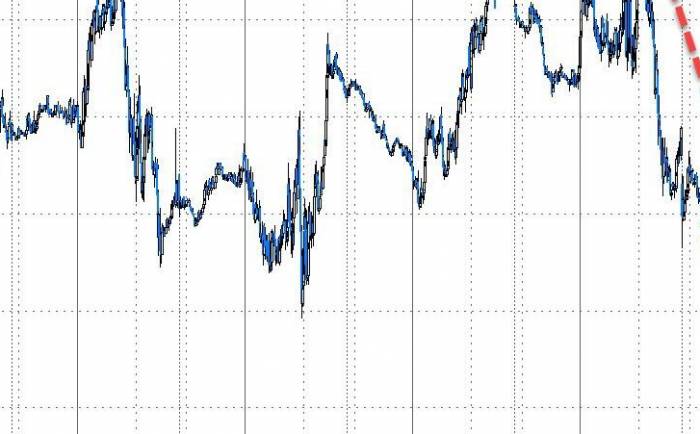

Unconsciously, Tesla has risen for 10 consecutive trading days.

Tesla's recent stock price has skyrocketed like a rocket, with a closing increase of 3.71% on Tuesday, pushing the share price to $262.33, marking 10 consecutive days of gains and a cumulative increase of nearly 44% over 10 days, setting a record for the longest winning streak in a year.

Although the ten-day winning streak is impressive, Wall Street analysts have significant disagreements on the future trend of Tesla's stock price. The difference between their highest and lowest target prices for Tesla is about $200, equivalent to 80% of Monday's closing price, while for Apple, another member of the "Big Seven," this ratio is about 40%.

This is not surprising, as Tesla's stock performance has been quite extreme and unstable. Over the past five years, Tesla's stock has been above Wall Street's average target price for nearly 50% of the time, while Apple's stock has only been above Wall Street's average target price for 20% of the time. This means that the volatility of Tesla's stock price is much higher than that of Apple.

Moreover, as one of the "Big Seven" stocks in the U.S. market, Tesla was the only one among these seven stocks that was expected to report a loss in 2024 until last week. Thanks to the nine-day winning streak, Tesla's year-to-date gain has finally turned to about 2%.

As of Monday, the average year-to-date increase for the six giants, Microsoft, Nvidia, Apple, Amazon, Alphabet, and Meta, was about 53%, far ahead of the rest.

Tesla's ten-day winning streak is inseparable from better-than-expected electric vehicle deliveries.

Some analysts believe that the new energy vehicle business is the driving force behind Tesla's continuous stock price increase.

Gary Black, co-founder of Future Fund Active ETF and a Tesla shareholder, pointed out that the easing of delivery pressure and the stabilization of the core electric vehicle business have been key drivers of Tesla's stock price increase.

On July 2, Tesla announced better-than-expected vehicle deliveries for the second quarter. With 443,000 vehicles delivered, it exceeded market expectations. Although it was a year-on-year decrease of 4.8%, the decline was not significant, as Wall Street had previously expected a drop of more than 15%.Improved performance in new energy vehicles has instilled confidence in investors, who believe that Tesla could achieve growth again by 2025. The market anticipates Tesla's deliveries in 2024 to reach around 1.8 million units, on par with 2023. The better delivery figures have also stabilized profit forecasts. Wall Street initially estimated Tesla's earnings per share to be around $3.8, while current expectations are around $2.4.

Brian Rauscher, founder of BFR Research, stated that investors typically dislike buying stocks with declining profit expectations. Although Tesla's profit expectations have not yet risen, they are no longer as bad as they were, which is often sufficient for investors.

Tesla's ten-day rally also relies on retail speculation?

However, there are differing opinions in the market regarding Tesla's ten-day rally.

On Tuesday, the "old bond king" Gross stated that Tesla's performance resembles that of a meme stock, where the fundamentals continue to weaken while the price soars straight up. It seems that a new viral stock appears every other day, most of which are pumped and dumped.

Toni Sacconaghi, an equity analyst at AB Bernstein, believes that Tesla's stock price may continue to rise for a while, but frankly, it is akin to the earlier meme stock craze, a result of retail investors' irrational speculation on the stock price, as Tesla's valuation is disconnected from its fundamentals.

As soon as Sacconaghi made this statement, it stirred up a storm on social media platform X, with many voices questioning Sacconaghi's views.

"This is an FOMO (Fear of Missing Out) game between institutions and retail investors."

"Retail investors' fervor is also one of the fundamental factors. When the meme economy is strong, Tesla will also be strong."

"What kind of meme stock has factories in multiple countries and does business with world leaders? Isn't the entire stock market about hope for the future? Aren't all predictions and spreadsheets just fancy guesses?"From these reviews, it can actually be seen that many people still have high hopes for Tesla's future. Currently, both profit expectations and vehicle delivery volumes are related to Tesla's automotive business. If Tesla's stock price wants to climb to a higher level in the future, it will require a stable development of its artificial intelligence business, which can bring more hope to Tesla's shareholders in the future.

Wedbush analyst Dan Ives stated that Tesla is the most undervalued artificial intelligence company in the market. The value of Tesla's AI business may increase by $1 trillion in the future. If the robotaxi event on August 8th is a huge success, it may further drive the stock price up.

Share Your Experience