On Wednesday, July 10th, the S&P 500 and the Nasdaq Composite both achieved seven consecutive days of gains, while the Dow Jones Industrial Average fluctuated with several short-term dips but ultimately rose after an hour and a half of trading. The major stock indices all closed higher.

Chip stocks and large-cap technology shares propelled the S&P 500 and the Nasdaq to new highs at the open, with the Nasdaq initially rising nearly 0.67% or approximately 122 points, and the S&P 500 increasing by nearly 0.36%. The Dow, which is composed of blue-chip stocks, fell nearly 0.09% within the first hour of trading before rebounding to a slight gain.

Most of the "Tech Ladies" saw gains. Tesla opened high but closed lower, ending its ten-day winning streak, and fell nearly 1.2% at the start of trading; NVIDIA led the gains, rising nearly 2.3% close to its all-time high; Apple hit a new high for seven consecutive days, once surging over 1.3%; Alphabet's Class A shares ended two days of losses, rising over 1%; Microsoft started strong, with gains once expanding nearly 0.8%; however, Amazon dived straight into the red after 50 minutes of trading, falling nearly 0.3%.

Chip stocks generally rose. The Philadelphia Semiconductor Index jumped over 1.7% at the open, breaking through 5860 points to set a new high, and the industry ETF SOXX rose over 1.6%. NVIDIA's double leveraged ETF rose nearly 4.4%; ARM rose nearly 2.6%, and TSMC's U.S. shares, which rose nearly 3.4%, both approached historical highs, with Applied Materials once rising nearly 0.8% to a new high; AMD surged over 5.6%.

AI concept stocks showed mixed performance, with SoundHound AI rising over 7.2%, while CrowdStrike fell over 4.4%.

In terms of news, it is reported that Baidu's RoboTaxi service is expected to become profitable by 2025; AI demand has helped TSMC's revenue significantly exceed expectations; Microsoft has given up its non-voting observer seat on the OpenAI board, but this may not alleviate the antitrust concerns of U.S. regulators. Reports suggest that AMD is set to acquire Europe's largest private AI lab, SILO AI, in an all-cash deal valued at approximately $665 million, in an effort to close the gap with NVIDIA.

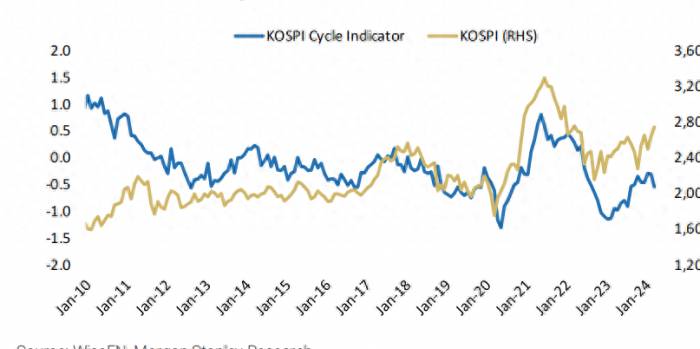

Chinese concept stocks edged higher. The China Internet ETF (KWEB) rose about 0.4%, the China Technology ETF (CQQQ) rose over 0.4%, and the NASDAQ Golden Dragon China Index (HXC) initially rose over 1% and reclaimed the 6000-point mark, but almost erased all gains before midday.

Among popular individual stocks, Baidu's ADR once rose nearly 6.2%, continuing its performance from the previous day when it closed up over 8%, while Zeekr fell over 3.5%.

The following content was updated before 21:50 Beijing time:

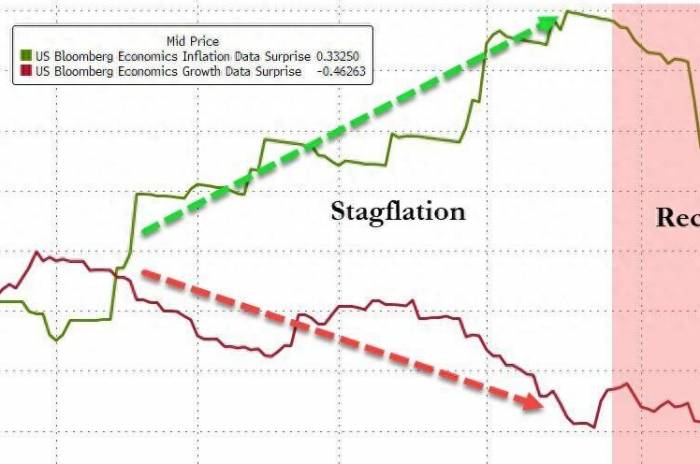

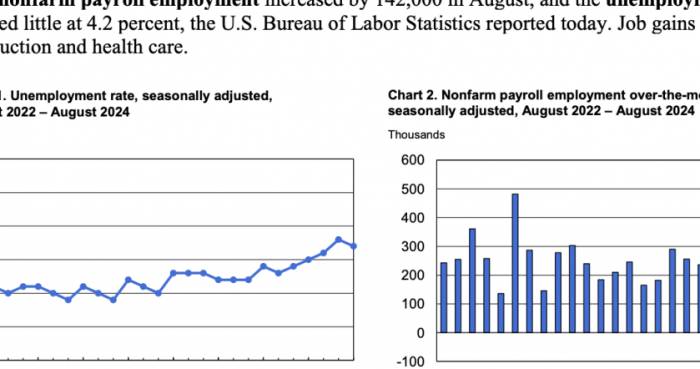

Overseas, Powell's speech emphasized signs of cooling in the job market, but indicated that "more good data" is needed to strengthen confidence in reducing inflation, and U.S. stocks continued to set new highs. Currently, the swap market is pricing in two rate cuts within the year, with the Federal Reserve most likely to start the first cut in September.Tonight at 22:00, Powell will continue to attend the House of Representatives for questioning, and it is expected that there will be no significant change in the tone of his speech. The market is focusing on the June CPI data to be released at 20:30 tomorrow night.

U.S. stock indices were mixed at the open, with the Nasdaq Composite up 0.46%, the S&P 500 up 0.25%, and the Dow Jones Industrial Average down 0.02%.

Several star tech stocks rose, with TSMC increasing by more than 1.5%, as the company's second-quarter sales exceeded market expectations, surging 40.1% year-on-year; AMD rose by more than 1.4%, with reports indicating that AMD will acquire Silo AI in an all-cash deal; Nvidia rose by more than 2%; Tesla rose by 0.22%, and due to better-than-expected delivery volumes, analysts at Goldman Sachs Group raised their target price for Tesla. Apple's stock price continued to hit a historical high, reaching a peak of $231.06, with a market capitalization of $3.54 trillion.

Most popular Chinese concept stocks rose, with NIO up by 1%, XPeng Motors up by more than 2%, and Baidu up by more than 5%, with its subsidiary, Luobo Kuaibao, expected to become profitable by 2025.

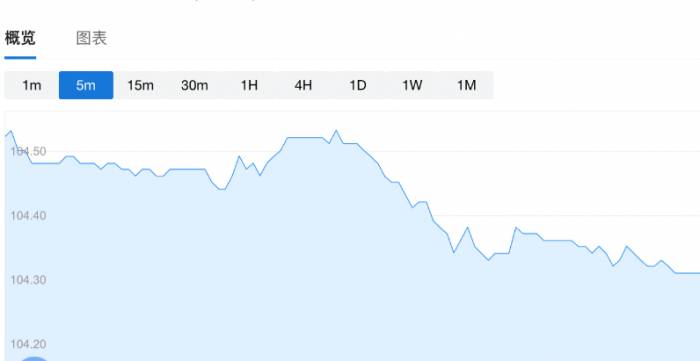

U.S. Treasury yields fell across the board.

Ahead of tomorrow night's inflation data release, the market will closely monitor the trend of U.S. Treasury yields, which are collectively falling due to heightened expectations of interest rate cuts.

The 10-year U.S. Treasury yield continued to decline in the afternoon and has now slightly rebounded, falling 1.6 basis points on the day to 4.282%.

The 2-year U.S. Treasury yield continued to plummet, still hovering near a three-month low.

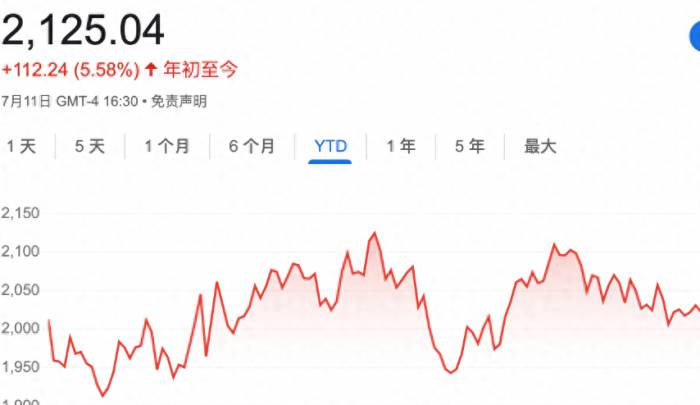

Spot gold surpassed $2380

Spot gold rose above $2380 per ounce before the market opened and has now slightly retreated to $2378.93 per ounce.Oil Price Decline Narrows

The downward trend in oil prices has slowed, with Brent and WTI crude oil falling by 0.39% and 0.29% respectively.

Share Your Experience