The first batch of 10 CSI A500 ETFs is about to be issued; "national team" heavy stock exposure.

Giant with 80 billion moves, world-class salt lake industry group is coming

On the evening of September 8, Yanhu Shares announced that China Salt Lake Group plans to purchase 681 million shares of Yanhu Shares held by Qinghai State Investment and its concert party Wuhu Xinze Qing with cash. If the transfer is completed, the controlling shareholder of the company will change from Qinghai State Investment to China Salt Lake Group, and the actual controller will change from Qinghai Provincial Government State-owned Assets Supervision and Administration Commission to China Minmetals.

Yanhu Shares is planning to change its owner in order to build a world-class salt lake industry base. By the end of 2023, China Minmetals' total assets exceeded 1.1 trillion yuan, ranking 69th in the Fortune Global 500, currently controlling 8 listed companies.

The transfer price is temporarily set at 13.558 billion yuan. If calculated based on 681 million shares, the acquisition price is 19.9 yuan per share, a 35% premium compared to the closing price of the last trading day. So far, the market value of Yanhu Shares is nearly 80 billion yuan. Based on the acquisition of this part of the equity, China Minmetals' valuation for Yanhu Shares is 108.1 billion yuan.

After the above transaction is completed, Yanhu Shares, the first stock of salt lake lithium resources, will become the 9th listed company under China Minmetals.

The first batch of 10 CSI A500 ETFs is about to be issued collectively

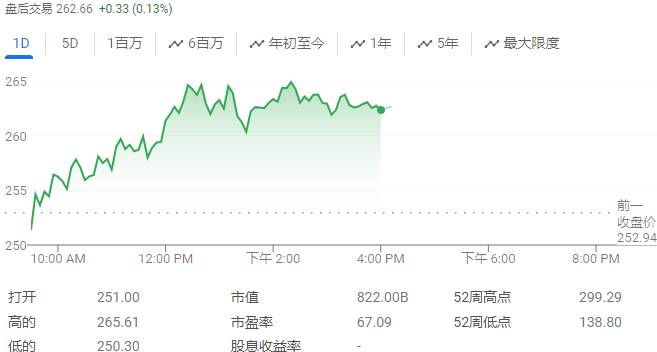

The ETF fund market is launching a heavy product again. The first batch of 10 CSI A500 ETFs have successively disclosed the announcement of sale, showing that the 10 ETFs will be issued on September 10 (Tuesday), with a unified scale limit of 2 billion yuan and an annual management fee rate of 0.15%.

Data shows that this is the first batch of CSI A500 ETF products reported after the official disclosure of the CSI A500 index.

It is understood that the first batch of 10 fund companies reported, including Jing Shun Great Wall, Guotai Fund, Nanfang Fund, Yinhua Fund, Hua Tai Bo Rui Fund, Morgan Asset Management, Fu Guo Fund, China Merchants Fund, Taikang Fund, Jia Shi Fund.According to industry insiders, as an important broad-based ETF in the market, the rapid approval and issuance of the first batch of CSI A500 ETFs, as well as their listing, provide investors with convenient investment tools to participate in index-based investment, and are also expected to introduce more incremental funds to the market.

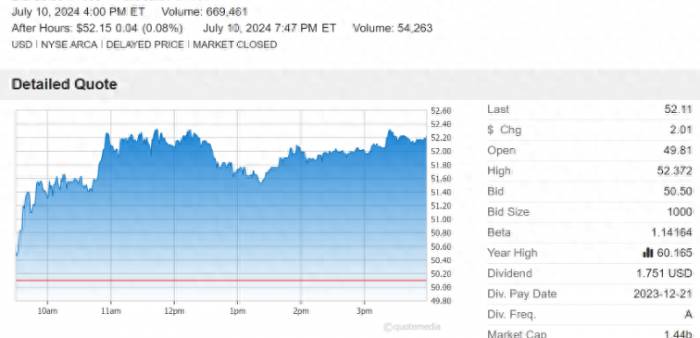

Looking at this year, ETF funds have been favored by capital, with the "national team" represented by Central Huijin making significant purchases of some leading broad-based ETFs and continuously increasing their positions in A-shares.

As of now, the four leading CSI 300 ETF products held by the "national team" such as Central Huijin Investment and Central Huijin Assets have seen a combined net purchase of over 500 billion yuan since the beginning of this year. In addition to continuing to increase their holdings in blue-chip broad-based ETFs like CSI 300, Central Huijin has also invested in growth-style broad-based ETFs represented by STAR 50 ETF, ChiNext ETF, and CSI 1000 ETF.

The "national team" heavy positions are exposed, with 33 stocks holding a market value of over 10 billion yuan.

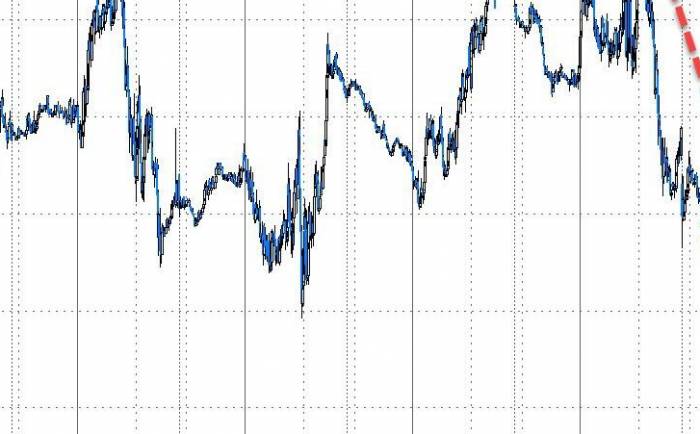

As one of the important institutional investors in the A-share market, the "national team's" holdings are closely watched. Recently, the "national team," represented by Central Huijin, not only bought broad-based ETFs aggressively but also made significant adjustments in the secondary market in the first half of the year, and their heavy positions have performed well.

At the end of the second quarter of this year, the "national team" appeared in the top ten circulating shareholders list of 836 listed companies, with a total market value of holdings of about 3.61 trillion yuan.

Among them, Central Huijin holds significant positions in 152 A-share companies, with a total market value of about 2504.747 billion yuan; China Securities Finance holds significant positions in 134 A-share companies, with a total market value of about 561.732 billion yuan; the Social Security Fund holds significant positions in 600 A-share companies, with a total market value of about 422.996 billion yuan; and the China Securities Finance Management holds significant positions in 71 A-share companies, with a total market value of about 120.326 billion yuan.

At the end of the second quarter, there were 33 individual stocks with a market value of holdings by the "national team" exceeding 10 billion yuan. Looking at the industry, there are 8 bank stocks and 9 non-bank financial stocks.

The "national team's" market value of holdings in Bank of China, Industrial and Commercial Bank of China, and Agricultural Bank of China are 917.269 billion yuan, 796.668 billion yuan, and 728.591 billion yuan, respectively. The reporter noticed that in the second quarter of this year, the "national team" did not change its holdings in the three major banks, and due to the recent significant increase in the bank sector's stock prices, the market value of holdings increased by 124.1 billion yuan.

Among the individual stocks with holdings over 10 billion yuan, in the second quarter, China Merchants Bank, CITIC Securities, and Luxshare Precision were added to the positions, while Shenwan Hongyuan and Datong Coal Industry were reduced, and the number of shares held in the remaining stocks remained unchanged.Looking at individual stock performance, as of now, among the stocks with a holding market value of over ten billion yuan, 24 stocks have achieved an increase this year, with an average increase of 11.12%. The stock with the highest increase is CRRC Corporation Limited, with a cumulative increase of over 33%. Data shows that at the end of the second quarter, China Securities Finance Corporation, Central Huijin Investment Ltd., and 10 products under China Securities Finance Co., Ltd. all appeared on the list of circulating shareholders of CRRC Corporation Limited, with a combined holding market value of over 24.4 billion yuan.

Next, Shanghai Pudong Development Bank, Agricultural Bank of China, and China People's Insurance have all seen increases of over 30%, and "Hydropower King" Yangtze Power and "Coal King" China Shenhua have also achieved increases of over 25%.

19 high-performing stocks are heavily held by the national team.

In terms of performance, among the stocks with a holding value of over ten billion yuan, Agricultural Bank of China, PetroChina, Ping An Insurance, Zijin Mining, and 24 other stocks have all achieved a net profit attributable to the mother company of over ten billion yuan in the first half of the year. Further statistics show that 19 stocks have achieved profitability and positive year-on-year growth in the first half of the year.

Looking at the growth rate of performance, Guodian Power achieved a doubling of its performance in the first half of the year compared to the same period last year, and Zijin Mining, Yangtze Power, Luxshare Precision, Beijing-Shanghai High-Speed Railway, and CRRC Corporation Limited have all seen performance increases of over 20%.

Benefiting from the accelerated growth in the demand for electricity across society and the improvement in the operation of traditional energy, Guodian Power achieved a net profit attributable to the mother company of 6.716 billion yuan in the first half of the year, a year-on-year increase of 127.35%, setting a historical record.

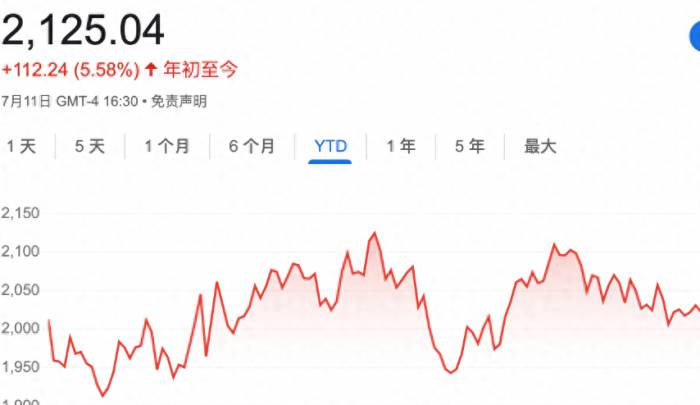

Zijin Mining achieved a net profit attributable to the mother company of 15.084 billion yuan in the first half of the year, a year-on-year increase of 46.42%. Industry insiders believe that the rise in the prices of mineral resources and the increase in the volume of mineral production are one of the main factors for the significant increase in the performance of related listed companies.

Share Your Experience