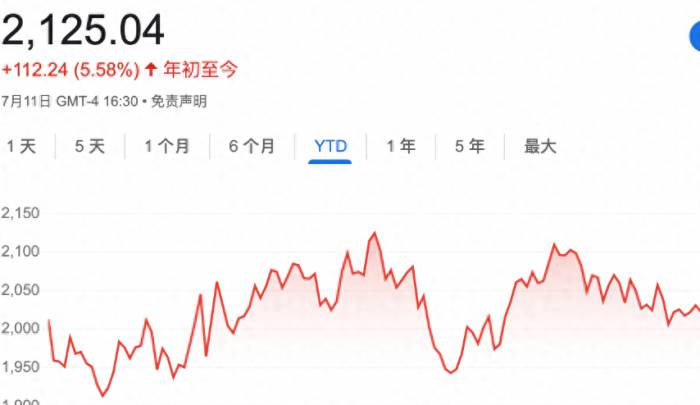

The long-awaited cooling of housing inflation has finally arrived, with the US core CPI in June hitting a new low in over three years. This signal provides a strong foundation for the Federal Reserve to cut interest rates, and the market has fully priced in two rate cuts this year!

The latest data released overnight showed that US inflation "turned cold" in June, with both the monthly CPI and core CPI falling short of market expectations:

The CPI fell by 0.1% month-on-month, marking the first negative turn since May 2020, mainly due to the decline in gasoline prices.

Excluding food and energy, the core CPI rose by only 0.1% month-on-month, the smallest increase since August 2021, mainly affected by the slowdown in the growth of housing costs.

The biggest "highlight" of this inflation report is the rapid cooling of the "stubborn" housing inflation, which fell from 0.40% to 0.17% month-on-month, while housing inflation has long been at a high level and has been the biggest "stumbling block" to rate cuts.

This has provided the Federal Reserve with the confidence needed to cut rates, and the market widely expects the Fed to start cutting rates in September. After the CPI report on Thursday, traders are almost fully betting that the Federal Reserve will cut rates twice in September and December.

Joseph Brusuelas, Chief Economist at RSM US LLP, said in a report:

We have enough confidence that even if the Federal Reserve is not yet ready to admit it, the inflation rate is returning to the 2% target, and the path for the Fed to cut rates in September is clear.

The "stubborn" housing inflation has clearly cooled down.

Looking at the breakdown, housing prices are the largest category in the service sector, which rose by about 0.2% month-on-month, the smallest increase since August 2021. The owner's equivalent rent rose by 0.3% month-on-month, also the lowest level in three years.Founder of MacroPolicy Perspectives LLC and former Federal Reserve economist Julia Coronado said:

The most important aspect of the June report may be the decline in housing inflation, which many Federal Reserve officials have indicated appears to be broad-based and persistent. This decrease will strengthen their confidence that the inflation rate will indeed return to 2% in a sustainable manner.

Apart from housing costs, other service prices, such as airfare, hotel accommodations, and medical expenses, have also seen a month-on-month decline. Core goods prices have generally fallen, with new and used car prices leading the decline in core goods prices.

For most of the past year, the continuous decline in goods prices has largely alleviated consumer concerns. In June, the "core goods price" excluding food and energy goods fell for the fourth consecutive month. Among them, new car prices have fallen for the sixth consecutive month, prices in various clothing categories have also declined, and home furnishing prices have almost fallen every month for the past year.

Is a rate cut in September a foregone conclusion, and could it even happen in July?

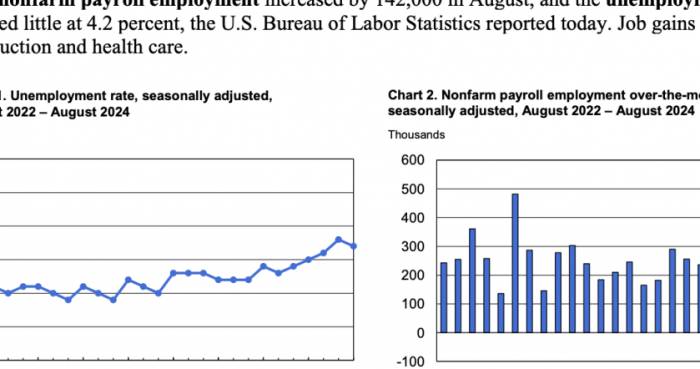

Following the cooling of the US non-farm payrolls in June and Powell's renewed mention of a rate cut, the June CPI surprise has further pushed up expectations for a rate cut.

Several economists have indicated that this inflation data shows that US inflation is steadily returning to the 2% target level. The significant slowdown in housing inflation is particularly encouraging, which will strengthen the Federal Reserve's confidence in the sustained decline of inflation.

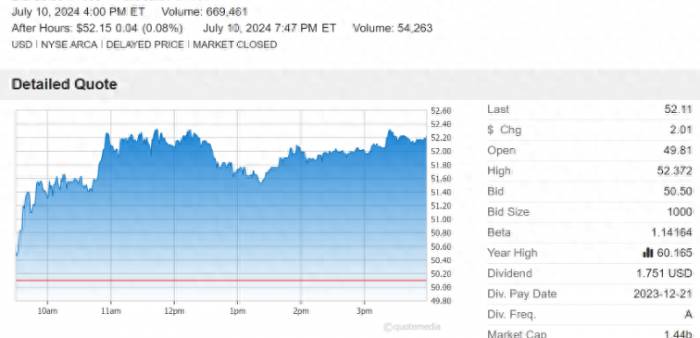

After the June CPI report was released, US Treasury bonds rose, and the market almost fully digested the expectations for rate cuts in September and December, while also raising the possibility of a rate cut in November to over 50%.

Bloomberg economist Anna Wong said:

The June CPI report is a step above the "very good" report in May, which should strengthen the FOMC's confidence in the inflation trajectory, laying the groundwork for a rate cut by the Federal Reserve in September, and even hinting at the possibility of an earlier rate cut in July.Huatai Securities believes that:

The Federal Reserve's interest rate cut in September is almost a foregone conclusion. With nominal growth rapidly declining, the logic for an earlier rate cut in July is more coherent, but the timing is somewhat hasty.

It is highly probable that the Fed will communicate its intention to cut rates in September at the Jackson Hole annual meeting in mid-to-late August, but it is not ruled out that the Fed may drop some hints at the FOMC on July 31st.

Overall, the June inflation data has paved the way for the Fed to begin cutting rates in September. Federal Reserve officials may release more policy signals at the end of July meeting, and the market will closely watch Powell's speech at the Economic Club of Washington next Monday for more policy guidance.

Share Your Experience