The market is optimistically anticipating that any signs of economic weakness later this year will lead to interest rate cuts by the Federal Reserve. The June CPI data released on Thursday is expected to further boost expectations for a rate cut. On Monday, the US stock market's Nasdaq and S&P 500 both reached new highs. Additionally, the latest survey results from the Federal Reserve Bank of New York show that US inflation expectations have fallen for two consecutive months, with the one-year inflation expectation for June dropping to 3.02%, down from 3.17% previously.

In the foreign exchange market, the US Dollar Index (DXY) remains stable, fluctuating around 105. Data indicates that average cash income in Japan increased by 1.9% in May, and overtime pay has risen, causing the Japanese Yen to break through 161. Comments suggest that with the strong wage agreements taking effect, real wages are expected to rebound in the third or fourth quarter, bolstering expectations for a rate hike by the Bank of Japan later this year.

Commodities have generally fallen. The market assesses that the impact of Hurricane Beryl is limited, and hopes for a ceasefire in the Middle East conflict have strengthened, leading to a roughly 1% drop in international oil prices. Gold prices fell by over 1.6%, giving up all gains since last Friday's "Non-Farm Day," and silver prices fell by over 2%. Analysts claim that last week's Non-Farm data drove a significant rise in precious metals, and investors are inclined to take profits. The strong performance of the US stock market has partly diminished the appeal of precious metals, while the People's Bank of China has paused purchasing gold for the second consecutive month.

Internationally, France is now focusing on who will take the helm, as no political party has secured a majority. While this may alleviate concerns about extremist policies, it also raises worries about increased political instability due to the tough negotiations ahead. The French stock market fell by over 0.6%. Analysts suggest that the left-wing becoming the dark horse in France's Sunday election is unfavorable for the Euro and French government bonds in the short term. It is highly likely that a prime minister will be chosen from a centrist coalition, and the market will gradually stabilize.

The market is also focusing on Federal Reserve Chairman Powell's testimony in the Senate on Tuesday and the House of Representatives on Wednesday, a series of speeches by Federal Reserve officials, and the release of US CPI inflation data on Thursday. This week will also see the issuance of US Treasury bonds with 3-year, 10-year, and 30-year maturities, and the start of the second-quarter earnings season for US stocks on Friday.

The S&P and Nasdaq achieved five consecutive days of gains to reach new historical highs, with Tesla on a nine-day winning streak, Apple closing at a new high and leading in market value, NVIDIA rising by nearly 1.9%, and TSMC reaching a new high.

On Monday, July 9th, the Nasdaq and S&P 500 closed at new historical highs once again.

The technology stock-focused Nasdaq hit a new daily high during the session, breaking through the 18,400 mark, with a gain of nearly 0.35%, and closed up by 0.28% at a new high; the S&P 500 index reached a new intraday high of 5,567.19 points, with a gain of nearly 0.29%, and gave up some gains at the end of the day, closing up by 0.10% at a new high; the Dow Jones, which is composed of blue-chip stocks, turned down in the afternoon, bidding farewell to a one-month high; the Russell Small Cap Index maintained its upward momentum, with the largest relative gain among the main indices.

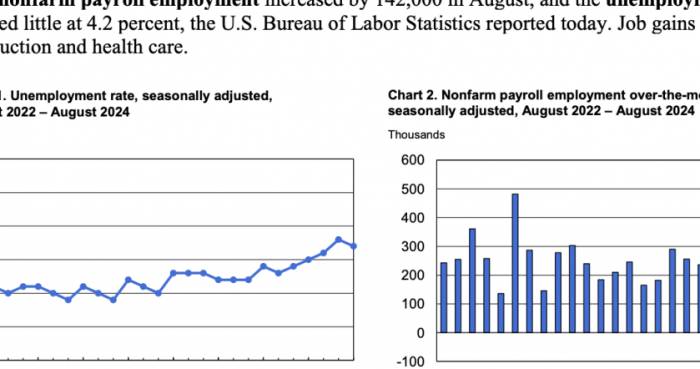

As of the close, the S&P 500, Nasdaq, and Nasdaq 100 all set new closing highs, with the S&P 500 and Nasdaq marking their 35th and 24th historical highs for the year, respectively:

The S&P 500 index rose by 5.66 points, or 0.10%, to close at 5,572.85 points. The Dow Jones fell by 31.08 points, or 0.08%, to close at 39,344.79 points. The Nasdaq rose by 50.98 points, or 0.28%, to close at 18,403.74 points.The NASDAQ 100 rose by 0.23% to a new high, with the NASDAQ Technology Market Value Weighted Index (NDXTMC), which measures the performance of technology stocks in the NASDAQ 100, increasing by 0.46% to a new high, historically closing above the 1800-point mark for the first time. The Russell 2000 small-cap stocks closed up by 0.59%, and the "fear index" VIX fell by 0.96% to 12.36.

At the open, the Dow and small-cap stocks experienced panic buying, and as the European market closed, the gains in U.S. stocks began to recede, with major indices briefly turning negative.

Among the 11 sectors of the S&P 500, the S&P Information Technology/Technology sector closed up by 0.72%, while the financial sector closed down by more than 0.1%, the energy sector fell by about 0.6%, and the telecommunications services sector fell by 1.01%.

Morgan Stanley and Goldman Sachs issued warnings on Monday, believing that the U.S. stock market faces a significant risk of pullback in the near term, and traders should be prepared. Goldman Sachs expert Rubner stated in a report to clients on Monday that he expects a substantial outflow of funds from the U.S. stock market in August. He wrote, "Buyers are out of ammunition, I am watching for capital outflows. I have actually turned tactically bearish. Painful trades have shifted from upward to downward."

Morgan Stanley strategist Wilson believes, "I think the likelihood of a 10% pullback between now and the election is very high: the third quarter will be very volatile. The possibility of stock prices rising from now until the end of the year is very low, much lower than usual."

In addition, Andrew Tyler from J.P. Morgan's trading department said he remains bullish, but recent weak economic data has caused his confidence to "slightly decrease." Scott Chronert from Citigroup warned about a potential pullback.

Star tech stocks showed mixed performance. Tesla closed up by 0.56%, achieving a nine-day winning streak with a cumulative increase of 38.5% over nine days; Apple closed up by 0.65% to a historical high, having risen for five consecutive days, and its market value once again surpassed Microsoft to take the top spot; Google, Microsoft, and Meta fell from the historical highs set last Friday, with Microsoft down by 0.28%, Google A down by 0.82%, "Metaverse" Meta down by 1.96%, Amazon down by 0.36%, and Netflix closed down by 0.71%.

Chip stocks generally rose. The Philadelphia Semiconductor Index increased by 1.93% to a historical high, and the industry ETF SOXX rose by 1.9%. NVIDIA rose by nearly 4%, then halved its gains to close up by 1.88%, with a market value of $315 billion, ranking third in the U.S. stock market, and the NVIDIA double long ETF closed up by 3.67%.

Furthermore, Arm, TSMC, and KLA Corporation reached new highs. TSMC once rose by more than 4% during the session, and its market value broke through $100 billion, closing up by 1.43% with a market value of $968.05 billion. Arm closed up by 1.94%, breaking through the 185 integer mark, achieving a four-day winning streak with a four-day cumulative increase of 16.3%, KLA Corporation closed up by 1.33%, Intel rebounded significantly, closing up by 6.15%, AMD rose by 3.95%, Broadcom rose by 2.5%, Qualcomm rose by 1.04%, while Micron Technology fell by 0.6%.

AI concept stocks showed mixed performance. Super Micro Computer rose by 6.23%, Dell Technologies rose by 5.04%, BigBear.ai rose by 3.5%, Palantir rose by 1.73%, CrowdStrike rose by 0.26%, SoundHound.ai rose by 0.24%, Oracle rose by 0.14%, while C3.ai fell by 0.13%, and Snowflake fell by 1.01%.In terms of market news:

NVIDIA: UBS has raised its target price for NVIDIA from $120 to $150.

Microsoft, Qualcomm: Is the AI PC, which Microsoft and Qualcomm are heavily promoting, "much ado about nothing"? This year's shipments will only account for 3%. Industry research firm IDC estimates that only 3% of personal computers (PCs) shipped this year will meet the processing power threshold that Microsoft considers for artificial intelligence computers (AI PCs). By 2026, AI PCs will only account for about 20% of the global new PC shipments, equivalent to one-fifth of the shipments two years later. Analysts believe that the practicality of AI PCs is limited because few software manufacturers, apart from Microsoft, are developing features that optimize computers to perform AI tasks using new chips. A major PC manufacturer once proposed adjusting the software so that new computers could use AI tools directly upon launch, but this request was rejected by app manufacturers such as Adobe, Salesforce, and SentinelOne.

Boeing: After rising by 3.6% during the session and then turning negative, the stock eventually closed up by 0.6%. The company will plead guilty to fraud charges related to the 737 Max fatal crash settlement agreement, but the failure of oxygen masks has led the Federal Aviation Administration (FAA) to require inspections of 2,600 Boeing 737 aircraft.

TSMC: MediaTek and Qualcomm's flagship smartphone chips are set to be released in Q4, with TSMC's 3nm process adding significant orders. According to predictions from several Wall Street investment bank analysts, due to the ongoing global shortage of high-end wafer foundry capacity, TSMC is expected to raise its full-year sales forecast in the financial report to be released next week. Previously, Morgan Stanley raised its target price for TSMC by 9.3%, citing expectations of sustainable demand for AI semiconductors and a trend of increasing wafer prices. It is projected that wafer prices will rise by 5% in 2025, up from the previous assumption of 2%. Morgan Stanley maintains an overweight rating on TSMC, raising its target price from 1080 New Taiwan dollars to 1180 New Taiwan dollars.

Apple: Media reports, citing sources from the supply chain, indicate that Apple has increased its production target for the iPhone 16 series to around 90 million units for this year. Executives from Apple's supply chain companies analyzed that during the domestic 618 e-commerce promotion in June, Apple adopted a discount promotion strategy. After the price reduction of the iPhone 15 series, sales significantly increased, which may have boosted Apple's sales expectations for the iPhone 16 series.

Samsung: The largest union of Samsung Electronics in South Korea—the National Samsung Electronics Union—conducted a general strike on July 8, with 6,540 people participating in the rain. Currently, Samsung holds about 20% of the global market share in synchronous dynamic random access memory and as much as 40% in the flash memory chip market. Analysts point out that any disruption in Samsung's production could trigger a chain reaction globally, affecting the stability of the entire industry.

Most Chinese concept stocks fell. Among ETFs, the China Technology Index ETF (CQQQ) closed down by 0.51%. The China Internet Index ETF (KWEB) closed down by 0.98%. The NASDAQ Golden Dragon China Index (HXC) closed down by 1.05%, breaking below the 5,900 point level.

Among popular Chinese concept stocks,贝壳 (BEKE) fell by about 4%, Alibaba fell by about 1.4%, Li Auto fell by more than 1.3%, Baidu and JD.com fell by about 1.1%, Douyu fell by more than 0.8%, VIPShop fell by about 0.7%, New Oriental fell by about 0.6%, Ctrip fell by 0.4%, NetEase fell by more than 0.2%, while ZTO Express rose by 0.7%, Bilibili rose by more than 2.4%, Sohu rose by more than 5.1%, and Global Data rose by more than 9.1%. XPeng Inc. fell by more than 6%, as the company confirmed the departure of the head of the automotive technology center. Niu Technologies rose by 16%, planning a large-scale retail expansion to over 800 Best Buy stores across the United States.

In terms of stocks with significant fluctuations:

(Note: The original text provided does not include specific information about the stocks with significant fluctuations, so this part of the translation is incomplete.)Biopharmaceutical company Morphic Therapeutic Inc. saw a surge of 75.06% in its stock price. On Monday, Eli Lilly officially announced that it would acquire Morphic in an all-cash deal at a price of $57 per share, which is a 79% premium over the closing price on the previous Friday. This transaction values Morphic at approximately $3.2 billion. The deal is not subject to any financing conditions and is expected to be completed in the third quarter.

Gold and silver mining stocks generally declined. Among the gold and silver mining concept stocks, Gold Fields Inc. fell by more than 2.6%, Pan American Silver Corp. fell by more than 1.7%, and Barrick Gold Corp. fell by 1.6%. The gold ETF GLD fell by 1.4%, GDX by 1.8%, and the silver ETF SLV fell by more than 2%.

Copper mining concept stocks also fell across the board, with BHP Group falling by 2%, Freeport-McMoRan Inc. by 1.7%, Rio Tinto Group by 1.2%, and Southern Copper Corp. by 1.1%. The ETF COPX fell by 2.2%.

Glass company and Apple supplier Corning Inc. rose by 12%, marking its largest single-day gain since March 2020, leading the S&P 500 components along with Advanced Micro Devices Inc. and Intel Corp. According to preliminary earnings reports, the company's core sales exceeded Wall Street expectations, with the second fiscal quarter core sales expected to surpass the previously given guidance.

In the second round of the French parliamentary elections, there was an unexpected upset as no party won an absolute majority of seats, causing European stocks to turn down at the end of the day, with only the Italian stock index closing higher. The pan-European Stoxx 600 index closed down by 0.03%, erasing a gain of 0.6% during the session. French stocks initially rose by 0.9% before turning down by 0.6%. Semiconductor stock ASML Holding NV hit a new high for two consecutive days, while LVMH and Kering Group fell by at least 2.8%.

The 10-year U.S. Treasury yield erased a 5 basis point increase, with French bond yields opening high and closing low.

At the end of the day, the two-year U.S. Treasury yield, which is more sensitive to monetary policy, rose by 2.08 basis points to 4.6243%, ending a three-day losing streak ahead of the release of the U.S. non-farm employment report, the opening of Federal Reserve Chairman Powell's semi-annual testimony, and the release of U.S. CPI data. The 10-year benchmark bond yield fell by 0.59 basis points, marking four consecutive days of decline, to 4.2725%, trading in a range of 4.3155%-4.2627% during the session.

The benchmark 10-year German bund yield fell by 1.6 basis points to 2.540% at the end of the day. The two-year German bund yield rose by 1.7 basis points to 2.906%, having reached a daily high of 2.937%.

The French 10-year government bond yield fell by 4.5 basis points to 3.167%, showing a "high open and low close" pattern throughout the day, with a trading range of 3.259%-3.164%, following the unexpected victory of the left-wing coalition in the French parliamentary elections on Sunday. Influenced by the French bond market, the Italian 10-year government bond yield fell by 4.7 basis points, the Spanish 10-year government bond yield fell by 3.8 basis points, and the Greek 10-year government bond yield fell by 4.6 basis points. The UK 10-year government bond yield fell by 1.2 basis points to 4.113%.

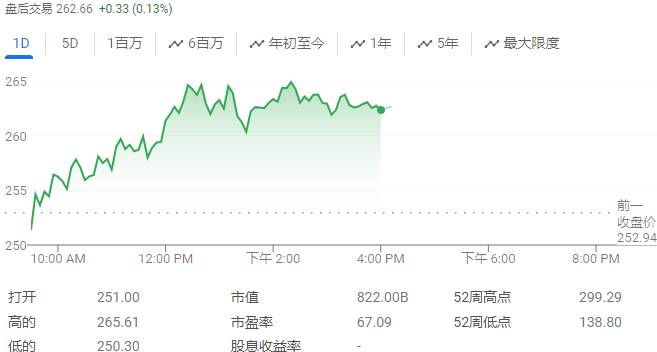

The U.S. dollar first fell and then rose, moving away from a three-week low, while the euro surged and then retreated, the Japanese yen broke through 161, and the offshore renminbi broke through 7.29.The U.S. Dollar Index (DXY), which measures the greenback against a basket of six major currencies, rose by 0.13% to 105.014 points, with intraday trading ranging from 104.801 to 105.034 points. The Bloomberg Dollar Index increased by 0.02% to 1260.56 points, with intraday trading ranging from 1259.13 to 1261.35 points.

The offshore renminbi (CNH) against the U.S. dollar was reported at 7.2857 yuan at 04:59 Beijing time, up by 32 points compared to last Friday's New York close, with overall trading within the range of 7.2930 to 7.2844 yuan.

The euro against the U.S. dollar slightly turned negative during the U.S. stock market session but remained above 1.08, close to a four-week high. The British pound against the U.S. dollar edged higher and stayed above 1.28, reaching the highest intraday level since June 12th.

The Japanese yen against the U.S. dollar once fell below the 161 level during the European stock market session, but it rebounded and returned to around 160.70 during the U.S. stock market session, trading at a one-week high. Last Wednesday, it had fallen below 162, hitting the lowest level since 1986.

The offshore renminbi against the U.S. dollar had been persistently below 7.29 yuan during the Asian session, but it broke through this level before the U.S. stock market opened and rebounded, reaching the highest increase of 70 points for the day to a two-week high. Last week, it had fallen below 7.31 yuan, reaching an eight-month low.

Major cryptocurrencies showed mixed movements. The largest by market capitalization, Bitcoin, rose by nearly 1%, breaking through $56,000, after falling below $64,000 last Friday to the lowest level since February. The second-largest, Ethereum, rose by nearly 2%, breaking through $2,900, moving away from the low point since mid-May.

Data from CoinShares International showed that during the week of July 5th, inflow of funds into cryptocurrency asset products reached $441 million, marking the first weekly inflow in the past month.

The impact of Hurricane Beryl was limited, and international oil prices fell by about 1%, further retreating after reaching a two-month high last Thursday.

Oil prices fluctuated and fell throughout the day. WTI crude oil futures for August closed down $0.83, a drop of nearly 1%, at $82.33 per barrel. Brent crude oil futures for September closed down $0.79, a drop of over 0.91%, at $85.75 per barrel.

U.S. oil WTI saw the deepest drop of $1 or 1.3% during the session, approaching $82, erasing nearly half of the gains since July 1st, and last Friday it had reached the highest since April 19th at $84.53. International Brent also saw the deepest drop of $1 or 1.1%, and last Friday it had reached the highest since April 30th and approached $88.Analysis indicates that the market assessed the impact of Hurricane Beryl on short-term supply. The National Hurricane Center reported that it made landfall in Texas as a Category 1 hurricane, then was downgraded to a tropical storm, with wind speeds decreasing from 80 miles per hour to 60 miles per hour, and further weakening is expected. This avoided the worst-case scenario that a hurricane could bring, and investors are less concerned about operational losses for oil companies due to the hurricane, which could lead to a drop in oil prices.

U.S. natural gas August futures closed up over 2.02%, at $2.3660 per million British thermal units. U.S. gasoline futures closed at $2.5379 per gallon, and U.S. heating oil futures closed at $2.5791 per gallon.

Reports suggest that due to Hurricane Beryl's local landfall, pipeline transportation company Enbridge suspended operations at its natural gas storage facility in Tres Palacios, Texas, which has a capacity of up to 31.122 billion cubic feet.

Furthermore, data from the U.S. Commodity Futures Trading Commission (CFTC) shows that speculators' bullish sentiment on WTI reached a nine-month high. In the week of July 2nd, speculators' net long positions in NYMEX WTI crude oil increased by 13,265 contracts, to 249,081 contracts. Net long positions in NYMEX gasoline decreased to 31,229 contracts, and net short positions in NYMEX heating oil decreased to 376 contracts, hitting a five-week low.

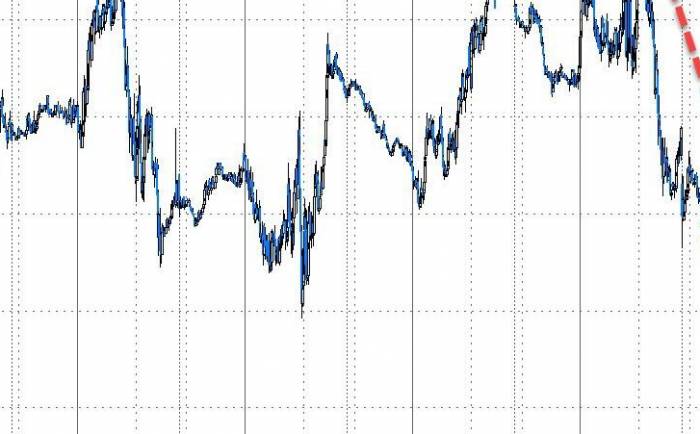

Gold prices fell by more than 1.6%, giving up all gains since last Friday's "non-farm day" and further declining. Silver futures fell by 3% at one point.

The dollar's rise on Monday was bearish for precious metal prices. COMEX August gold futures fell by more than 1.35% to $2,365.30 per ounce, and COMEX September silver futures fell by 2.36% to $30.940 per ounce, with a drop of 3% at one point during the session.

Spot gold fell moderately before the U.S. stock market opened, but it plummeted during the early trading session, falling nearly 1.7% to $2,351.24 per ounce, breaking below $2,360 per ounce, and partially recovering by the end of the U.S. stock market, retreating from the May 21st high of $2,421.

Spot silver also plummeted during the early U.S. stock market session, falling by more than 2.5%, breaking below $30.5 and losing the $31 level, moving away from the high set last Friday since June 7th.

Other precious metals such as platinum and palladium also fell by more than 2%.

However, many analysts remain optimistic about the gold trend, with the market awaiting this week's inflation data. Some analysts have indicated that, based on expectations of a Federal Reserve rate cut in September, if the U.S. CPI data comes in below expectations again, gold prices could rise further.The latest data released by the U.S. Commodity Futures Trading Commission (CFTC) shows that speculators' bullish sentiment on gold has cooled. In the week of July 2nd, speculators' net long positions in COMEX gold futures decreased by 6,169 contracts to 178,541 contracts. Their net long positions in COMEX silver futures fell to 32,472 contracts, and net long positions in COMEX copper futures dropped to 34,885 contracts, hitting a new low in over three months.

London's base metal prices showed mixed movements, with zinc closing down by over 1.5%, while tin rose by over 1%:

The economic indicator "Dr. Copper" closed down $0.29, at $9,915 per ton. Aluminum closed down $4, at $2,532 per ton. Zinc closed down $46, with a drop of over 1.53%, at $2,956 per ton. Lead closed down $6, at $2,232 per ton. Nickel rose by $132, at $17,473 per ton. Tin closed up by $344, with a gain of over 1.01%, at $34,218 per ton.

In addition, international copper night session closed down by 0.24%, Shanghai copper closed down by 0.24%, Shanghai aluminum closed down by 0.10%, Shanghai zinc closed down by 0.81%, Shanghai lead closed down by 0.15%, Shanghai nickel closed down by 0.27%, and Shanghai tin closed down by 0.90%.

CBOT soybean futures once fell by over 3% to a session low not seen since November 2020. Hurricane Beryl is expected to benefit precipitation and crop yields in the Midwest of the United States. At the close, Chicago corn and wheat futures fell by at least 3.6%.

Share Your Experience