In yesterday's and today's midday articles, I have already warned everyone that the current market has not returned above the offensive trend line, so everyone should continue to remain cautious. Therefore, the pullback that occurred today is not surprising. The overall market performance today was sluggish, with more than 4,000 stocks falling, and the domestic main force continued to flow out significantly. However, fortunately, the trading volume of the two markets shrank noticeably, reaching the lowest volume since the rebound from the bottom at 2635 points, which leaves a great suspense for the subsequent trend. Faced with the current complex trend, most retail investors can't help but ask, what is the main force trying to do? Is it luring more people to sell, or is it a phase of washing the market?

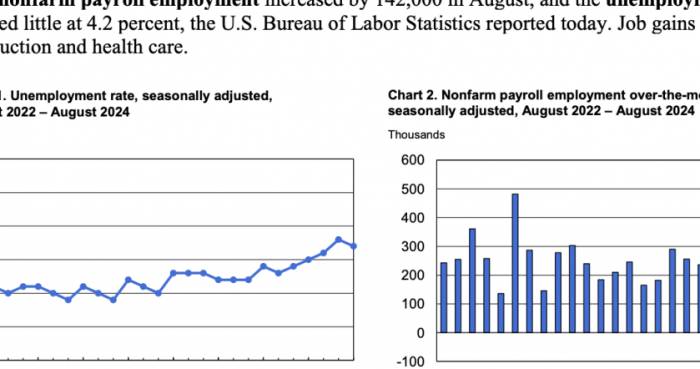

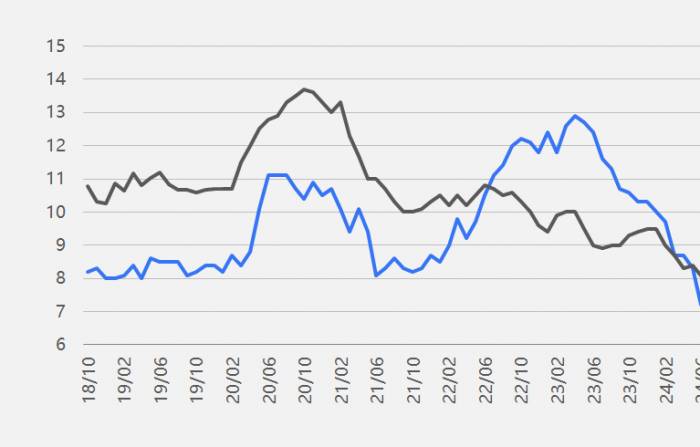

Shanghai Stock Exchange Daily Trend

The market is no longer in the novice protection period, so it is normal for many investors who lack experience and technical ability to feel a lot of pressure and be at a loss. However, my old friends who have been following me closely are well-prepared, as I always inform everyone of the market trends and trading strategies in advance, allowing everyone to be prepared and respond calmly to various changes, maintaining composure and stability.

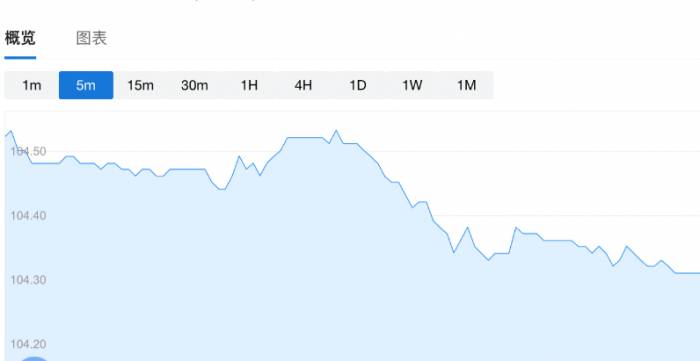

In yesterday's closing article, I made it very clear to everyone that although the market has ushered in a volume contraction rebound, it has not fully returned above the offensive trend line, so we cannot be blindly optimistic. Therefore, it is not surprising that the market dived again in the afternoon, as the current short-term adjustment trend has not undergone a substantial change and will continue to move in the direction of least resistance. In addition, in today's midday article, I reminded everyone to pay close attention to whether the index can effectively stand above 3128 points. Only by returning above this point can there be a possibility of a short-term trend reversal; otherwise, continue to watch and wait. As you can see, the market did not stand firm above this point at the morning close, and it fell significantly in the afternoon, further away from this point. If you strictly follow the trading rules, you can completely avoid today's adjustment. The most concerned issue for everyone now is how the market will move next. Let's analyze it specifically next, so that everyone has a clear understanding.

Midday Closing Article

Today's Review

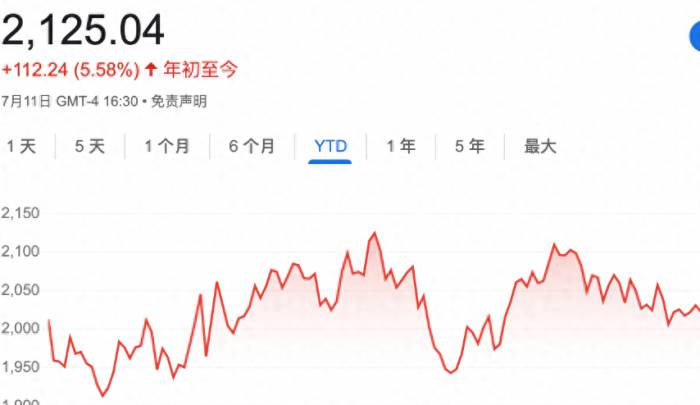

All three major indices closed lower today, with the Shanghai Stock Exchange index falling slightly less, by 0.46%, while the Shenzhen Component Index and the ChiNext Index fell more significantly, by 1.23% and 1.35%, respectively. Looking at the intraday trend, the yellow and white lines were separated all day, both in a state of decline, with the yellow line falling more, reaching about 1%, representing that the overall market situation is not very good. In addition, the total trading volume of the two markets was only over 745 billion, which was extremely shrunk, indicating that the market is currently lying flat, and this trading volume cannot create any waves. It can only wait for the main force to give orders, relying on retail investors cannot solve any problems.

In terms of individual stocks, only more than 1,100 stocks rose today, while the number of falling stocks once again exceeded 4,000, with 2,869 stocks falling within the range of 1%-5%. The general decline pattern is very obvious, and the effect of losing money is very obvious. Retail investors had another day of eating noodles. The number of stocks hitting the upper limit was 34, and the number of stocks hitting the lower limit was 49. The number of stocks hitting the upper limit was once again lower than the number of stocks hitting the lower limit, and the market speculation sentiment was low.

In terms of funds, the northbound funds also flowed out significantly, reaching about 50.55 billion, and the domestic funds flowed out by about 22.9 billion. The two main forces both flowed out, so it is not surprising that the market performed poorly today. Faced with the continuous crazy smashing of domestic funds, most individual stocks are indeed difficult to have outstanding performances.

Specifically, the performance is as follows:Shanghai Stock Exchange 50 down 0.3%

CSI 300 down 0.73%

China Securities 2000 down 0.83%

CSI 500 down 1.03%

CSI 1000 down 1.05%

Micro-cap stocks down 1.57%

Average A-share price down 1.57%

From the above data, it can be seen that all indices closed lower today, with heavyweight stocks experiencing a smaller decline, and only the Shanghai Stock Exchange 50 Index outperformed the market, indicating a clear one-nine effect. Micro-cap stocks performed poorly, significantly underperforming the market.

Market Trend Analysis for Wednesday

To survive in the market for the long term, one must have their own trading rules and discipline, and strictly adhere to and execute them, training oneself to be like a robot. In trading, one must not be swayed by subjective emotions, and should not make judgments or decisions based on a piece of news or a rumor, as this is a sign of an immature investor. Also, do not get excited by a day's rise or depressed by a day's fall. Whether it's a rise or a fall, we must maintain a calm attitude, so that we can make rational and objective decisions. The stock market is not about who earns more in a short period, but about who lasts longer. Finding the right trading method is the key to seeing the truth of the stock market. We often tell everyone to closely follow the market trend, which is the principle, letting the market give us direction. When the market is rising, we patiently hold our positions and wait for the increase. When the market is in an adjustment phase, we calmly watch and wait for opportunities to come, never going against the trend, otherwise, it is highly likely to end in disaster.From a technical analysis perspective, let's examine the current market trends.

On the 60-minute timeframe, the index is currently below the offensive trendline, with the trendline turning downwards. The MACD has shortened again, and the KDJ is about to form a death cross, indicating a consolidating pattern.

60-minute chart trend

Looking at the 120-minute timeframe, the index is also below the offensive trendline, with the MACD green bars continuing to shorten, and the KDJ nearing a death cross, which also suggests a consolidating pattern.

120-minute chart trend

On the daily chart, the index is below the offensive trendline, with the MACD green bars above the zero axis continuing to shorten, and the KDJ maintaining a downward trajectory, which is a sign of ongoing consolidation.

Daily chart trend

In summary, whether it's on the hourly or daily timeframe, the overall market is in a state of adjustment. Therefore, we should maintain a cautious attitude, primarily observing and doing less. The two trendlines above the index are near 3121 and 3126 points, respectively. If the index fails to hold above 3126 points tomorrow, it indicates that the short-term trend remains in a state of adjustment without any fundamental change. It's advisable not to act rashly to avoid unnecessary passivity. Don't feel like you've lost out by not buying at the lowest point. It's beneficial to make some concessions. Don't try to take everything for yourself, as this could lead to significant losses in the end, just like the saying goes, "Don't try to make the last penny." The long-term trend support level on the 120-minute chart is near 3070 points, which is not far from the index. The long-term trend support level on the daily chart is near 3046 points, and both support levels are quite strong. If further adjustments occur, these levels should be closely monitored.

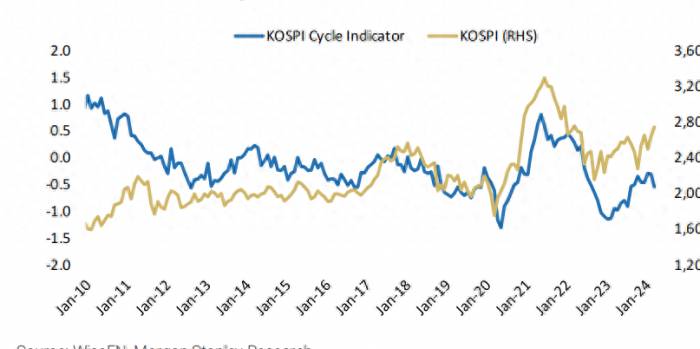

Now, let's look at the trend of small-cap stocks.

The CSI 2000 Index fell by 0.83% today with reduced volume, closing at 2020.46 points. Technically, the index is still below the offensive trendline, which continues to turn downwards, indicating that the short-term trend is still in a state of adjustment. The MACD green bars are still lengthening, and the KDJ is moving downwards, with indicators also showing a consolidating process. Therefore, patience is required for small-cap stocks, waiting for the short-term adjustment to end. If the index can hold above 2036 points tomorrow, the short-term trend may begin to turn around; otherwise, continue to observe.Daily Chart Trend

Currently, it is quite normal for the index to undergo adjustment and consolidation around the 3150 point level. Firstly, this area is the true dividing line between the market's strength and weakness, which is crucial for the subsequent trend. Secondly, there is a significant amount of trapped capital above, making it necessary to carry out a phased consolidation. Everyone should be mentally prepared for this and not overly concerned. The market's long cycle is still maintaining an upward trajectory, and 3174 points will not be the focal point. Our first target remains around 3260 points, and we hope everyone continues to be patient and optimistic.

Share Your Experience