* Major stock indices plummet, Dow plunges 1,000 points;

* Chicago Fed Chairman Goolsbee downplays risk of recession.

* Berkshire Hathaway reduces holdings by nearly half, Apple drops nearly 5%.

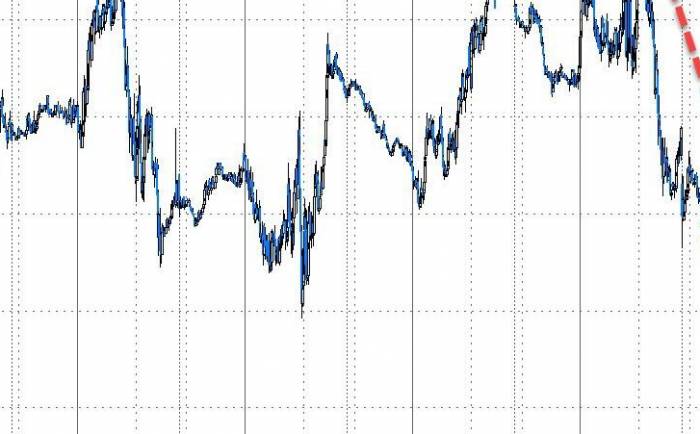

On Monday, the three major U.S. stock indices fell across the board, with concerns about a U.S. economic recession unsettling global markets and forcing investors to pull out of risk assets. By the close, the Dow Jones Industrial Average fell 1,033.99 points, or 2.60%, to 38,703.27, the Nasdaq Composite fell 3.43% to 16,200.08, and the S&P 500 fell 3.00% to 5,186.33, marking the largest drop since September 2022. The CBOE Volatility Index (VIX), which spiked over 200% during the session, closed at 38.57, up 64.9%.

Long-term U.S. Treasury yields rebounded after hitting bottom. The 2-year Treasury note, closely linked to interest rate expectations, rose nearly 1 basis point to 3.88%, while the benchmark 10-year Treasury note fell 1.5 basis points to 3.78%, continuing to set a 13-month low.

Market Overview

In terms of individual stocks, Apple fell 4.8%, as Berkshire Hathaway's second-quarter report showed that the company nearly halved its holdings in Apple last quarter.

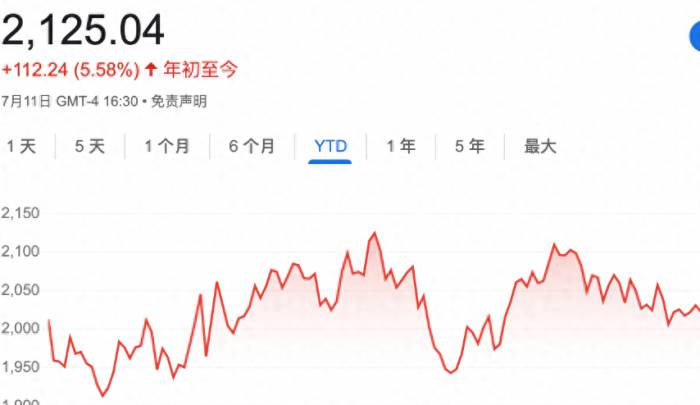

Nvidia closed down 6.4%, having dropped more than 14% in the morning, with news that the company's flagship artificial intelligence chip, Blackwell, might be delayed due to design issues, affecting major customers such as Microsoft, Meta, and Alphabet's Google. Microsoft fell 3.3%, Meta fell 2.5%, and Google fell 4.6%.

Concerns about a recession also weighed on the banking sector, with Bank of America, Goldman Sachs, and Morgan Stanley falling more than 2%.

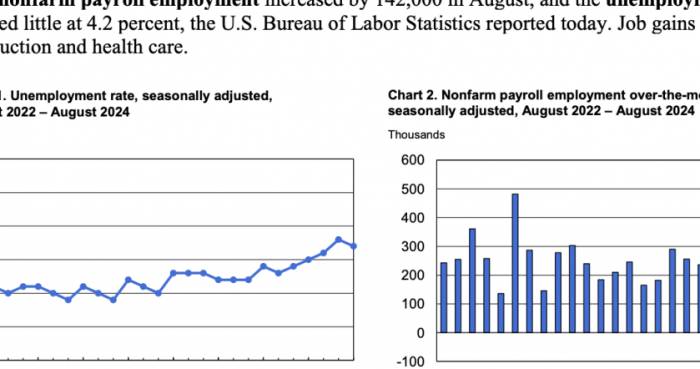

Last Friday's non-farm payrolls report intensified global capital market turmoil on Monday, as the unemployment rate reached its highest level in nearly three years, raising fears that the Federal Reserve might cause a recession. John Lynch, Chief Investment Officer at Comerica Wealth Management, said: "An increasing number of people believe that the Fed is now behind the curve. One thing that seems certain is that there will be more volatility in the future."Allspring portfolio manager Neville Javeri believes that the sell-off is a continuation of last week's anxiety. "Starting with last week's employment data, this clearly leads people to believe that the Federal Reserve needs to start more aggressively addressing the direction of these unemployment figures."

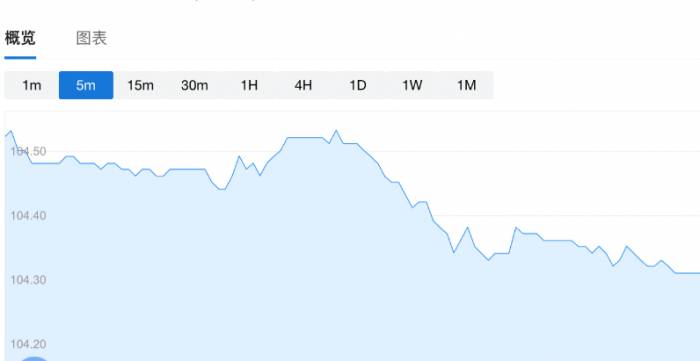

According to the FedWatch tool of the Chicago Mercantile Exchange, traders now consider the possibility of the Federal Reserve cutting rates by 50 basis points in September to be over 90%. However, Chicago Fed President Goolsbee downplayed concerns about a recession that day but stated that Federal Reserve officials need to recognize changes in the environment.

Institutions also attribute some of the stock market's weakness to the closing of arbitrage trades, in which investors borrow from low-interest-rate economies such as Japan or Switzerland to fund investments in high-yield assets. Glenmede analyst Jason Pride said, "Considering the 15% return in the first half of the year and the balanced risks in the later stages of the economic cycle, it is not unusual for the stock market to have a correction of more than 5%. Investors should actively rebalance their portfolios and closely monitor the risks that could push the United States into a recession."

In terms of economic data, the U.S. service industry recovered somewhat in July, which to some extent eased concerns about an economic slowdown. Data released by the Institute for Supply Management (ISM) showed that the U.S. service industry activity index rose from 48.8 in June to 51.4 last month, better than the economists' forecast of 50.9, and brought the index back above the 50 boom-or-bust line.

However, the Conference Board's Employment Trends Index fell from the revised 110.58 in June to 109.61 in July. Conference Board economist Michelle Barnes said that the economic slowdown is consistent with other signs of slowing down. She said, "The labor market is clearly cooling down from the post-pandemic frenzied pace."

In other individual stocks, Kelanova rose by 16% after media reports said that Mars is considering acquiring this snack manufacturer.

International oil prices fell, with the nearest month WTI crude oil contract down 0.79%, at $72.94 a barrel, and the nearest month Brent crude oil contract down 0.66%, at $76.30 an ounce.

International gold prices rose and then fell, with the COMEX gold futures contract for delivery in August at the New York Commodity Exchange down 0.99%, at $2401.70 an ounce.

Share Your Experience