On August 5th, the U.S. stock market experienced a "Black Monday," continuing the downward trend from the previous week. Intel's stock price fell during the pre-market trading phase, and after the market opened, the company's stock price plummeted by as much as 10%. As of the time of writing, Intel's stock price was reported at $19.845 per share, with a decline of 7.61%.

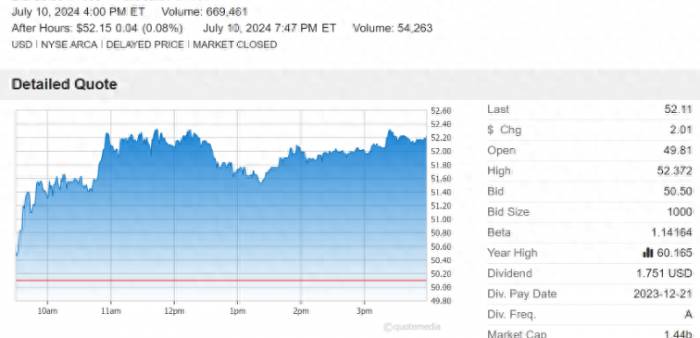

Behind the sharp drop is the market's waning confidence and performance expectations for U.S. technology companies. Last week, Intel released its second-quarter financial report and announced a plan to lay off approximately 15,000 employees by the end of the year. In addition, to control capital expenditures, Intel CEO Pat Gelsinger stated that the company would suspend dividend payments starting from the fourth fiscal quarter of this year, marking the first time in nearly 32 years that the company has decided to halt dividend payments. Intel's series of actions have caused a stir in the secondary market. After the financial report was announced, the company's stock price plummeted by more than 26% in after-hours trading, setting a record for the largest single-day drop since 1982.

In a recent memo to employees, Gelsinger stated, "I will not delude myself into thinking that the road ahead will be smooth... there will be more difficult days ahead."

Since taking over Intel, Gelsinger has been focused on regaining a leading position, and IDM 2.0, as a key strategy to achieve this goal, has been the direction where he has been pouring resources. Previously, he set a "four years, five nodes" plan for Intel, and now, as the industry enters the era of artificial intelligence, Intel has also included AI chip manufacturing plans in its IDM 2.0 strategy.

The competition in the semiconductor industry is a race against time, but as the blueprint becomes larger, the costs that Intel is incurring are also increasing. As of the second quarter of this year, Intel's cash reserves were $11.29 billion, but its current liabilities were as high as $32 billion.

Financial pressure is rising.

Gelsinger's package of adjustments mainly targets Intel's current financial situation. After the financial report was released, he admitted in a conference call that the financial performance in the second quarter was indeed "disappointing." He said that revenue did not grow as expected, and the company has not fully benefited from the strong trend of artificial intelligence. "Our costs are too high, and our profits are too low."

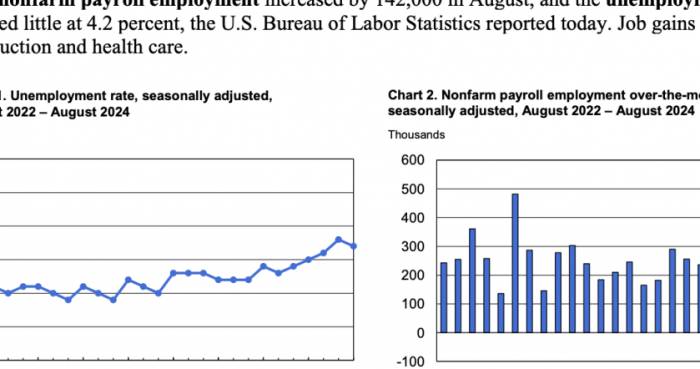

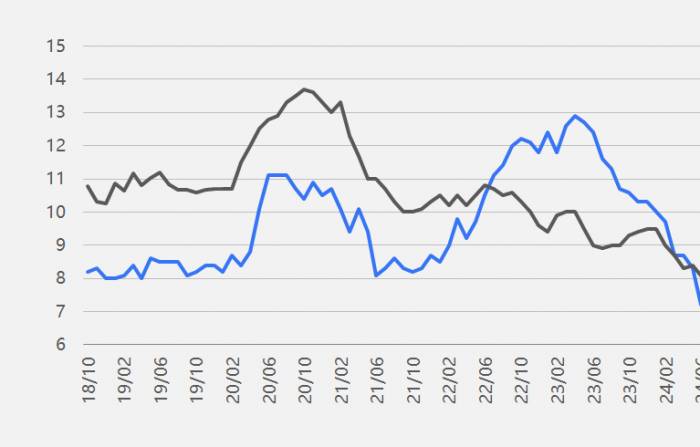

Financially, looking at the single quarter, Intel's loss expansion was mainly affected by the collapse of the gross margin. In the second quarter, the company's gross margin was 35.4%, a sequential decline of 5.6 percentage points, far below the market expectation of 42.1%. The company attributed the significant decline in gross margin to the increase in AI PC products, the transition of wafer fabs, and other non-core business expenses.

It should be noted that R&D expenses are an important component of Intel's non-core business expenses. The company's R&D expenses in the second quarter were as high as $4.239 billion, a year-on-year increase of 6.6%, and the R&D expense ratio also reached 33%, which is almost catching up with the company's gross margin level for that quarter.

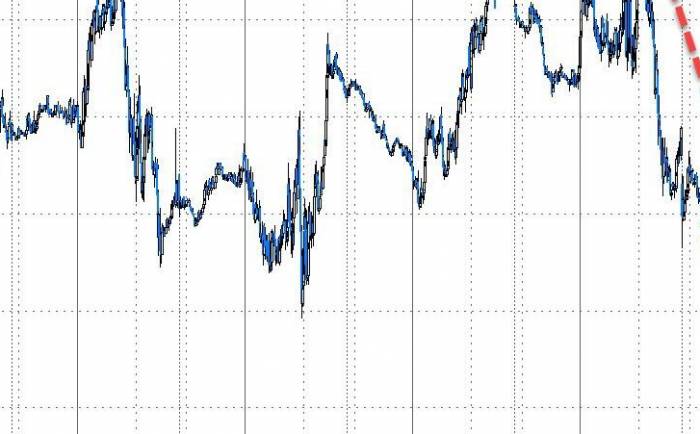

Looking at past financial data, Intel's gross margin level in the second quarter of 2021 had exceeded 50%, but as time went on, this figure showed an overall trend of fluctuating decline. This is not only related to the cyclical fluctuations in the semiconductor industry but also largely affected by Intel's substantial investment in advanced manufacturing. According to the reporter's analysis, since the first quarter of 2022, Intel's R&D expense ratio has climbed onto the 20% platform and continued to rise. Even when the company went through the semiconductor industry cycle at the beginning of 2023, this figure has always remained at a level not lower than 25%.Despite Intel's ambitious plans, due to significant investments in a four-year, five-node roadmap progression, ecosystem construction, and capacity expansion, Intel disclosed a loss of $7 billion in its foundry business for 2023, which is larger than the operating loss of $5.2 billion from the previous year.

Intel's China President, Wang Rui, previously stated in an interview with First Financial Daily that the IDM 2.0 strategy is a "must-follow path."

The Star Business's C-Position is Hard to Defend

Intel was a winner in the PC era, with the proliferation of personal computers quickly making the company the largest chip manufacturer in the United States. At the same time, thanks to the boom in PC and data center businesses, Intel has always been the dominant player in the CPU processor market. Some analysts believe that Intel's Client Computing Group's business share has always been quite stable, which means Intel's fate is deeply tied to the CPU share in the PC and data center markets.

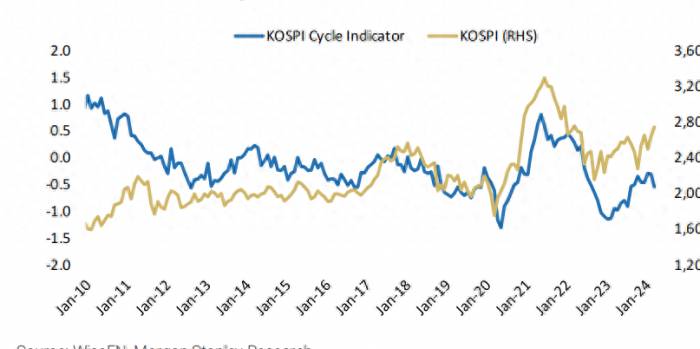

However, since 2022, with the advent of generative artificial intelligence, which has created a massive demand for computing power, the focus of the data center market has begun to shift. Indeed, Intel has launched the Gaudi series of computing chips to compete with NVIDIA, but the market seems to still prefer NVIDIA's GPUs.

At the same time, with the rise in the GPU market position, AMD, which was previously criticized for spanning both CPU and GPU business lines, has seized the opportunity to compete with Intel's CPUs for market share due to the better compatibility and architecture between the two. According to market research firm Mercury Research's fourth-quarter 2023 AMD processor market share statistics, AMD EPYC has captured 23.1% of the server market share, with its share continuing to expand. Public information shows that although EPYC, as a general-purpose processor, is not as powerful as GPU accelerators, the product can work in conjunction with AMD's GPU accelerators, AI accelerators, etc., to maximize efficiency.

In addition, Intel is also facing a rising competitor in the CPU field - Qualcomm. Qualcomm released its new CPU Snapdragon X Elite chip in May this year, and this chip has been applied to Microsoft's new Surface Laptop and Surface Pro.

On the other hand, the rise of the Arm architecture is also one of the threats to Intel's PC business in the market C-position. In 2020, Apple successfully launched its self-developed chip M1 based on the ARM architecture, which showed excellent performance and energy efficiency ratio as soon as it was released. Recently, Qualcomm, MediaTek, AMD, NVIDIA, and others have planned or have already launched processor chips based on the Arm architecture. However, in comparison, Intel, which has always adhered to x86, seems to have a low willingness to embrace the ARM architecture.

Intel's Client Division, which includes the PC business, achieved revenue of $7.41 billion in the second quarter, a year-on-year increase of 9.3%, which is one of the few bullish items in the company's second-quarter business. In the business, Intel's desktop and notebook sales have increased to varying degrees.

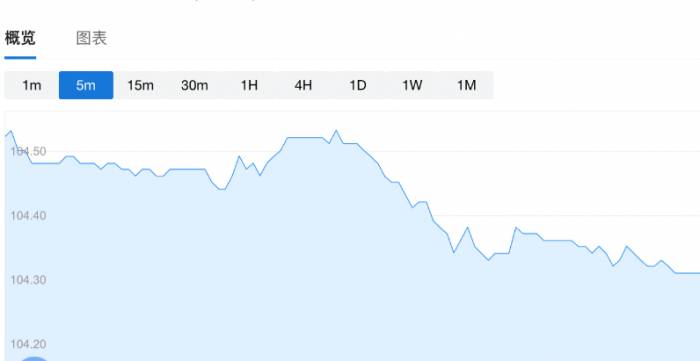

From industry data, global PC shipments continue to rebound after hitting a quarterly shipment bottom, but the growth rate remains in the single digits. Market research data shows that the global PC shipment volume in the second quarter was 64.9 million units, a year-on-year increase of 5.4%. Analysts believe that although the PC industry has come out of the trough, corporate shipments are still at a relatively low level, indicating that current market demand is still not very strong, and whether Intel's PC business revenue growth can be maintained is still to be observed.Can AI Put Out Fires?

Currently, compared to large models, AI PCs are one of the most promising business models for monetization in artificial intelligence.

In fact, not only Intel, but also other industry players have been competing fiercely to bring AI PCs to everyone's desktop. Microsoft, Apple, and others have already launched new terminals with AI capabilities. In the AI chip sector, a "tripod" situation has been formed with NVIDIA, Intel, and AMD. Wang Rui introduced to the First Financial reporter that since the release of the Intel Core Ultra processor, 8 million devices have been equipped with this product, and it is expected that by the end of this year, Intel will deliver 40 million Core Ultra processors.

However, Intel's competitors are not slacking off. From the perspective of product landing, at the recently concluded 2024 ChinaJoy, AMD announced with a group of OEM manufacturers that the first batch of PCs equipped with the Ryzen AI 300 series processor began to hit the market. Earlier, during the 6.18 event, AI PCs equipped with Qualcomm Snapdragon X Elite/Plus processors also began to be sold in succession. In contrast, Intel's Lunar Lake processor for the new generation of notebook computers will not be released until September this year.

This puts immediate pressure on Intel's Gaudi 3 chip. Some analysts believe that the success or failure of Gaudi 3, which is used to compete with NVIDIA's H100 chip, is crucial for Intel. If the product fails, it will more heavily hit the confidence of the outside world in Intel, including Intel's own confidence.

In the current AI "arms race," NVIDIA still seems to be the leader in the GPU chip market. The company previously released a new generation of artificial intelligence computing chip B200. NVIDIA CEO Huang Renxun said that the AI computing performance of the B200 GPU can reach 20 petaflops in FP8 and the new FP6, which is 2.5 times the computing performance of the previous generation H100.

In terms of performance, the second quarter financial report shows that Intel is still facing the dilemma of data center and AI business decline, with the business revenue falling by 3%, further highlighting the weak demand for its products in the market. Intel CFO David Zinsner frankly stated that the decline in the data center market is partly because, although enterprises are heavily investing in artificial intelligence infrastructure, most of the purchased GPUs come from non-Intel brands, such as NVIDIA.

In order to catch up with NVIDIA, Gelsinger once publicly stated that in addition to designing Gaudi 3, Intel also plans to produce AI chips in a new factory in Ohio, but the implementation time of this plan may have to wait until 2027 or 2028.

Gelsinger said in a previous speech to investors that he expects 2024 to be the year with the most severe operating losses in the company's foundry business, but the business is expected to achieve operating break-even by the end of 2030. This means that in order to ensure stable performance, for a period in the future, the rest of Intel's businesses will bear the task of blood transfusion to the foundry. However, whether the future market will allow this delicate balance is unpredictable.

Share Your Experience