In the first half of this year, large-cap stocks led by tech giants contributed to the main gains of the S&P 500 index, while small-cap stocks became the short-selling targets of hedge funds. However, this trend seems to be reversing.

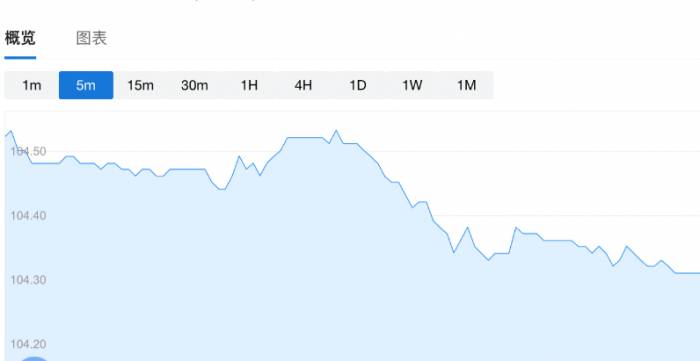

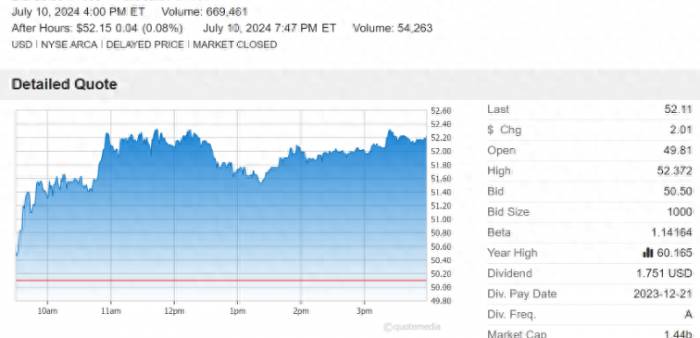

Overseas stocks in the US saw a collective surge in small-cap stocks due to the continued significant slowdown in CPI data. Investors began to sell off leading large-cap tech stocks and turned to small-cap, mid-cap, and interest rate-sensitive sectors such as real estate. The Russell 2000 index rose by 3.6%, while the tech-heavy Nasdaq Composite Index fell by 2%. This contrast is the largest on record. Many funds were forced to quickly close their short positions in small-cap stocks while reducing their long positions in tech giants.

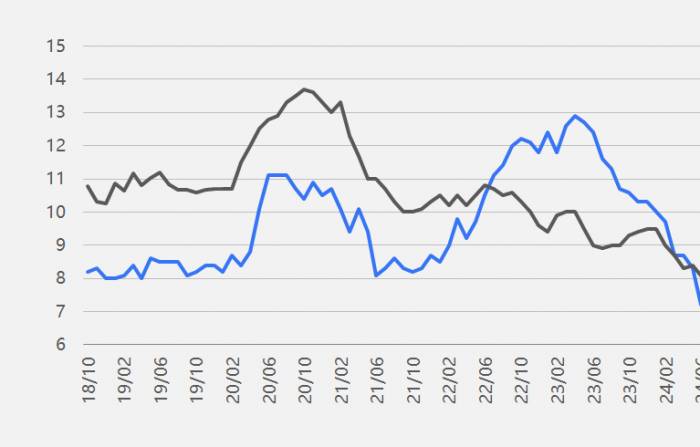

This change caught many hedge funds and investors off guard. According to an analysis by Bespoke Investment Group, over the past five weeks, investors such as hedge funds have significantly increased their short positions in the Russell 2000 small-cap index, with net short positions expanding by 9.5 percentage points to 16.8%. This is the largest five-week increase since March 2020.

The reason behind the overnight surge in small-cap stocks is quite simple: interest rate cuts help to increase the earnings of small-cap stocks while allowing these companies to better manage their debt.

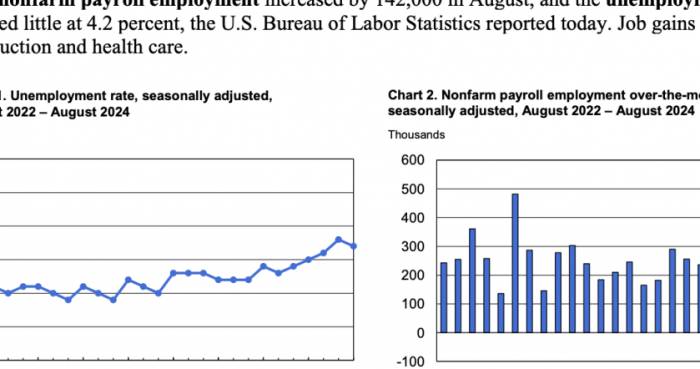

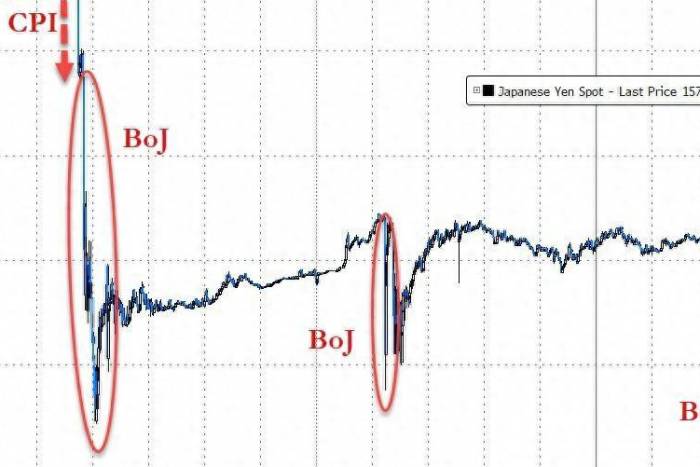

The June CPI data showed that US inflation has cooled down across the board, with the overall CPI month-on-month growth rate turning negative for the first time in four years, and the core year-on-year growth rate hitting a new low in over three years. Expectations for interest rate cuts within the year have significantly increased, with the possibility of the first rate cut in September rising back to 80%, and the probability of a rate cut in July reappearing.

Jordan Irving, a portfolio manager at Glenmede Investment Management, told the media that, from the current valuation level, the potential for small-cap stocks to rise is much greater than that of large-cap stocks. Data from FactSet shows that the price-to-sales ratio of Russell 2000 index constituents is 1.2 times, while that of S&P 500 index constituents is 3 times.

So far this year, small-cap stocks have only risen by less than 6%, while the US stock market has risen by more than 15% over the same period.

Callie Cox, Chief Market Strategist at Ritholtz Wealth Management, told the media that the rotation of stock market winners in 2024 has surprised the entire market.

Jefferies' analysis shows that in the first year after the Federal Reserve begins to cut interest rates, small-cap stocks tend to outperform large-cap stocks. Interest rate cuts may help to boost the profits of small companies and improve their debt management capabilities. With the expectation of interest rate cuts heating up, small-cap stocks may see a larger-scale rise.

However, analysts also remind investors that interest rate cuts alone may not solve all the problems faced by small-cap stocks. Investors still need to pay attention to whether these companies can increase profits and invest in growth projects.Considering that the valuation gap between small-cap and large-cap stocks is at one of the highest historical levels, small-cap stocks may still be favored by investors seeking undervalued opportunities.

Share Your Experience