A-shares maintained a pattern of low-volume consolidation this morning, with the lowest point during the session at 3,063.59, and there has not yet been a continuation of setting new lows for the phase. Overall, individual stocks are still predominantly declining, with a very noticeable effect of losses, and small-cap stocks continue to be in a dire situation. Additionally, yesterday's focus on the contention around the 120-minute long-term trend line at 3,074 points is important; from the intraday trend, it can be seen that the market is currently consolidating around this level. Whether it can hold this support level is crucial for the subsequent trend. At present, most retail investors are in a state of confusion, eagerly wanting to know what the market will do next and how to respond. Let's analyze this in detail to give everyone a clear understanding.

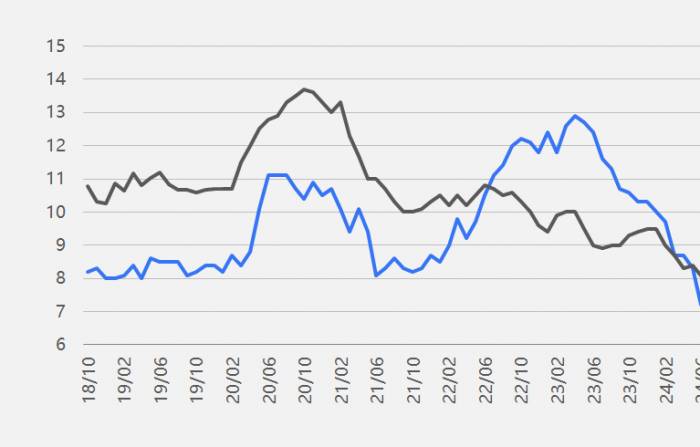

120-minute trend analysis

Morning review

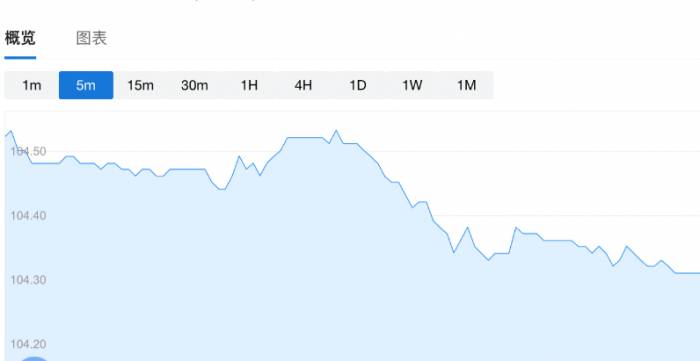

As of 11:03 AM, all three major indices are currently in the red, with the Shanghai Composite Index showing a slightly weaker trend, lagging behind the Shenzhen Component Index and the ChiNext Index. The ChiNext Index is strong because it leads the Shanghai Composite Index and the Shenzhen Component Index, having already crossed the white offensive trend line yesterday.

ChiNext daily trend

From the intraday trend, the yellow and white lines are still deviating, with the white line above and the yellow line below, indicating a significant decline. However, around 10:50 AM, there was a small rebound that narrowed the gap, otherwise, the overall market situation would be even worse. In terms of trading volume, it continues to be low today, and if the main force does not act in the afternoon, it is expected to be around 700 billion, a volume level that is unlikely to support a large-scale trend.

Individual stocks, as of 11:10 AM, currently have more than 1,700 rising and over 3,400 declining, still a pattern of more declines than rises, with a general decline and a noticeable effect of losses. However, compared to the morning session with less than 1,000 rising, there has been a significant improvement. There are more than 20 stocks hitting the upper limit, and about 60 hitting the lower limit, indicating that speculative sentiment is still poor.

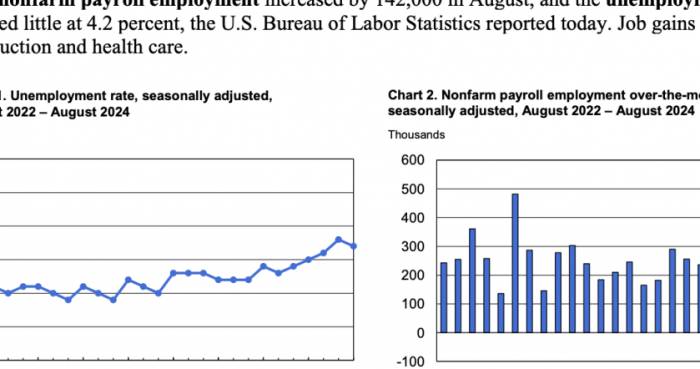

On the capital front, domestic main force funds continued to play a stable role today, with around 10 billion being sold off as of 11:11 AM, remaining the biggest obstacle in the market. However, there has been a slight easing since half past ten in the morning, and whether small-cap stocks can catch a breath in the afternoon will depend on the attitude of domestic capital.

Specific index performance:

As of 11:14 AM, it can be seen from the chart that mid-cap stocks, large-cap stocks, and heavyweight stocks are maintaining an upward trend and outperforming the market. Small-cap and micro-cap stocks continue to perform poorly, with significant declines, especially micro-cap stocks, which are down by about 3%, significantly underperforming the market. This indicates that the market's panic effect is still present. If small-cap and micro-cap stocks cannot return to normal, the market sentiment will not improve, and focusing solely on large-cap and heavyweight stocks will not be helpful.Current Market Trend Analysis and Response Strategies

A temporary rebound occurred during the trading session, but we must not blindly get excited and chase the rise without thinking. This is the behavior of immature investors. Have we forgotten the lesson from last Monday so quickly? We have repeatedly reminded everyone that we must wait until there is a breakthrough and a stable position at key points, and when the trend is clear and the bulls have regained control, then we can follow. Never rush in for a small temporary advantage, as this can easily put us in a passive position and repeatedly make the same mistakes. What we need is a safer and higher probability environment, not to go against the market trend, but to wait patiently for the opportunities that truly belong to us.

Let's analyze the current market trend from a technical perspective.

At the daily level, the market rebounded with reduced volume in the morning, and the index is still below the white offensive line, the yellow short-term trend line, and the red medium-term trend line. Therefore, the market is still in a state of short-term adjustment. In terms of indicators, because the morning was in a state of oscillation, the MACD is between the trend of shortening again and continuing to lengthen, with an unclear direction. This also proves that the market is currently in a more critical position. The KDJ has been running at the bottom, and the J and K values are currently turning upward, showing signs of improvement.

Daily Level Trend

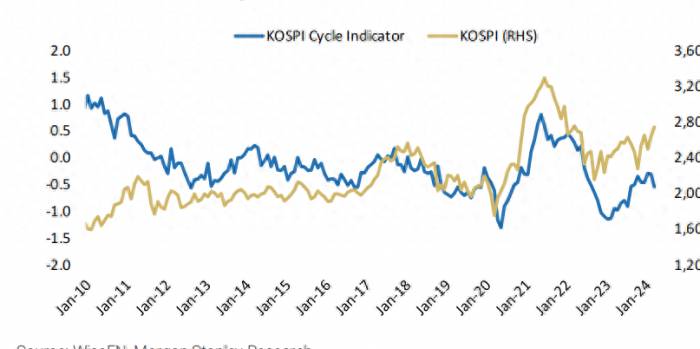

At the 120-minute level, the highest point in the morning, 3084.62 points, touched the white offensive line, but there is still no effective breakthrough and stable position, and it is also below the yellow short-term trend line and the red medium-term trend line. The morning closed temporarily above the green long-term trend line at 3073.6 points, and the trend has not completely weakened. In terms of indicators, the MACD green column continues to shorten, and the KDJ is close to forming a golden cross, with further improvement in the indicators. All signs indicate that the 120-minute level is at a critical time.

120-Minute Level Trend

In summary, whether it is at the daily level or the hourly level, the market is still in a state of short-term adjustment. Therefore, we should continue to be cautious and careful, and not act blindly and impulsively. Keep our hands in check and do not give ourselves the opportunity to make mistakes easily. Since the market is in a state of adjustment, we should still focus on the support levels first. The long-term trend line at 3074 points at the 120-minute level is still the first support level. The market is still oscillating and organizing near this point, and we cannot be blindly optimistic before it has completely stopped falling and stabilized. In addition, if the index cannot effectively stand above the yellow trend line at 3108 points today, the trend of short-term adjustment cannot be effectively reversed. Prudent investors should mainly watch and wait, observe more and act less, and wait for the bulls to regain the initiative.

Trend of Small-cap Stocks

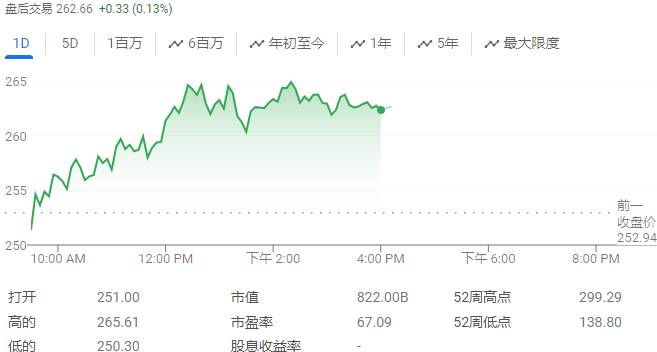

The CSI 2000 Index fell by 1.6% with reduced volume in the morning, reporting at 1955.89 points. Since breaking below the white offensive line on May 23, we have been reminding everyone not to blindly intervene in operations in the short term. Looking back now, it has verified our views. Therefore, following the market trend closely is the right approach, which can minimize the probability of our losses. The index is still below the offensive line, the MACD green column is also continuing to lengthen, and the KDJ is still running downward. It is clear that small-cap stocks are still in a state of adjustment. Let's continue to wait patiently; it won't keep falling blindly. After all, it is near the previous low point, and there are no major issues with the fundamentals. At this time, we should not be blindly pessimistic either. Today's offensive line is near 1998 points, and the index is a bit far away from it. The hope of standing on it today is not very high.Daily chart trend

Share Your Experience