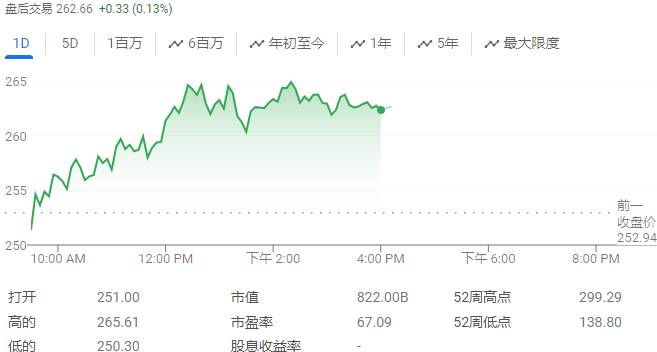

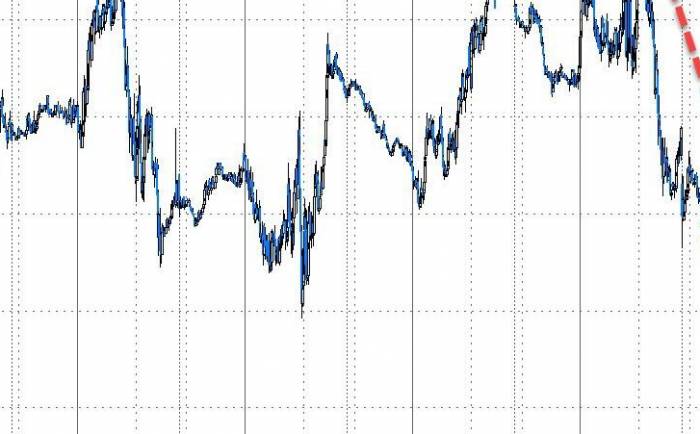

On August 5th, the U.S. stock market faced a wave of selling. According to data from the London Stock Exchange, the "Miracle Seven" giants, including Apple, Tesla, Google, Amazon, Nvidia, Meta, and Microsoft, saw their market value evaporate by approximately $800 billion. Market concerns about the U.S. economy entering a recession intensified investors' worries about tech companies' large-scale construction of artificial intelligence (AI) infrastructure.

Bad news keeps coming, scaring the market

As of the market close that day, Apple, Tesla, Google, and Amazon's stock prices fell by more than 4%, Nvidia dropped by about 7%, and Microsoft and Meta's stock prices fell by around 3%. Worried about a U.S. economic recession, Berkshire Hathaway has sold about half of its stake in Apple.

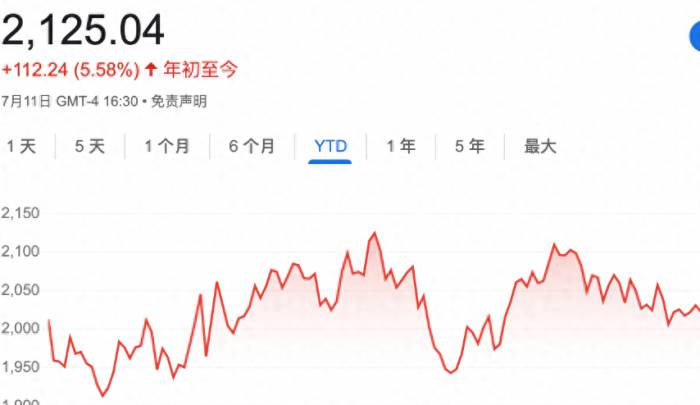

The Philadelphia Semiconductor Index plummeted by 2.6% that day, bringing the index's drop to 14% over the past three trading days. Due to Nvidia being exposed for potential design flaws that could delay shipments of the next-generation chips, the company's stock price has fallen by more than 10% over the past five trading days. In the past month, Nvidia's stock price has dropped by over 20%, but the company's stock price has still doubled year-to-date.

Due to underperformance by companies like Arm, SoftBank Group's stock price plummeted by nearly 19% in Monday's global sell-off, with the group's founder, Masayoshi Son, losing $4.6 billion in wealth in one day. Since last Wednesday, SoftBank's market value has evaporated by about $28.3 billion, erasing all gains made so far this year.

Bad news for tech companies keeps pouring in, and tech giants are facing strict antitrust market regulation. On August 5th, local time, a U.S. federal judge ruled that Google illegally monopolized online search, violating the law. This ruling could lead to Google's breakup and change the landscape of the online advertising market, which Google has dominated for many years.

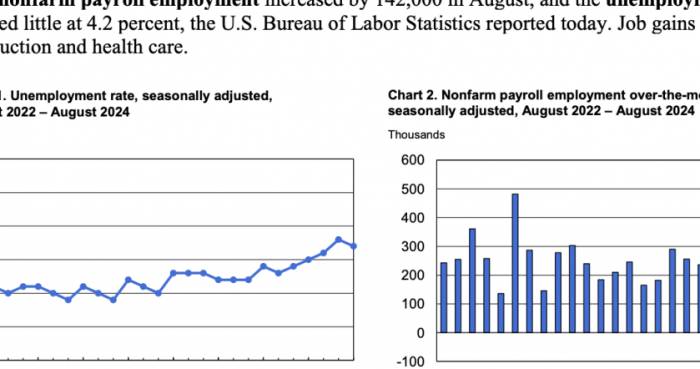

From a macroeconomic perspective, last week the U.S. released a weak employment report, and Tesla CEO Elon Musk called on the Federal Reserve to lower interest rates to avoid a recession. These factors further weakened the U.S. stock market's multi-month rally driven by optimism about artificial intelligence.

Brokerage firm AJ Bell said in an investor advisory: "The market's expectations for the so-called group of seven companies may be too high. The success of these tech companies has made them unshakable in the eyes of investors, and when they fail to meet expectations, investors holding a large number of these companies may be 'stabbed in the back.'"

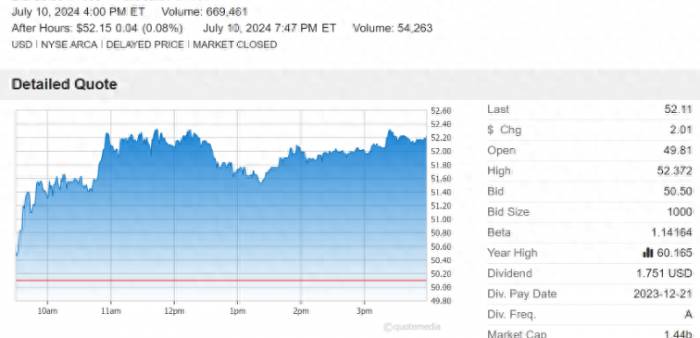

After tech companies' earnings reports, the market was frightened by the companies' significant increase in capital expenditure. Data shows that Microsoft, Amazon, Google, and Meta's capital expenditure increased by 50% in the first half of this year, reaching an unprecedented level of over $100 billion. Market analysis predicts that, at the current pace of investment growth by tech companies, large tech companies' AI-related investments may more than double by the end of this year.

This means that the construction cost of AI infrastructure may be significantly higher than investors' original expectations, and it will take longer for expenditures to yield returns. Jim Tierney, the head of U.S. growth at Alliance Bernstein, said: "Tech companies are aggressively increasing investments, but investors are still unclear about all the business models and returns. Everything is describing a future vision, and such a high level of spending is unsettling."Technology company earnings reports were just the spark that ignited a global sell-off. Research firm YARDENI Research analyzed several major reasons for the global sell-off that occurred on Monday: a rapid decline in yen-financed transactions, escalating geopolitical tensions in the Middle East, large positions in technology stocks, and weak employment reports and earnings.

An investor from Indiana, USA, told Yicai Global: "The economy is indeed weakening, and there have been signs of this happening over the past few months. But whether last week's data were sufficient to cause such a significant market plunge is still very complex."

The investor believes that the market's investment in artificial intelligence has been overextended over the past two years, and once there is bad news, the market's reaction becomes more unstable.

"Many investors will be surprised why so many successful tech giants have such a significant correction, but this happens when the entire market is selling off," he said, "And for disciplined investors, this is an opportunity to rebalance their asset purchases."

Clearing the bubble to achieve long-term investment value

Jefferies London European Chief Economist Mohit Kumar said in an investment report: "Firstly, we believe that positions are the main driver of recent market trends. The US stock market, especially technology stocks, is over-owned and needs to clear some bubbles. Secondly, our view of the US employment situation has not changed. We have always believed that the market will weaken moderately, but will not fall into disaster. In this context, we believe that the adjustment of risk assets is not the beginning of an economic recession, and the adjustment and cleaning of positions are meaningful."

Some analysts who firmly believe in technology stocks believe that Monday's decline may provide investors with more attractive valuations to buy large technology stocks. "From the investment in artificial intelligence, people may obtain long-term returns," DBS Bank China Investment Director Deng Zhijian told Yicai Global.

Deng Zhijian believes that the earnings of technology companies in the second quarter were generally good, especially some large technology companies. "About 80% of the S&P 500 companies in the United States have announced their second-quarter earnings reports, with an average profit of 11%, which is the best performance in the past three quarters. The probability of a soft economic landing is relatively large, and moderate interest rate cuts may be the main theme," he told Yicai Global.

Long-term technology stock bull analyst Dan Ives of Wedbush Securities has been tracking Wall Street technology stocks for the past 24 years. He said: "Our strategy is to lead investors through panic and irrational global sell-offs, hold the best technology stocks that drive growth themes, and become winners."

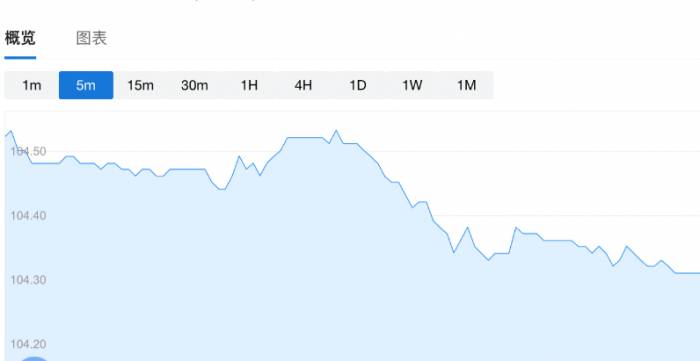

Exencial Wealth Chief Investment Officer Tim Courtney analyzed that although the market has focused on inflation, artificial intelligence, potential economic recessions and other issues in the past few years, the most critical thing is to closely monitor the Federal Reserve's interest rates. "The current situation is very similar to the end of 2019, when the yield curve was inverted, and the market believed that the Federal Reserve should lower interest rates, there was a severe fluctuation that lasted for several weeks," he said.A Chinese investor told the First Financial reporter that the rapid fluctuation of the yen has put downward pressure on the Japanese stock market, with investors leveraging up by borrowing yen to purchase other assets, mainly U.S. tech stocks. "The tech stocks soared significantly in the first half of the year, leaving a lot of room for subsequent selling," he analyzed, "It's too early to say that the economy is slowing down, but perhaps the market crash will pave the way for the Federal Reserve to start significant interest rate cuts."

Share Your Experience