A-shares continued their lackluster performance this week, experiencing a volume contraction and oscillating adjustments, closing at 3086.81 points, setting a new recent low. Compared to last week, there wasn't much of a drop, but why does everyone have the illusion of falling every day? To put it bluntly, the rebound on Monday misled everyone, followed by four consecutive days of high-reaching and falling back, with both the high and low points continuously moving downward, creating this negative feeling. Coupled with the persistent volume contraction, the market lacks profit-making effects, leaving everyone with no choice but to lie flat. The most pressing question for retail investors at the moment is where the market will go next and how they should respond. Let's analyze this in detail to give everyone a clear understanding.

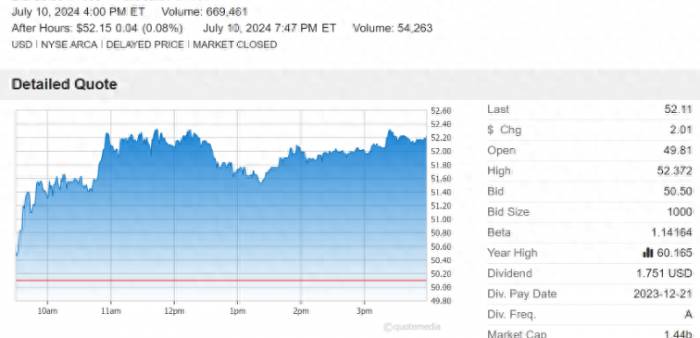

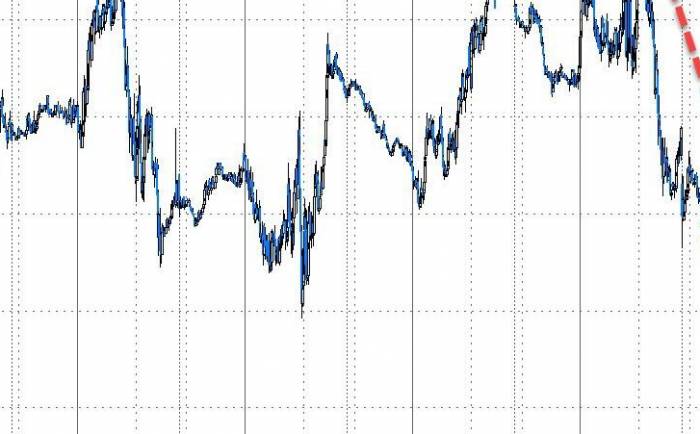

Weekly review of the Shanghai Stock Exchange Index

This week, all three major indices closed lower, with slightly different degrees of decline. The Shanghai Stock Exchange Index fell slightly by 0.07%, the Shenzhen Component Index fell by 0.64%, and the ChiNext Index fell by 0.74%, indicating that the situation for most individual stocks in the market is not very good. In terms of trading volume, all three indices experienced extreme volume contraction this week.

On the capital front, Northbound capital had a net outflow of 5.661 billion this week, marking the first outflow after five consecutive weeks of inflows, but the magnitude is not significant. Combined with the pullback in heavyweight stocks, this outflow is reasonable. On the domestic front, the main funds continued to flow out significantly for five consecutive days, with a total outflow of about 79.2 billion, causing most small-cap stocks to continue to bear pressure.

Performance of specific indices this week:

CSI 1000 rose by 0.1%

CSI 2000 rose by 0.01%

CSI 500 fell by 0.09%

Micro-cap stocks fell by 0.28%Shanghai Stock Exchange 50 falls by 0.5%

CSI 300 falls by 0.6%

Average A-share price falls by 0.51%

From the above data, it can be observed that only the small-cap stocks represented by the CSI 1000 and CSI 2000 indices rose this week, outperforming the broader market, while all other indices fell, underperforming the market. The average stock price fell by 0.51%, indicating that the overall market this week was not very good, and the market as a whole was in a state of adjustment.

In terms of sectors, the top three performing sectors this week were Electronic Chemicals, Semiconductors, and Consumer Electronics. Among them, the Electronic Chemicals sector saw a weekly increase of 11.66%, significantly outperforming the market. Below, we will analyze the trend of the Electronic Chemicals sector from a technical perspective.

At the daily level, the index has already broken through the long-term trend line, indicating that the long-term trend is beginning to strengthen. Moreover, the offensive trend line has crossed above the long-term trend line. Since December 20, 2023, when the offensive line crossed below the long-term trend line, this is the first time the offensive line has returned above the long-term trend line, which is a positive signal. Although there was a volume contraction adjustment on Friday, the index remained above the offensive trend line, indicating that the short-term offensive posture and upward trend have not yet undergone any substantial change. The offensive line will move up to around 1323 points on Monday, and as long as it remains above this level, there is no need for short-term concern.

Daily level trend

At the weekly level, this week saw a significant increase with increased volume, regaining all trend lines, especially the long-term trend line. There are initial signs that the medium to long-term trend is improving. Next week, it is crucial to focus on whether the index can effectively hold above 1318 points. Only by consistently holding above this level can the validity of the breakthrough be confirmed, and subsequently, there can be room for further significant increases.

Weekly level trend

How will the market perform next week?On the weekly chart, last week's index broke below the white offensive trendline. Since the offensive line has been breached, it indicates that the market is no longer in an offensive posture on the weekly scale. Therefore, it is not surprising that this week continues to see adjustments, and I have already warned everyone in last week's article to be prepared for continued fluctuations and adjustments. My long-time followers should have a clear understanding and remain calm.

Given that the market is in an adjustment phase, we must maintain a cautious attitude. With the closing price at the lowest point and no significant positive news over the weekend, we should be prepared for further declines. The yellow trendline below is the first support level on the weekly scale, which will move up to around 3075 points next week. You can see that this trendline support is quite strong; there have been three pullbacks before, all of which stopped and stabilized near this trendline, followed by rebounds. Therefore, we can continue to trust this support as the first line of defense on the weekly scale. The red trendline below is the second support, which will move to around 3055 points next week. Focus on these two support levels next week; as long as the closing price remains above 3055 points, the uptrend on the weekly scale will not change. The offensive line for the weekly scale this week is at 3108.61 points, and it will move to around 3105 points next week. If it can hold above this level next week, the market will return to an offensive posture on the weekly scale, and everyone can remain optimistic.

It should also be noted that although the market has been fluctuating and adjusting for three consecutive weeks on the weekly scale, the trading volume during these weeks has been gradually shrinking, especially this week, which is even more pronounced. A volume contraction at this level is not too worrying and is acceptable. Currently, both the MACD fast and slow lines have crossed above the zero axis, indicating that the market has entered a bullish phase. It remains to be seen when the main force will act again to break the current stalemate, so everyone should remain patient.

On the daily scale, the index is currently below the white offensive line, the yellow short-term trendline, and the red medium-term trendline, clearly in an adjustment posture. If the index cannot effectively hold above 3115 points on Monday, that is, return above the white offensive line and the yellow trendline, then the short-term adjustment trend will not change substantially. Everyone should continue to watch and wait for the bulls to regain control before entering the market. Do not rush in; wait for the main force's starting gun, as rushing in can lead to being eliminated.

Looking at the small-cap stocks, let's start with the CSI 2000 Index. This week it slightly increased by 0.01% with reduced volume, closing with a doji, which implies a strong potential for a trend change. The index is still below all trendlines, indicating that it is still in an adjustment posture on the weekly scale, with a weak trend. Next week, the offensive trendline will move down to around 2040 points. If it can hold above this level by the end of next week, the trend on the weekly scale will see an initial reversal, and small-cap stocks may look forward to a rebound.

On the daily scale, a rebound occurred on Friday, just shy of reaching the offensive line, but the MACD green column has begun to shorten, and the KDJ has reached the bottom, about to form a golden cross, with indicators gradually improving. If it can hold above 2027 points on Monday, it can reach the offensive trendline, and the adjustment trend on the daily scale may be reversed, offering a chance for small-cap stocks to turn around.Daily Trend Level

Overall, the downside potential for small-cap stocks is quite limited at present. The weekly trend has shown signs of a shift, coupled with the emergence of a phase bottom signal at the daily trend level. Therefore, it can only be said that the probability of moving upwards is much greater than that of moving downwards. Everyone should continue to maintain patience.

The ongoing market consolidation with continuous volume contraction is very tormenting, which is a test by the main force. Of course, this situation will not continue indefinitely. Once it contracts to a certain extent and the cleaning is in place, a rebound will naturally be initiated again. The 3174 point is just a phase high, not the end of this round of the market. Our first target is still around 3260 points. Before that, please continue to maintain strong willpower and an optimistic attitude, and actively face the future trend.

Share Your Experience