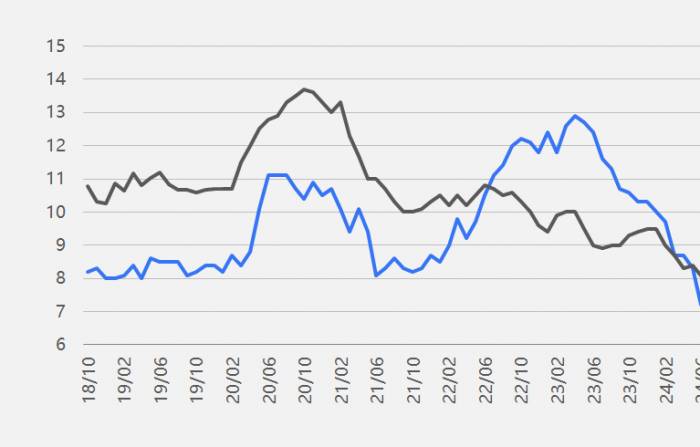

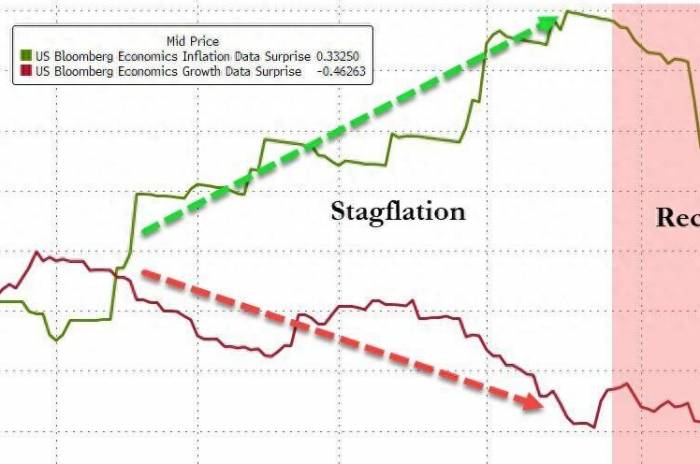

Back to the A-share market, on Monday, the Shanghai and Shenzhen markets withstood the sharp decline in the peripheral markets and showed a narrow range of fluctuations, with many blue-chip stocks rebounding, which is commendable. Under the situation of a sharp decline in the peripheral markets, A-shares can withstand the market's decline, fully demonstrating that the previous adjustments have been relatively sufficient. I have always explained the logic to everyone, because over the past three years, the trends of the European, American, and Japanese stock markets and A-shares have shown significant divergence, and the divergence has now reached a great extent. Once the European, American, and Japanese stock markets peak and fall back, A-shares may usher in a reversal opportunity. Global capital will take profits from the European, American, and Japanese stock markets and look for new value lows, and A-shares and Hong Kong stocks are undoubtedly the two major value lows. Therefore, for A-shares and Hong Kong stocks, the decline in the peripheral market may bring a new round of opportunities instead of further declines. So I suggest everyone recognize this point. Last Thursday and Friday, I attended the China Chief Economist Forum in Huangpu, Guangzhou, and discussed the Chinese economy and capital market with nearly 50 chief economists. I shared my views at the roundtable forum on the Federal Reserve's policy and global capital markets. I believe that the current pace of the Federal Reserve's interest rate cuts is expected to accelerate, and the first cut may come in September. After a 25 basis point cut in September, there may be further cuts in November and December, with a 25 basis point cut at each of the remaining three interest rate meetings. At that time, some economists also believed that my forecast was too dovish. However, looking at the sharp decline in the U.S. stock market last Friday, especially with the recently released U.S. non-farm employment data far below expectations, the pace of the Federal Reserve's interest rate hikes may accelerate. Some people even expect a direct cut of 50 basis points in September.

The Federal Reserve's previous monetary policy goal was mainly to fight inflation, and now inflation has been effectively controlled, with the U.S. CPI already reduced to around 3%. The next primary goal is to stabilize growth, prevent the U.S. economic growth rate from declining or even falling into a recession, increase employment rates, and boost the performance of the U.S. stock market. Although the trend of the U.S. stock market is not the target of the Federal Reserve's monetary policy, the performance of the U.S. stock market often affects the votes of U.S. presidential candidates and support rates because more than 30% of American family assets are in the capital market. Therefore, once the U.S. stock market experiences a significant decline, the U.S. president will also put pressure on the Federal Reserve chairman to cut interest rates as soon as possible. So from this point of view, the pace of the Federal Reserve's interest rate cuts may accelerate. Once the Federal Reserve cuts interest rates, the U.S. dollar index will fall from a high position, and non-U.S. currencies will appreciate. Last Friday, we also saw the yuan appreciate by 1,000 points in a single day, returning to a position of 7.1. It is expected that under the background of the Federal Reserve gradually confirming interest rate cuts, the yuan still has room for further appreciation, and it may even return to the sixes next year. Once the yuan has an appreciation expectation, it will attract the inflow of foreign capital, especially when China's high-quality assets are currently severely undervalued, and foreign capital may also take a low position to layout China's high-quality assets, including A-shares, Hong Kong stocks, and Chinese concept stocks. Therefore, I suggest everyone must maintain confidence and patience, and firmly layout some high-quality stocks or high-quality funds in A-shares and Hong Kong stocks that have been wrongly killed under the situation of the peripheral market's high position falling back.

Share Your Experience