Without suspense, the morning article also administered a preventive shot to everyone; the battle to defend the 3000-point level ended in failure once again, and everyone should be used to it by now. It's also good that it broke, as the 3000-point level was never a significant support level to begin with. Only by breaking can we establish; the sooner the adjustment is in place, the sooner a rebound can be expected. Additionally, there are two points that need close attention today: one is that the trading volume has reached a new low for this phase, and the other is that a doji pattern was formed, indicating a potential change in the market trend. How will the market operate next Monday? How should retail investors respond? Let's analyze in detail below to give everyone a clear picture.

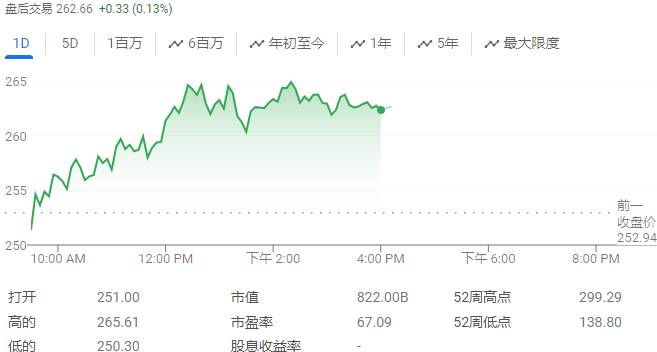

Shanghai Composite Index Daily Trend

The market is still in a downtrend

The market is still in a downtrend, and it's important to remind everyone repeatedly that those who have not yet entered the market should continue to hold back, maintain a wait-and-see attitude, and not easily get involved. Although the market has fallen significantly in the past month, do not try to bottom-fish before the trend has truly reversed. Everyone must overcome the psychology of greed and not fantasize about buying at the lowest point and selling at the highest point. This mindset is unrealistic and very dangerous; wait for the market to give us a clear signal.

The highest point in the current market phase was 3174 points, and the level at which I reminded everyone to exit was 3156 points. Once the market effectively broke below 3156 points on May 23, the market's offensive trend changed. Subsequently, the market continued to decline and never stood above the offensive line again. The offensive line never turned upward, and the market entered a state of lethargy, falling nearly 200 points in a month, with most individual stocks falling by 30%, which is quite terrifying. I can only blame my limited influence for not being able to help more friends.

Yesterday, I reminded everyone to pay attention to whether the market could stand above 3019 points. Today, the highest point of the market was only 3011.91 points, which obviously did not break through and stabilize at the key level, that is, the offensive line. Therefore, the current market's downtrend does not yet have the basis for a reversal and continues to weaken, so we can only continue to wait.

Summary of Today's Market

All three major indices fell today, with the Shanghai Composite Index and the ChiNext Index closing with a doji pattern. Is this a continuation of the decline or a signal of a bottom? There is no need for subjective speculation; the market will provide the answer on Monday, and we can simply follow the trend of the market. The total trading volume of the two markets was only about 622.3 billion, a decrease of about 10 billion from yesterday, which has basically become stagnant. Those inside the market are lying flat, and those outside are watching, waiting for what? Waiting for the big players to come in and save the day. Until the Shanghai 50 and the CSI 300 pull out a large volume long red candle, it will be difficult to break the current stalemate.

Performance of Specific IndicesFrom the data above, it can be observed that today only the CSI 500 maintained an upward trend, while the CSI 1000 and CSI 2000 also experienced relatively small declines, outperforming the broader market. The rest of the indices, although in a downtrend, did not see significant drops, all within 0.5%. Thus, although the overall market was in a downtrend today, the decline in individual stocks was relatively limited, indicating that many stocks are indeed hard to push down further.

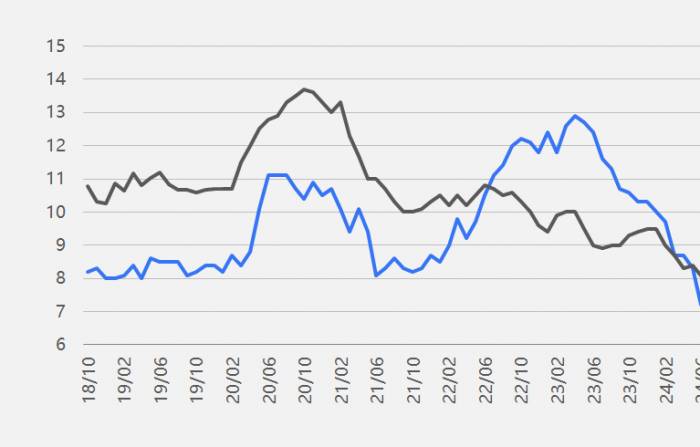

In terms of sectors, the leading gainers today were relatively obscure engineering-related sectors, which we will not analyze in detail. Instead, let's continue to focus on the current popular semiconductor sector.

The semiconductor sector experienced a volume contraction with a decline of 0.59% today, closing at 1056.16 points. Similar to yesterday, there was significant intraday volatility. Yesterday it was a high-open and low-close pattern, while today it was a low-open and high-close pattern, both with volume contraction, suggesting a higher likelihood of a washout. From a trend perspective, the index is still above all trend lines, and the current short-term rebound uptrend has not undergone any substantial change. Next Monday, the line of attack will move to around 1044 points. As long as the index closes above this level, there is no need for concern. However, if it breaks below this level completely, those holding should be cautious in the short term and may consider avoiding the market, waiting for the trend to become clear before re-entering.

Daily trend analysis for next Monday:

Shanghai Composite Index trend:

The index fell by 0.24% today, closing at 2998.14 points. It remains below all trend lines, with a clear downtrend that has not changed at all. We continue to remind everyone to remain cautious and not to go against the market trend. Next Monday, the line of attack will move to around 3010 points. Without standing above this level, there is no basis for a reversal of the current downtrend.

Daily trend analysis for next Monday:

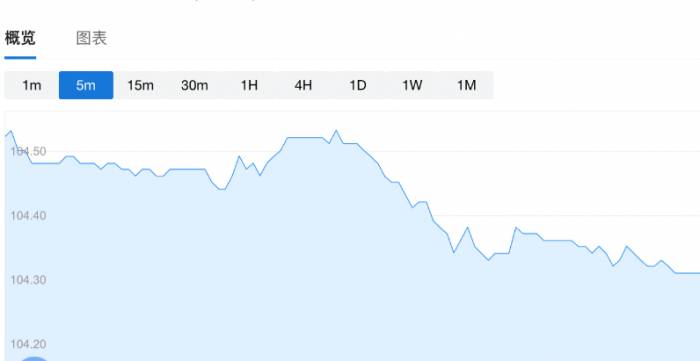

ChiNext Index trend:

The index fell by 0.39% today, closing at 1755.88 points. It experienced significant volatility, with a high-open and low-close followed by a low-open and high-close, also resulting in a doji candlestick pattern, and the trading volume shrank significantly. The index is also below all trend lines, with a clear downtrend. Next Monday, the line of attack will move to around 1770 points. Only by standing above this level can there be a possibility of reversing the downtrend.Daily Level Trend

Micro-cap Stock Trend

The index fell by 0.27% today, closing at 1,254.98 points, and it also closed with a doji star today. Currently, the index is below the short to medium-term trend lines, indicating a clear downtrend. On Monday, the attack line will move to around 1,259 points. Only by standing above this level can there be a basis for a reversal of the downtrend.

Daily Level Trend

CSI 2000 Trend

The index fell by 0.11% today, closing at 1,884.9 points. It is also below all trend lines, showing a clear downtrend. On Monday, pay attention to the 1,900 point level. Only by standing above this level can there be a possibility of reversing the downtrend.

Daily Level Trend

CSI 300 Trend

The index fell by 0.22% today, closing at 3,495.62 points, setting a new low for the phase, and also closing with a doji star. The index is currently below all trend lines, and the downtrend is continuing. On Monday, focus on the contest at the 3,510 point level. It is necessary to stand above this level for there to be hope of reversing the downtrend.From the trend of the various indices above, it can be observed that they are generally in a downward trend. There are not many good opportunities in the current market, and the difficulty of operation is high. Coupled with the contraction of trading volume, to be honest, this stage is not for making money but for forcing retail investors to sell their positions and leave the market, handing over their chips in the bottom area. The most uncomfortable ones at the moment are the investors who are deeply trapped in the market. However, I still want to comfort everyone that difficulties are only temporary, and there is very limited room for further decline. Although the A-share market does not perform well most of the time, it has always existed and will not disappear. New opportunities will still emerge. I believe this is the darkness before dawn, which has historical precedents. I still insist on being optimistic that there will be a very good market in the second half of the year. It will not be difficult to surpass 3174 points, and we will continue to wait for the arrival of 3270 points.

Share Your Experience