Yesterday, the market continued to show weakness, with another significant decline. Nearly 5,000 individual stocks were in a downward trend, with many experiencing losses exceeding 5%. Retail investors suffered heavy losses, reaching a level that is almost unbearable to watch. The market's plunge at the end of the day triggered a wave of panic selling, indicating that confidence in the current market has been lost, and there is a complete lack of conviction. Can the market stabilize today? This is probably the most pressing question on everyone's mind. Significant changes have occurred in the market after hours, which are worth analyzing carefully, as they may provide the answers we are looking for.

Several positive changes emerged after the market closed:

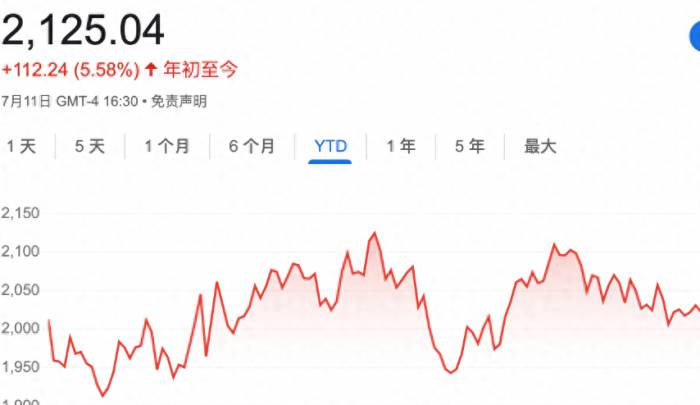

1. Despite the weakness in the U.S. stock market, Chinese concept stocks rebounded, with an increase of 1.35%, which is quite impressive. Importantly, they have once again crossed the white offensive line, and the line has started to turn upwards. This is the first time the offensive line has turned upwards since it turned downwards on May 21st, indicating a preliminary change in the downward trend, which is a very positive development. Based on past experience, Chinese concept stocks tend to bottom out and peak earlier than A-shares. The current signs of improvement in Chinese concept stocks are a positive signal for A-shares.

Daily chart trend:

2. The Hang Seng Index began to rebound quickly after the A-share market closed yesterday, changing from a 0.8% drop to a flat close. The index has not set a new low for five consecutive trading days, showing a significantly stronger trend than A-shares. From the recent trend, the Hong Kong stock market also leads the A-share market. If the Hong Kong market can stabilize, it will be beneficial for A-shares. Today, we will watch whether it can stand above 18,090 points; if it does, there is a possibility of a reversal in the short-term downward trend.

Daily chart trend:

3. The Singapore A50 Index rebounded with increased volume yesterday, which is a good sign. It is currently in a slightly positive state, fiercely contesting near the white offensive line at 12,163 points. The offensive line has temporarily turned upwards. If it can stand above this level today, the downward trend will be preliminarily changed. The A50 represents the trend of heavyweight stocks; if it can stabilize first, then there is not much room for the overall market to fall further.

Daily chart trend:

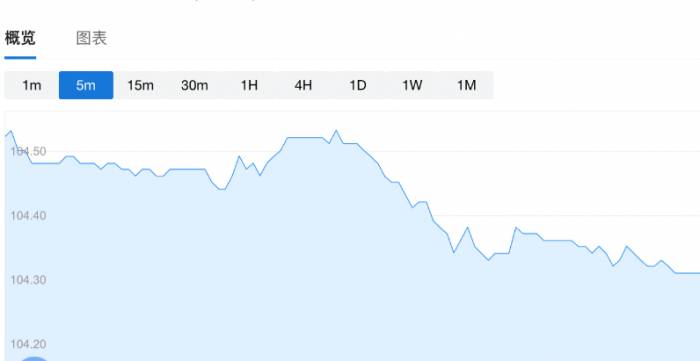

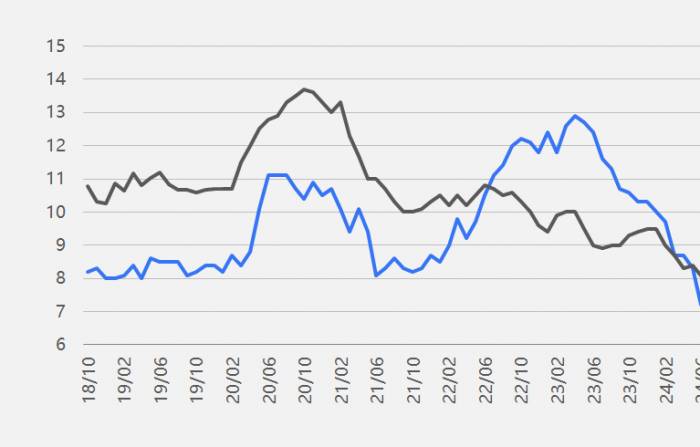

4. The U.S. dollar offshore RMB exchange rate has also continued to depreciate recently, from a low of 7.1657 on May 3rd to 7.2948 on June 24th. During this period, there was first a short-term peak for the large A-shares, followed by a continuous decline to the present, showing a very close relationship. An appreciation of the exchange rate does not necessarily lead to a rise, but depreciation will definitely put a lot of pressure on A-shares. From the short-term trend, there are signs of a short-term peak, with the MACD red column continuously shortening and the KDJ also forming a death cross downward. The cessation of the short-term depreciation trend in the exchange rate is also beneficial for A-shares.

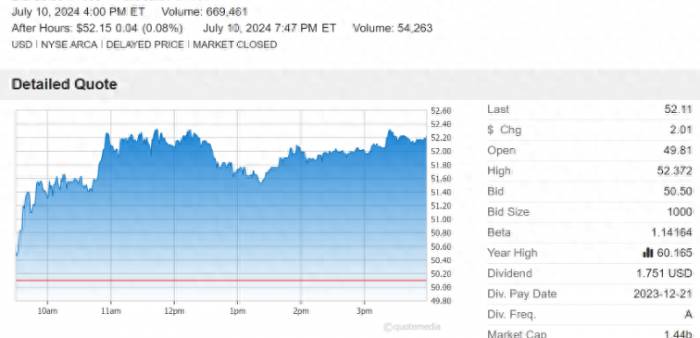

Daily chart trend:On June 24th, the trading volume of several leading broad-based ETFs continued to expand. Among them, the Huatai-Pineco CSI 300 ETF's single-day trading volume exceeded 7 billion yuan, leading the market with 7.315 billion yuan. The Southern Zhongzheng 500 ETF and the Huaxia SSE 50 ETF followed closely behind, with single-day trading volumes reaching 4.219 billion yuan and 3.123 billion yuan, respectively.

The major forces continued to buy in, having done so for two consecutive days. As I mentioned before, only the major forces have the capability to change the current market's downturn. However, based on past experiences, they do not immediately rebound as soon as they start to get involved in the market; they need to continue adjusting. So even though they began to intervene last Friday, the market continued to decline on Monday. But at least everyone can know one thing: they have started to move at this position, which gives some confidence, and the market will not fall endlessly.

How will the market perform on Tuesday, and how should retail investors respond?

After the market closed, there were still many positive factors in terms of news and the trends in related markets, which had a positive impact on today's market, preventing it from being as brutal as yesterday. Above 2950 points is a relatively important position; if this is completely lost, it is likely that the market will continue to probe the area near 2860 points, which would indicate a weaker trend. From the recent continuous involvement of the major forces, it seems they should not easily give up on this position.

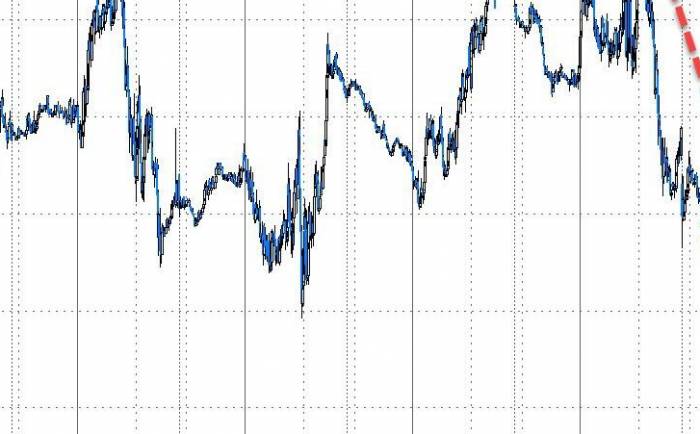

Additionally, the market is still in a downtrend, and investors outside the market should remain cautious and not blindly intervene. As can be seen from the chart below, during this continuous decline, the white attack line has always turned downward, and there has been no substantial change in the downtrend. When the white line begins to turn upward, the downtrend will start to change, and that is when it is safer to consider getting involved. Today, focus on whether the market can stand above 2990 points, which is above the white attack line; only by standing firm can there be a possibility of further rebound.

Shanghai Stock Exchange Index daily trend

Recently, there has been an increase in the voices of people closing their accounts, indicating that retail investors are very desperate. The market currently has no profit effect to speak of; everyone is continuously losing money. If someone has made up their mind to leave, then closing their account is also a correct choice, not giving themselves the opportunity to continue making mistakes. However, if you are deeply trapped and still holding on, there is no need to sell at this position and time. The opportunities are definitely greater than the risks ahead, and the market will not continue to shrink and fall endlessly. It is believed that the market will soon adjust thoroughly and start a new round of rebound.

Share Your Experience