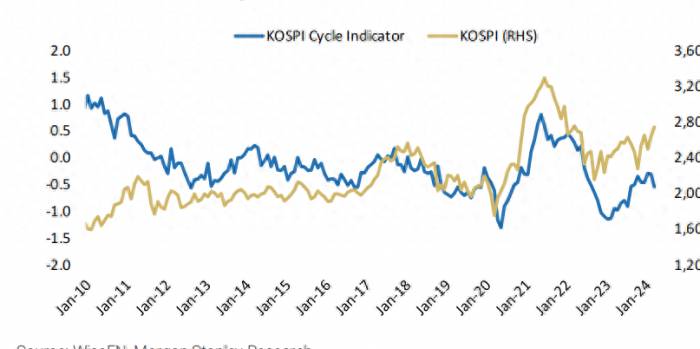

Today, although the A-share market regrettably failed to hold above the 3000-point mark at the close, we also saw the dawn of hope during the session, as significant capital began to enter the market. To break the current deadlock, relying on retail investors is obviously unrealistic; it is necessary for the powerful major players to step in. We have been waiting for this moment, and today might have just been a slight move. Will next week see a full-scale attack to quickly reclaim the 3000-point mark and usher in a bottoming rebound? I believe it is highly likely to be achievable, and everyone can definitely look forward to it. In addition, there are some important news after the market that deserves our attention; let's analyze and interpret them specifically.

1. Abrupt movement in the afternoon! Is the national team stepping in?

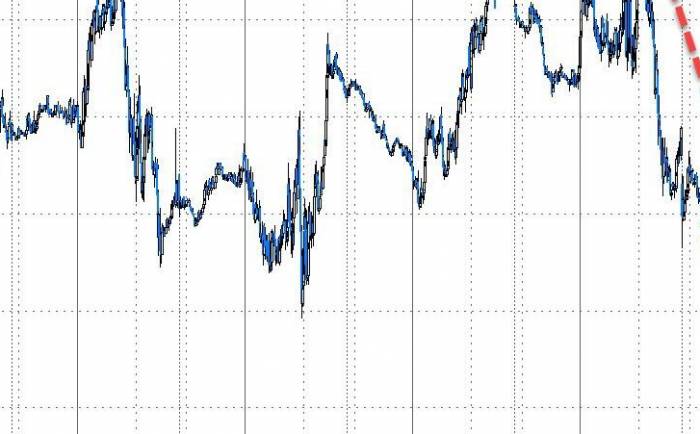

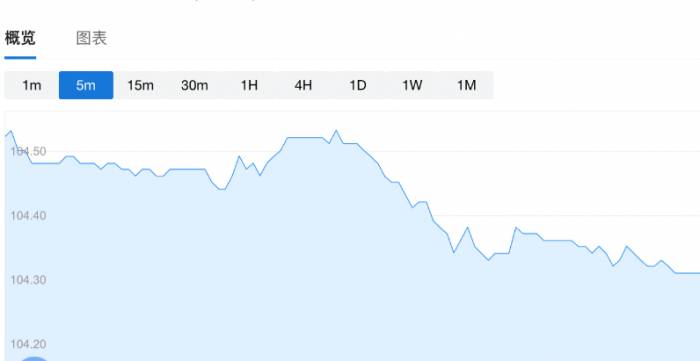

Around 1:30 PM, the Shanghai Composite Index fell nearly 20 points at one point, seemingly on the verge of a larger-scale plunge. At this critical moment, the index suddenly rose, with the CSI 500 and CSI 1000 quickly turning red. The HS300 (510300), in particular, showed a significant increase in trading volume, with a turnover of 6.91 billion yuan. Based on past market trends, an increase in volume for this index fund is often a sign of the national team's entry, as was the case before the Spring Festival this year when the market plummeted, and the index fund experienced similar situations several times, which were later confirmed to have been the result of the national team's capital entering the market.

HS300 ETF 510300

The national team's choice to enter the market again at this time also indicates an attitude of not wanting the market to decline significantly further. Once confidence is completely lost, it will take much more effort to restore it. This is the right time to act. Based on the experience during the Spring Festival, the national team's entry does not necessarily lead to an immediate significant rebound, but it essentially eliminates the possibility of a continued significant decline. We have always asked everyone to remain patient and confident, firmly believing that the market will not remain sluggish forever. At the real critical moment, the upper hand will decisively intervene. There is no need to worry about the issue of trading volume; once the super major players step in again and reverse the current downward trend, the market will gradually regain its enthusiasm. The market has now shown the most important signal, so at this position, there is no need to be too pessimistic. Believe that the upward momentum will be regained soon.

2. According to the news from the Central Commission for Discipline Inspection and the National Supervisory Commission's disciplinary inspection and supervision team stationed at the China Securities Regulatory Commission, and the Jiangsu Provincial Discipline Inspection and Supervision Commission: Ling Feng, the Party Committee Secretary and Director of the Jiangsu Regulatory Bureau of the China Securities Regulatory Commission, is suspected of serious violations of discipline and law, and is currently under disciplinary review by the Central Commission for Discipline Inspection and the National Supervisory Commission's disciplinary inspection and supervision team stationed at the China Securities Regulatory Commission, and under investigation by the Jiangsu Provincial Supervisory Committee. The top level is starting to strictly investigate within the regulatory system, which is a good start.

3. On June 21st, the Huawei Developer Conference 2024 was held, where a humanoid robot named "Kuafu" was showcased, demonstrating a series of capabilities such as item recognition, interactive Q&A, high-fives, and handing over water. It is understood that "Kuafu" is the first open-source HarmonyOS humanoid robot for domestic family scenarios in China, released by Leju (Shenzhen) Robot Technology Co., Ltd. (hereinafter referred to as "Leju Robot Company").

The Huawei concept has always been a hot pursuit in the market. Once this news comes out, it will have some impact on the trend of the robot sector. Everyone can pay close attention. Below, let's analyze the trend of this sector.

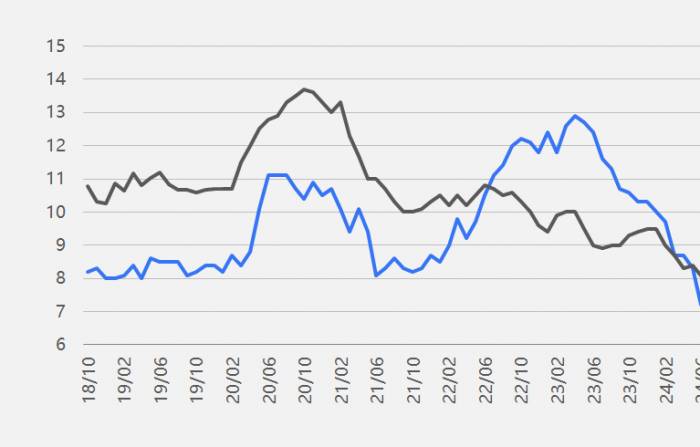

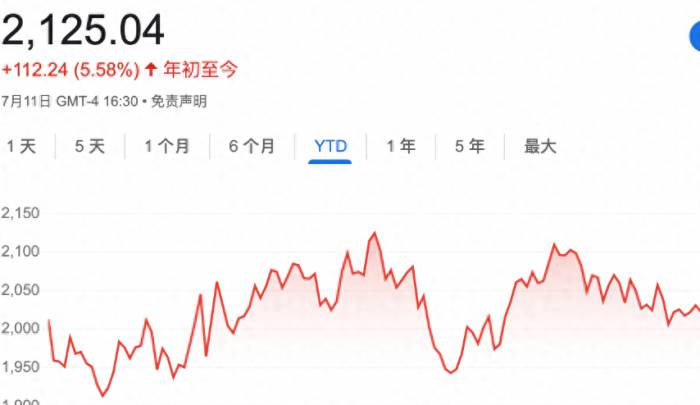

At the daily level, it fell by 0.39% today, closing at 1017.73 points. The index is currently below all trend lines, and the downward trend is quite obvious. The rebound in the previous few days was suppressed by the red medium-term trend line above, and it has fallen back again in recent days. On Monday, it is necessary to focus on whether it can stand above 1029 points. Only by standing above this point can the short-term downward trend be reversed.

Daily level trendOn June 21st, according to Xiaozhu Homestay, as of 24:00 on June 20th, nearly 100,000 room nights of premium homestay package products were sold on the platform. Since the "618" sale began, nearly 10% of the premium homestay package product orders have been booked, and some popular dates for premium homestays are already very popular, with many consumers even booking accommodations for October.

The summer vacation is approaching, and it's time for the peak travel season. Is there an opportunity for the tourism and hotel sector? Let's analyze in detail.

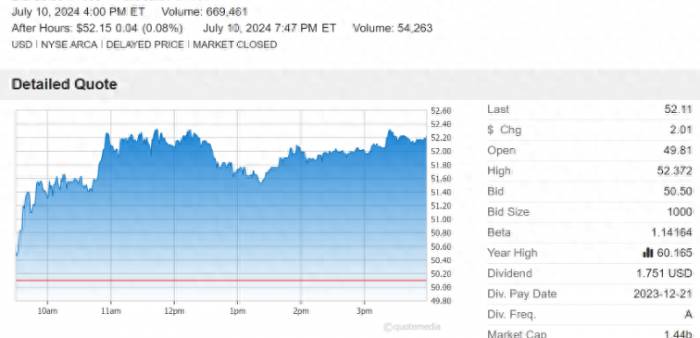

From a daily line perspective, the sector is still in a clear downtrend, with the index below all trend lines, and it's not the right time to get involved in the short term. Next Monday, pay attention to whether the index can hold above 12,250 points. Only by holding above this level can the current short-term downtrend potentially be reversed.

Daily line trend

From a monthly line cycle perspective, the sector has been declining for a year, trapping many people along the way. So, is the current level the bottom area? From the trend, the index has returned near the green long-term trend line, which is basically the bottom. The downward space is limited, and the upward space is greater. The index is currently near the green line, so there is no need for blind panic at this time. Wait for the reversal of the large cycle; there will definitely be a market later.

There is no need to be overly pessimistic about the future trend.

Although the market is still falling today, and the downtrend has not changed, the closing below 3,000 points also set a new low for the phase, the trading volume has already shrunk to the extreme, and the closing is a doji pattern. With the major forces starting to get involved, the market could stabilize at any time next week.

From the trend of the monthly line, the index is below the green long-term trend line, all in an over-sold state, and there will definitely be a large-scale rebound or a main upward trend later. Of course, this requires enough patience and strong willpower because often the closer to the bottom, the more retail investors can't hold onto stocks, that's human nature. The current long-term trend line is near 3,042 points. From a broader perspective, the current 3,000 points are just the horizontal plane, and there is no need to worry too much. I also believe that there will definitely be a very good round of market in the second half of the year. The current predicament is just the last darkness before dawn.

Share Your Experience