The Japanese stock market suddenly collapsed.

On the morning of September 9th, Asian stock markets generally fell in the early session. Among them, the Nikkei 225 index fell as much as 3% at one point.

The South Korean Composite Index fell as much as 2%.

In addition, the Australian S&P 200 index fell nearly 1%.

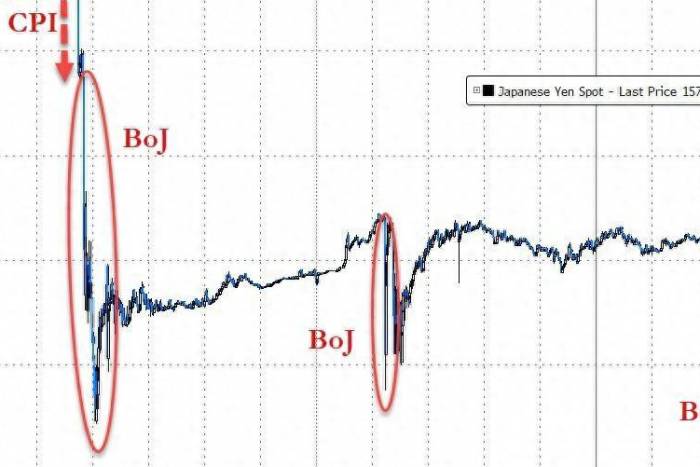

In terms of news, data from Japan's Ministry of Health, Labor and Welfare showed that real wages adjusted for inflation in July rose 0.4% year-on-year, marking two consecutive months of increase, mainly driven by wage increases from spring labor-capital negotiations and summer bonuses. During the period, nominal wages increased by 3.6%, marking 31 consecutive months of increase.

Moreover, Japan's inflation may continue to rise. Since July, many places in Japan have experienced a "rice shortage." Officials in Osaka Prefecture once again called on the Japanese central government to release reserved rice as soon as possible to alleviate supply tension, but were rejected by central government officials. As of the end of June, Japan's private rice inventory was 1.56 million tons, a decrease of 410,000 tons year-on-year, hitting a new low since 1999; the average wholesale price of rough rice in June was 14% higher than the same period last year, setting a record high since August 2013.

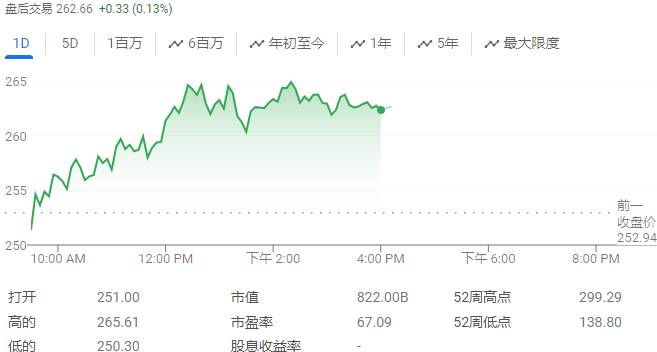

Last Friday, the three major U.S. stock indices all closed lower. By the close, the Dow Jones fell 1.01%, the Nasdaq fell 2.55%, and the S&P 500 index fell 1.73%.

On that day, popular technology stocks fell across the board. Broadcom fell more than 10%, Tesla fell more than 8%, Advanced Micro Devices fell more than 6%, ASML fell more than 5%, Arm, Nvidia, Google A fell more than 4%, Amazon, AMD, Micron Technology, Qualcomm, Meta fell more than 3%, Intel, Netflix fell more than 2%, Microsoft fell more than 1%, and Apple fell slightly.

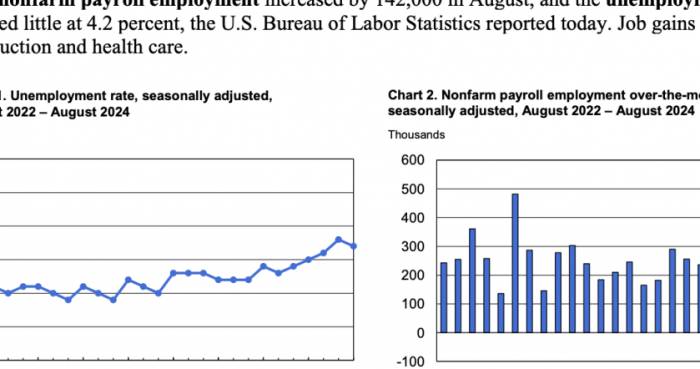

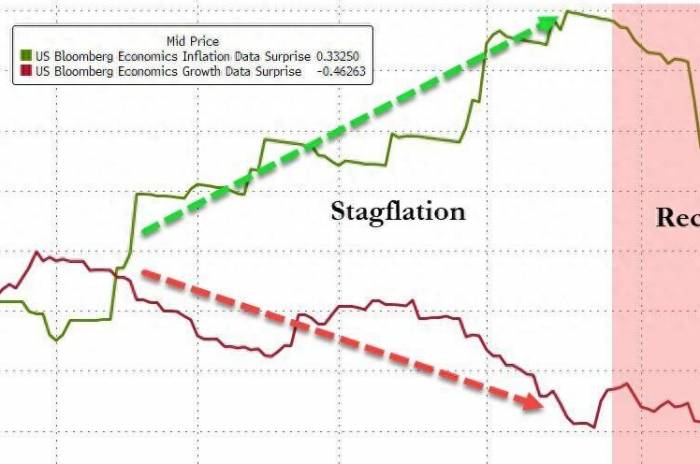

In terms of news, data released by the U.S. Department of Labor showed that the number of non-farm employment in the United States increased by 142,000 people in August, with an estimate of 165,000 people, and the previous value was 114,000 people. The U.S. unemployment rate in August was 4.2%, with an estimate of 4.2%, and the previous value was 4.3%.

Specifically, the number of non-farm employment in the United States increased by 142,000 people in August. The employment growth in August is consistent with the average level of recent months, but lower than the average monthly increase of 202,000 people in the past 12 months. In August, employment growth occurred in the construction industry and the health care industry.Employment in the construction industry increased by 34,000 jobs in August, higher than the average monthly gain of 19,000 over the past 12 months. Healthcare employment added 31,000 jobs in August, which is about half of the average monthly increase of 60,000 over the past 12 months.

The unemployment rate in August was 4.2%, with the number of unemployed persons at 7.1 million, showing little change from the previous month. These figures are higher than the same period last year, when the unemployment rate was 3.8%, and the number of unemployed was 6.3 million. Among the principal working groups, the jobless rate for adult men was 4.0%, for adult women it was 3.7%, and for teenagers it was 14.1%. Among the unemployed, the number of temporary job losers decreased by 190,000 in August to 872,000, offsetting the increase from the previous month. The number of permanent job losers remained essentially unchanged in August, at 1.7 million.

In terms of wages, in August, the average hourly earnings for all employees on private nonfarm payrolls increased by 14 cents (0.4%) to $35.21. The average hourly earnings for production and nonsupervisory employees in the private sector increased by 11 cents (0.4%) to $30.27.

Furthermore, the report indicates that the nonfarm payroll employment for June was revised from 179,000 to 118,000, and for July it was revised from 114,000 to 89,000. After the revisions, the combined employment increase for June and July was 86,000 less than previously reported.

After the data release, swap traders slightly raised the possibility of the Federal Reserve cutting interest rates by 50 basis points later this month. The probability rose from about 36% before the release to about 50%. According to the CME Group's FedWatch tool, the likelihood of a 50 basis point rate cut by the Federal Reserve in September even reached 55%.

Federal Reserve Governor Waller stated that the current batch of data necessitates action from the Federal Reserve; if circumstances are appropriate, he would advocate for "front-loaded rate cuts." Waller believes that the inflation rate will reach the Federal Reserve's 2% target, and starting rate cuts at the next meeting is crucial. He noted that the labor market continues to soften but has not deteriorated, and the unemployment rate has risen mainly due to an increase in labor supply; compared to inflation concerns, the risks to employment are more prominent, and a monthly increase of 100,000 jobs is normal in the long run. Waller said that if the data warrants it, he supports consecutive rate cuts at subsequent meetings and, if necessary, supports more significant rate cuts.

Following Waller's support for the Federal Reserve to take "front-loaded action" on rate cuts, traders increased their bets on the Federal Reserve's easing policy. Traders are now betting that the Federal Reserve will cut rates by 25 basis points in September, with a larger cut expected in November.

Share Your Experience