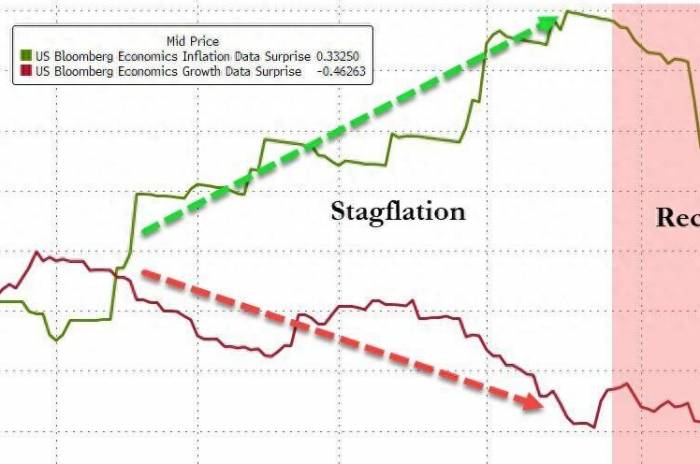

Without any surprises, a preemptive warning had already been given, and today A-shares once again experienced a significant decline. The weekend's news still had a substantial impact on sentiment, and the market began to vote with its feet. With nearly 5,000 stocks falling, the entire day was spent underwater without a decent rebound, indicating how fragile the market is currently. The further plunge after two o'clock also saw a surge of panic selling, with many investors once again cutting their losses and exiting. The most pressing concern for everyone now is how the market will operate tomorrow, and how retail investors should respond. Let's analyze this in detail to give everyone a clear picture.

Shanghai Composite Index Daily Trend

Over the past month, the market has been shrinking in volume and falling almost every day, which is truly painful and tormenting for investors in the market. The index is still at 2963 points, and many individual stocks have already returned to levels of 2600, with no shortage of those even at 2400. This leaves retail investors in a difficult position, as what is lost is not only confidence but also trust. The market, at this juncture, requires substantive action; if it continues to decline, the panic effect will intensify, making the situation more troublesome.

For investors outside the market, it is still necessary to maintain a wait-and-see approach and not to intervene blindly. Since May 22nd, when we warned that once the index effectively fell below 3156 points, it was necessary to exit decisively, we have been repeatedly reminding everyone in our daily articles that the market is in a downtrend. We have advised to restrain from trying to catch falling knives, as it is very likely that one might buy at the halfway point. As can be seen from the chart above, the white offensive line turned downward from May 23rd and has never turned upward to this day, with the downtrend remaining unchanged. Therefore, it is crucial to recognize and follow the market trend. If one strictly adheres to our trading discipline, it is possible to perfectly avoid this round of significant plunge.

Post-Market Analysis on May 22nd

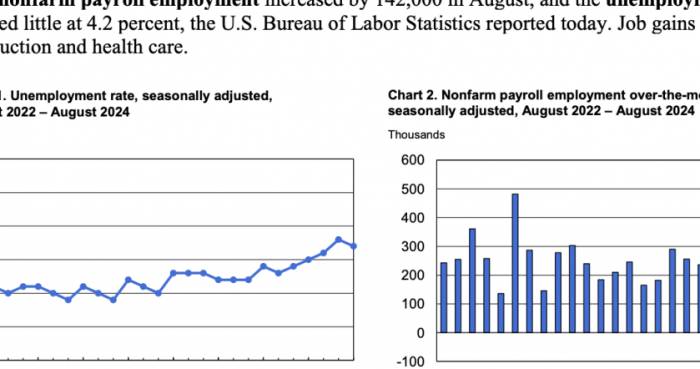

Today's Review

All three major indexes plummeted today, with the Shanghai Composite falling by 1.17%, the Shenzhen Component Index by 1.55%, and the ChiNext Index by 1.39%. Looking at the intraday trend, both the yellow and white lines were underwater all day, with a significant deviation, and the yellow line fell by about 3.5%, indicating that the overall market situation is very poor. The total trading volume of the two markets was around 697.8 billion, still in a state of significant contraction, with no change in the situation.

In terms of individual stocks, the ratio of gainers to losers was 327:4992, with 78 stocks hitting the daily limit down and 1,388 stocks falling more than 5%. This is not just a general decline but has already entered a stock market disaster mode.

On the funding side, domestic capital outflow today was as high as 42.2 billion, choosing to accelerate the selling at the open, pausing for a while at noon, and then accelerating again at the end of the day. This is why our market cannot stand up; what have the domestic main forces been doing every day for more than a month, other than selling? With this approach, can most stocks rise?From the data above, it can be seen that today only the Shanghai Stock Exchange 50, representing the heavyweight stocks, was up, while all other indices were down. The CSI 300 index fell slightly less, by 0.54%, outperforming the broader market. The remaining indices all experienced significant declines, with small-cap stocks performing very poorly, with declines all exceeding 3%. This indicates that today's market downturn had a strong negative impact on everyone's accounts, with most investors taking a substantial hit today.

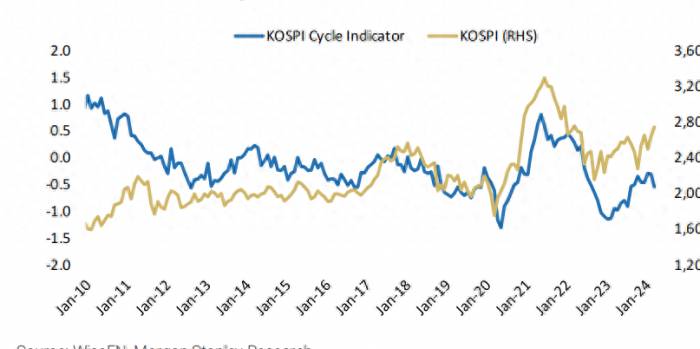

In terms of sectors, today presented a rare scene of a complete rout, with not a single industry sector rising. This shows that the current market has reached an extreme state of lethargy. The semiconductor sector, which has been performing well recently, also saw a significant drop today, with a decline of 4.44%. In the article analyzing the market close on Friday, it was also discussed that once the index fell below 1044 points, it would be wise to exit and wait for a better opportunity, indicating that the short-term uptrend had deteriorated. Today's closing point was 1009.26, clearly breaking through the support level, and caution is needed in the short term. Tomorrow, the line of attack will move to around 1035 points; if the index fails to recover above this level, the short-term trend will further deteriorate.

Daily level trend

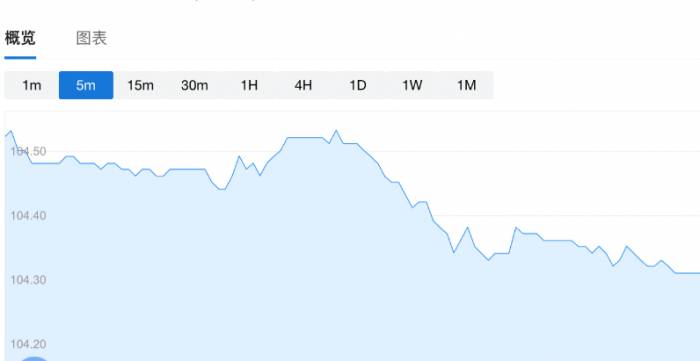

Market trend analysis for Tuesday

Shanghai Stock Exchange Index trend

Looking at the daily level, the index is currently below all trend lines, with a clear downtrend. Today's decline was significant, accelerating the deviation from the line of attack. Tomorrow, the line of attack will move to around 2990 points. If the index cannot stabilize above this level, there is no basis for a temporary reversal of the downtrend. Friends who want to enter the market from the outside should not be hasty and must wait until the white line of attack begins to turn upward before considering any action. This approach is relatively more prudent, and the trend becomes clearer.

Daily level trend

Growth Enterprise Market trend

The Growth Enterprise Market also saw a significant decline today, marking four consecutive days of losses, and breaking below the previous low of 1735 points. The index is currently below all trend lines, with a clear downtrend. Tomorrow, the line of attack will move to around 1754 points. If the index cannot stabilize above this level, there is no possibility of a reversal in the downtrend.Daily Chart Trends

Shanghai SE 50 Index Trends

The Shanghai SE 50 Index represents the heavyweight stocks, which have the greatest impact on the overall market trend. If these heavyweight stocks can first stop falling and stabilize, then the market will truly hit bottom. Although the Shanghai SE 50 Index rose today, it is unfortunate that it did not successfully hold above the white offensive line at the close, and it left a long upper shadow. Tomorrow, the offensive line will move to around 2407 points, and today's closing position is 2404 points, which is very close to the offensive line. If it can hold above the offensive line tomorrow, it would be good news for the market, and there would be hope for the overall market.

Daily Chart Trends

CSI 2000 Index Trends

Today's decline was also significant, reaching 4.02%, closing at 1809.2 points, and breaking below the low point on April 16th. The index is currently in a clear downtrend, so one should not blindly bottom-fish for small-cap stocks in the short term. The index is now quite close to the gap below at 1740, and the next focus should be on whether this gap will be filled. From my perspective, it does not matter if it breaks below the previous low, but I do not want this gap to be filled; if it is, it would indicate weakness. Tomorrow, the offensive line will move to around 1860 points, and it is currently significantly deviated from this level.

Daily Chart Trends

The current pattern is quite similar to that of January 2019, when the market bottomed out and rebounded, leaving a gap at the bottom, which was followed by continuous weakening and a final adjustment that broke below the previous low. The gap was at 1424 points, and the lowest point before the significant rise was 1455 points, very close to the gap, but it was ultimately filled, and then a large rebound of about 45% ensued.

January 2019 Trends

From the analysis of the above indices, it is clear that there are not many good opportunities in the market now, as everything is in a downtrend. Therefore, I must once again remind those friends who are preparing to enter the market to bottom-fish, not to be impulsive, to avoid getting into a passive situation. For those who are deeply trapped in the market, I would like to comfort everyone and express my sympathy. The market has come to this point, and there is nothing more to say. It is no longer necessary to cut losses; if you want to stop losses, do it early and do not fall here. I still believe that this week will see a bottoming and rebound trend. All major indices are currently oversold. Looking at the trend of the CSI 2000, there is not much room to go down. Once the adjustment ends, I believe the strength of the rebound and repair will be significant, provided that we do not fall before the dawn.

Share Your Experience