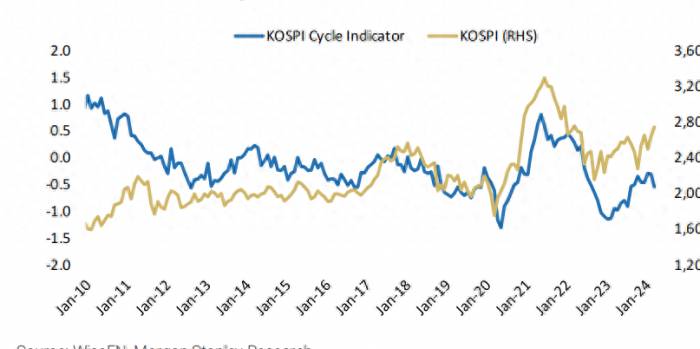

Over the past decade, South Korea's KOSPI index has been long-term stuck between 2000 and 3000 points. Benefiting from the rapid development of artificial intelligence technology, this year, the KOSPI index has been on an upward trend, with a cumulative increase of 8.36%, approaching the 2900 point threshold.

However, Morgan Stanley analysts believe that the rise of the KOSPI has approached its peak and is unlikely to break through the 3000 point mark.

Analysts argue that the uncertain trade policies from the United States, the delay in South Korea's corporate reform plans, and the overall weakness of the domestic business cycle have cast a shadow over South Korea's economic growth prospects, adding unknown factors to the stock market.

The trade outlook between the US and South Korea remains unclear.

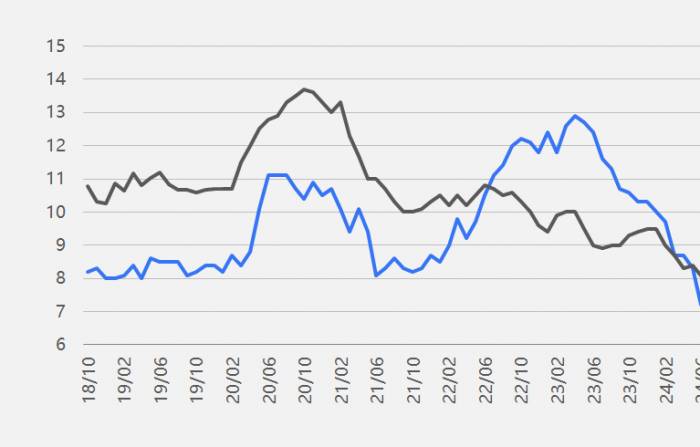

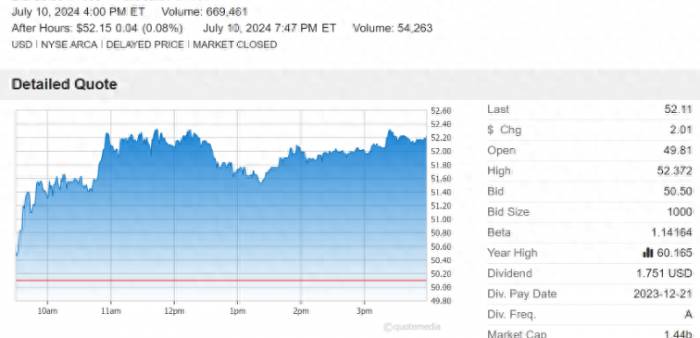

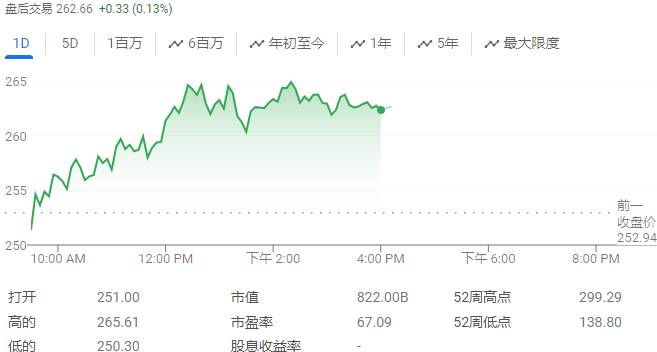

In the first half of 2024, technology stocks played a key role in the performance of the KOSPI. In particular, SK Hynix's outstanding performance in the field of artificial intelligence has driven the index's rise. Entering the second half of the year, Samsung Electronics took over the baton.

However, Morgan Stanley believes that the Korean stock market may have "peaked at the start" in the third quarter. If Samsung Electronics and SK Hynix can reach the target stock prices set by Morgan Stanley, the KOSPI index could slightly exceed 3000 points. But even so, the market may still experience significant fluctuations in the coming period.

The main pressure comes from the United States. Looking back at history, during the Trump administration, the US-Korea Free Trade Agreement and issues related to automobile and steel exports had caused market turmoil.

Considering the current poll data, if Trump were to be re-elected, it might cause South Korea to lose the eligibility for subsidies under the Inflation Reduction Act (IRA) that the domestic battery industry gained during the Biden era. The scheme stipulates that if a country with a Free Trade Agreement (FTA) with the United States extracts and processes more than 40% of the core minerals, it can receive subsidies.

In this regard, Morgan Stanley warns:

If Trump is re-elected, market concerns about the electric vehicle supply chain may exceed expectations.Corporate Reform May Be Delayed

Recently, the South Korean Ministry of Finance proposed a series of amendments to tax and commercial laws, covering tax incentives related to shareholder and company value-added, tax rate adjustments, tax compliance, and revisions to inheritance tax, among other aspects.

South Korea is also about to welcome a new chairman of the Financial Services Commission, Kim Byoung-wan. Before the confirmation of the appointment, an interview process in the National Assembly is required.

Discussions surrounding the tax bill are usually conducted during the regular National Assembly session in September. However, Morgan Stanley cautions that despite the South Korean government's commitment to implementing tax incentives and corporate reforms, actual execution faces challenges. The reason is that since the South Korean general election, the political situation has become more complex, and the attitude of the National Assembly and the stance of the opposition party will be key in determining whether these policies can be implemented.

We believe that the postponement of the reform agenda is more likely than the previous delay, as many bills have not been passed this year.

Overall Business Cycle Weakness

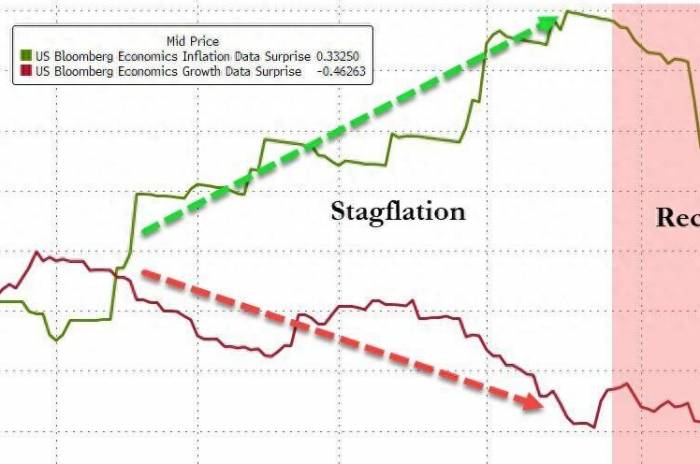

Morgan Stanley believes that South Korea's economic cycle may be in a weak phase, which is unfavorable for the stock market. Factors such as the contraction of domestic demand, the depreciation of the won, and the rise in oil prices all put pressure on the market.

The report shows that South Korea's cyclical indicators fell by 0.54 in March and decreased again by 0.31 in April. Although the decline has narrowed on a month-to-month basis, it is "uncertain" to reach an inflationary expansion phase in the next three quarters.

Strong exports and continuously improving industrial production should be able to keep the cyclical indicators in a recovery phase, but we believe that weak domestic demand, geopolitical factors, and a weak won are the factors that limit the entry into the expansion phase.

Morgan Stanley states that there is a view that South Korea has entered the mid-cycle phase of the economic cycle. However, considering the Federal Reserve's delayed interest rate cuts, the strengthening of the US dollar, and the complexity of South Korea's macroeconomic trends, analysts currently believe that the market is in a transitional phase between the early and mid-cycle stages.Although the market has not fully entered the mid-cycle phase of the economic cycle, due to the rise in value of some companies, we have observed phenomena commonly seen in the mid-cycle phase of the economic cycle, namely the accelerated rebound in the automotive and banking industries.

Share Your Experience