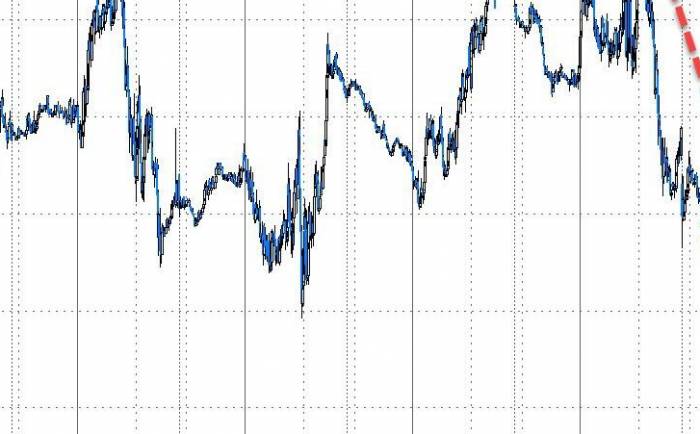

The rebound that created the largest intraday gain since the end of 2022 is still fresh in memory, and the yen almost returned to its downward trend on Friday, fluctuating several times during the session, but managed to maintain its upward momentum, leading market participants to speculate whether the Japanese government intervened again after a strong intervention on Thursday.

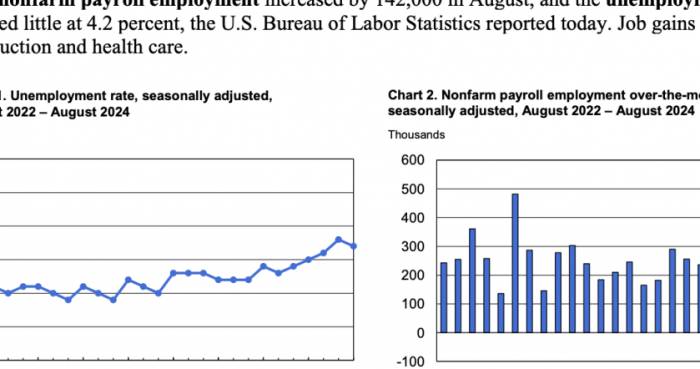

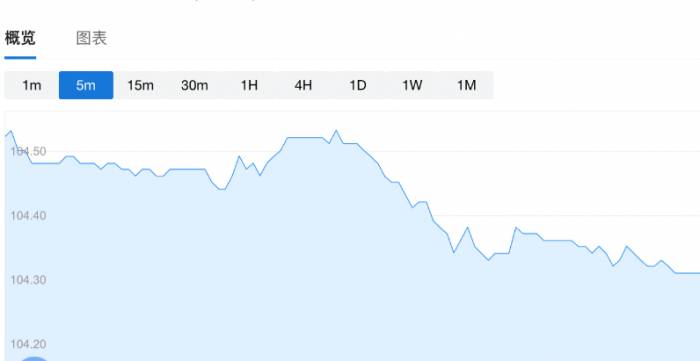

In the early Asian session on Friday, the US dollar against the yen first refreshed its daily high to 159.45, up nearly 0.4% for the day, then quickly turned down, falling nearly 0.5% within an hour to approach 158.00, and turned up again within half an hour, only to turn down again before the US stock market opened and accelerated its decline. In the early US stock market session, the University of Michigan announced that the initial value of consumer confidence in July unexpectedly reached an eight-month low, and consumers' expectations for inflation over the next year have declined for two consecutive months, releasing data favorable to the Federal Reserve's rate cut. Subsequently, the US dollar against the yen fell further, breaking below 157.40 in the early US stock market session, refreshing the low since June 17 set on Thursday, with a daily drop of over 0.9%.

Compared to the significant rebound of over 2.6% seen on Thursday, the yen's volatility on Friday has eased. So far, the Japanese government has not publicly confirmed that it intervened in the currency market on Thursday.

The highest official in Japan responsible for foreign exchange affairs, Deputy Minister of Finance Masato Kanda, responded on Thursday, saying he could not comment on whether the yen's fluctuations were due to intervention. However, Japanese media cited officials on Friday morning, local time, saying that the government did intervene on Thursday to boost the yen.

Later on Friday, Masato Kanda stated that the Japanese government would take action in the currency market as needed, and he refused to comment on whether intervention measures had been taken. Japanese Finance Minister Shunichi Suzuki also refrained from commenting on whether the currency market had been intervened in that day. Suzuki said that exchange rates should be determined by the market, expressed concern about one-sided exchange rate fluctuations, hoped for exchange rate stability, and added that Japan's continuous attention to exchange rate fluctuations remains unchanged.

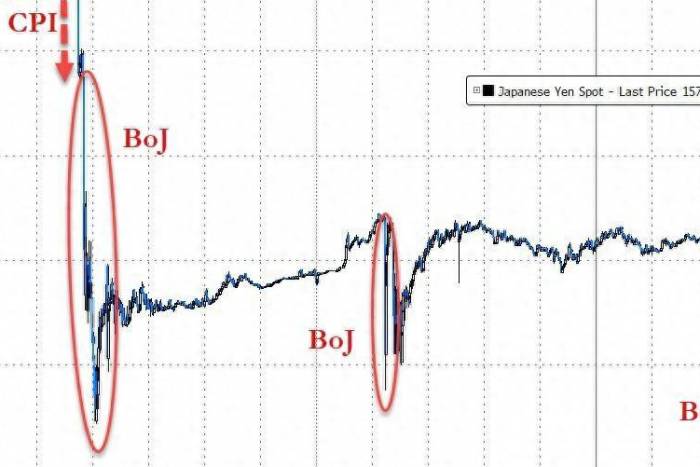

The media mentioned on Friday that the daily operation data released by the Bank of Japan showed that on Thursday, the Bank of Japan spent between 3.37 and 3.57 trillion yen, equivalent to about 21.18 billion to 22 billion US dollars, to purchase yen, less than three months after the last intervention.

An article by Wall Street News pointed out that on Thursday, the day the Japanese government was accused of intervening, the US dollar was falling sharply due to the unexpected cooling of the US June CPI announced that day. Unlike the intervention actions from late April to early May this year, this is the first time the Japanese government has taken action when the yen has strengthened against the US dollar since September 2022. This strategic shift marks a new step by Japanese authorities in curbing currency market speculation.

Regardless of whether the Japanese government admits to intervening this time, there are comments on Friday suggesting that the yen may continue to rise due to market speculation that Japanese officials are willing to boost their currency, and there is still room for the yen to appreciate in the future. The weakness of the yen has already caused political concerns, and the high inflation brought about by the sharp drop in the yen is one of the reasons for the low approval rating of Japanese Prime Minister Fumio Kishida.

On the other hand, in the US market, investors are increasing their bets on the Federal Reserve cutting rates this year, which would reduce the yield difference that Japanese investors can obtain by choosing US Treasuries over Japanese government bonds. Option prices indicate that the possibility of the yen rising in the next month is increasing.

Share Your Experience