A-shares once again fell below the 3,000-point mark this week, closing at a new low for the phase, with a decline of 1.14%. The weekly line has been down for six consecutive weeks. The continuous volume contraction and downward trend over the past month have been extremely damaging, with many individual stocks falling more than 30%, returning to levels before the Spring Festival, or even lower. The confidence of retail investors is also gradually being eroded. At present, both on and off the market, investors are most concerned about when this downward trend will end and whether there will be a bottoming rebound next week. Next, we will analyze in detail to help friends no longer be confused.

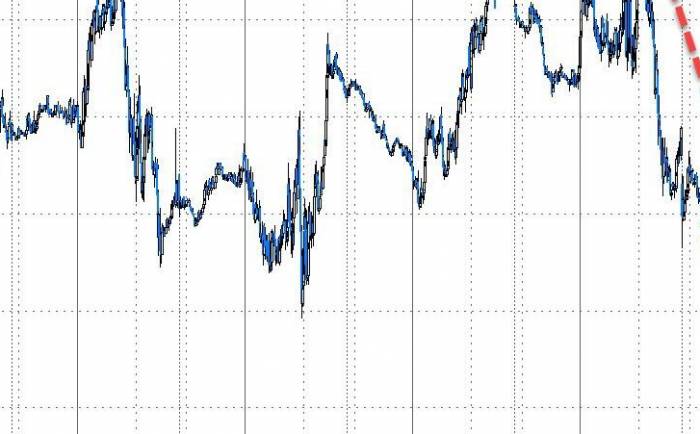

Shanghai Stock Exchange Weekly Trend

Let's first look at the performance of various indices this week. Although they are in the same market, the profit and loss situation may vary greatly because the current pace of each index is not completely the same. If you can't keep up with the market rhythm, it's easy to suffer significant losses.

STAR 50 increased by 0.54%

Micro-cap stocks fell by 0.57%

Shanghai Stock Exchange 50 fell by 1.14%

CSI 300 fell by 1.3%

Zhongzheng 2000 fell by 1.94%

GEM fell by 1.98%

CSI 500 fell by 2.12%The CSI 1000 index fell by 2.42%

From the data above, it can be seen that only the STAR 50 Index maintained an upward trend this week, with the STAR 50 and micro-cap stocks being the only two to outperform the broader market. The SSE 50 and the overall market were flat, while all other indices significantly underperformed. The situation is clear: the overall market is very challenging to operate in currently, with little profit-making effect to speak of, and investors in the market are taking small losses as wins. Why did the STAR 50 perform relatively well this week? It's because the important meeting highlighted the STAR Market, which suddenly became a hot topic again. Of course, don't expect any index to show a dazzling independent trend before the overall market has truly stopped falling and stabilized.

Market trend analysis for next week

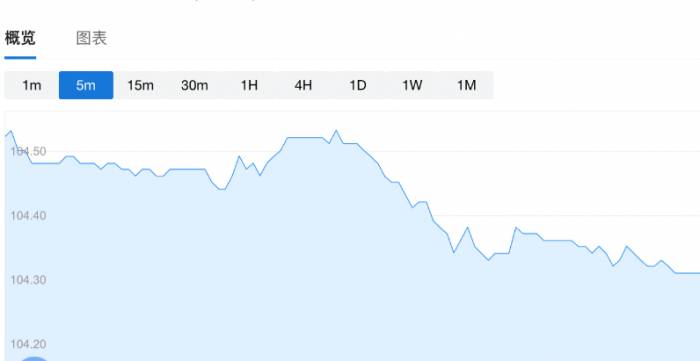

The market is currently in a clear downtrend at both the daily and weekly levels, with little room for operation and a clear loss-making effect. Old friends are well aware of how we precisely escaped the peak, having issued an early warning to everyone. The 3174 point on May 20th was the phase peak, and the closing point on May 22nd was 3158. In the post-market article, it was clearly reminded that once the market effectively broke below 3156 points, as shown in the figure below, it would be time to consider leaving. Because breaking below 3156 points, from our trading discipline perspective, means breaking the offensive trend line, and the market starts to weaken. There's no need to continue fighting. The next day, the market directly broke below 3156 points, and it has been on a downward trajectory ever since. Moreover, during this downward adjustment process, the offensive line has never turned upward again, indicating that the downtrend has been consistent and no substantial change has occurred. In daily articles, we tirelessly remind friends outside the market not to be deceived by ineffective rebounds during the day, to control their hands, to be patient, and to wait for the arrival of real opportunities.

Closing article on May 22nd

Daily level trend

Looking back now, nearly 200 points have fallen, and our strategy can be said to be problem-free, effectively avoiding a major crash. So following the market trend is not an empty phrase. The longer you observe, the more you will understand. In this market, only those who can truly see the big trend and have a large enough perspective can surpass ordinary people and survive in the stock market for a long time. How the market will move in the short term is not something you and I can fully control, but it is necessary to be able to see the trend. There will be rebounds in a downward trend, and many people will bottom-fish halfway up the mountain. In an upward trend, there will be pullbacks, and many people will hastily get off at the beginning of the main wave, making small profits and losing big money, which is the true portrayal of most retail investors.

Below is a technical analysis of the current market trend

Shanghai Composite Index

Looking at the weekly level, the index is currently below all trend lines, and the downtrend is very obvious. The previous rebound returned to the vicinity of the green long-term trend line, but unfortunately, it did not hold firmly, so it is normal for a fall to occur again here. In terms of indicators, the MACD has already shown green columns, indicating that adjustments are also underway. Next week, the index will only have the possibility of reversing the weekly downtrend if it can stand above 3040 points, that is, return above the white offensive line.Weekly Trend Analysis

On a daily scale, the index is currently below all trend lines, indicating a clear downward trend. Only if it can stand above 3010 points on Monday, there is a possibility of reversing the downward trend.

Daily Trend Analysis

In summary, both on a weekly and daily scale, the market is in a clear downtrend. Therefore, everyone should remain cautious and consider re-entering the market only after the trend has reversed. Blindly bottom-fishing will only lead to unnecessary passivity.

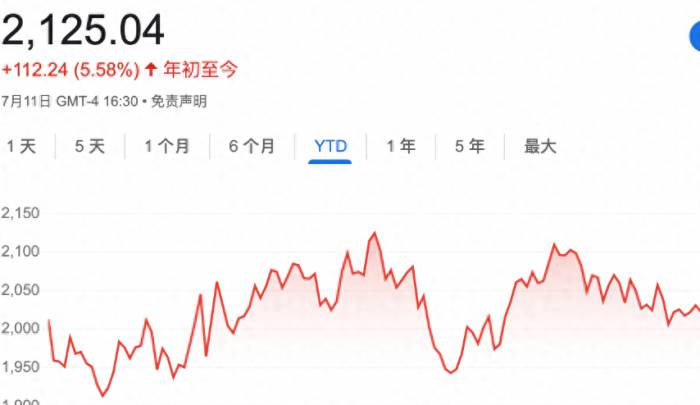

Will the market stabilize next week? I believe there is a good chance. First, small-cap stocks have basically reached their bottom and are not likely to drop further. This week, although the main board index hit a new low, small-cap stocks did not, indicating they are in a severely oversold state. Second, large funds began to return on Friday, with a significant increase in volume for the CSI 300 ETF, several times the usual volume. This is clearly not the work of ordinary funds and can only be interpreted as the intervention of super majors. They control the index by managing large-cap stocks. Their intervention at this point is a clear signal that they do not want the market to continue falling. If the market keeps dropping, the panic effect will intensify, and the market will be in trouble again. In the current market, relying on anyone else is useless; only the major forces can provide a signal to change the current dilemma. Next week may not see an immediate rebound, but overall, there is not much room for further decline. There is no need to be overly pessimistic below the 3000-point level.

CSI 300 ETF Easy Fund

ChiNext Board Trend

On a weekly scale, the index is also below all trend lines, with a clear downward trend. Since breaking below the red medium-term trend on February 17, 2023, it has not been able to climb back above. The suppressing force is still strong, and the two recent weak rebounds also stopped at the red trend line. The ChiNext Board is currently in a bottoming phase, so there is no need to be too nervous. Once the adjustment is in place, there will be a rebound. First, it needs to return above 2060 points. From a long-term perspective, the index is in an oversold state below 2060 points, and subsequent recovery is an inevitable event. Whether it can further strengthen, we will discuss at that time. Next week, focus on whether it can stand above 1790 points. Only by standing above this level can there be a possibility of reversing the weekly downtrend.

Weekly Trend Analysis

Zhongzheng 2000 TrendOn a weekly chart, the current situation is also below all trend lines, with a clear downward trend. The highest point of the week only touched the white offensive line above. A good sign is that there have been no new lows for two consecutive weeks. Next week, the focus should be on whether it can hold above 1930 points. Only by holding above this level can there be a foundation for reversing the downward trend on the weekly chart. Currently, looking at the larger cycle, the CSI 2000 is in an oversold state below 2057 points, waiting for the correction to arrive.

Weekly Chart Trend

The market has been adjusted for a sufficient amount of time, and the decline has been significant enough. There is no need for tension below 3000 points; patiently wait for the adjustment to end, and it won't be long. Darkness will eventually pass, and dawn will surely come. The second half of the year's market is worth looking forward to. Once this adjustment is over, the market will move towards the 3270 point area again; everyone should continue to maintain optimism.

Share Your Experience