The market has closed lower for six consecutive weeks, continuously in a downtrend, with trading volumes also continuously shrinking. The current market is very depressed, with no profit-making effect to speak of, and retail investors are losing patience day by day. Everyone hoped that some good news would be announced this week, but instead of good news, the resumption of IPO acceptance was what arrived, which further dampened the spirits of the retail investors. What impact does the resumption of IPOs have on the market? How will the market perform tomorrow? How should retail investors respond? Let's analyze this in detail to give everyone a clear understanding.

1. The IPO acceptance and review at the three major exchanges have all been fully resumed. On the evening of June 21, the Beijing Stock Exchange accepted the IPO applications of three companies, marking the resumption of IPO acceptance after a three-month hiatus. On the evening of June 20, the Shanghai and Shenzhen stock exchanges each accepted one IPO application, which was the first time in half a year that they have accepted IPOs. This also means that the IPO acceptance at the three major exchanges has been fully restored.

In the current market environment, the resumption of IPOs is perceived by retail investors as a bearish signal. Given the market's current state, isn't this just adding insult to injury? Objectively speaking, it does have a certain impact on sentiment, as the market is currently weak, and even good news may not be effective, let alone this kind of news. It's understandable that everyone feels pessimistic. However, the index has now fallen below 3,000 points, and at this time, it is hoped that everyone can remain rational and not be influenced by subjective emotions.

The resumption of IPOs should be viewed comprehensively. On one hand, since the implementation of the registration system, the speed of IPOs has significantly exceeded the past, and such supply has clearly exceeded the market's carrying capacity, with many companies having more or less certain issues. Therefore, after the new chairman took office, everyone has seen that many problematic stocks have been delisted, and there will definitely be more junk stocks facing the same fate. The China Securities Regulatory Commission (CSRC) is determined to address the issue of fraudulent listings this year. From a long-term perspective, this is a good thing. However, the compensation system has not kept up, leading to many innocent retail investors suffering significant losses, which is an urgent pain point that needs to be addressed. On the other hand, we say that a stable market cannot only delist without new listings; there are also many high-quality, high-growth technology companies that need to go public and raise funds in the market. If this continues to be halted, it is not a long-term solution.

The CSRC has also stated that the IPO is still in a tightening trend, so there is no need for everyone to feel as if facing a major enemy. It is believed that the regulatory authorities will grasp the degree well and maintain a dynamic balance, and the problem will not be too big. In terms of the current market size, for example, if two companies are delisted, one can be listed, or if three are delisted, one can be listed, until the total number is controlled to around 4,500-5,000 levels. I believe this is a good approach, which will not only prevent the market from becoming stagnant but also continuously improve the overall quality of listed companies, with the survival of the fittest.

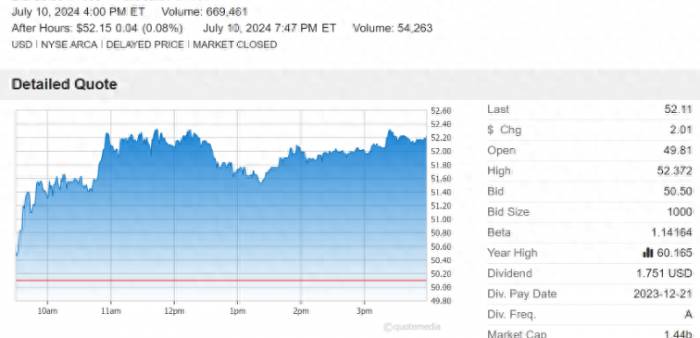

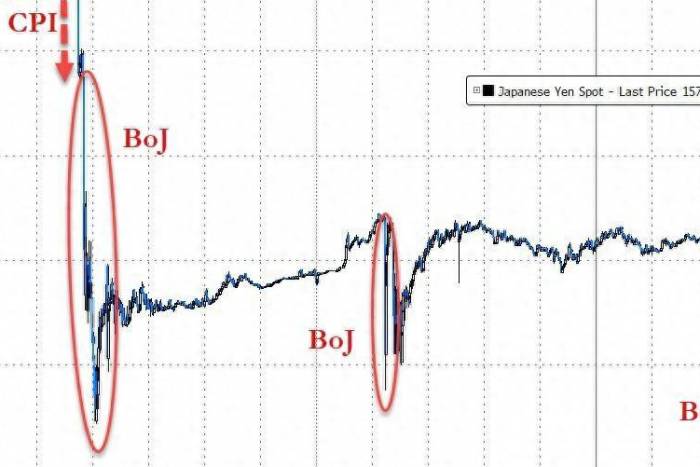

In addition, the resumption of IPOs has a positive impact on securities firms. If the market wants to break through in the future, the efforts of securities firms are indispensable. From the monthly trend line, when the index falls back to the green long-term trend line, it is at the bottom area. Historically, it can be said that more than 95% of the time is above the green trend line. The index is currently near this trend line, and the downward space is relatively limited, while the upward space is relatively large. There will definitely be a new round of market movements in the future, after all, the merger of securities firms is also in full swing.

Monthly trend line

2. Over the weekend, Kweichow Moutai once again attracted the market's attention due to two pieces of news: one is that self-made counterfeit Moutai was identified as genuine, and the other is that the wholesale reference price for 24-year-old Feitian Moutai bottles fell from 2,235 yuan the previous day to 2,140 yuan, a drop of nearly a hundred yuan in a single day.

The decline in Moutai's price should not come as a surprise to everyone, given the current environment, which I will not discuss in detail here. We will focus on analyzing the trend of the liquor sector for everyone. After looking at the sector's trend, you will also understand Moutai's trend.

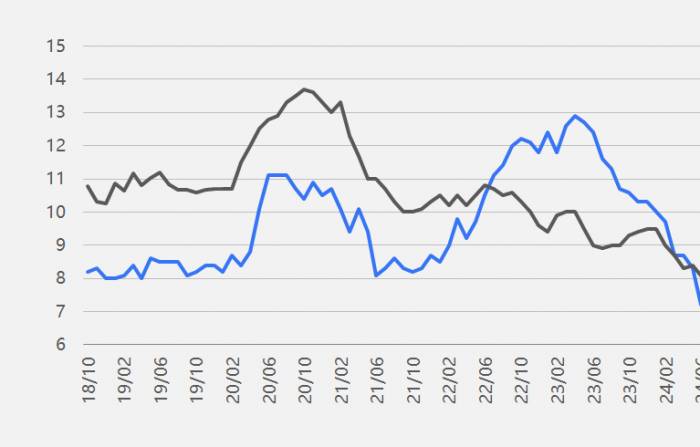

From a weekly perspective, the index is below all trend lines, and the downward trend is very clear. The major upward wave of the liquor sector started in March 2020 and lasted until June 2021, rising for more than a year, and then it has been continuously declining, with obvious main force selling. The sector is still in the process of bottoming out. At this time, from a medium to long-term perspective, it is not the time to get involved. Only when the index breaks through and stands firm above the green long-term trend line can the sector be considered to have improved, and it may start a new round of increases. The index is currently at 1,812 points, and the trend line above is currently near 2,334 points. There will still be oversold rebounds later, but whether it can truly strengthen will need to be seen at that time.Weekly Trend Analysis

How will the market perform on Monday?

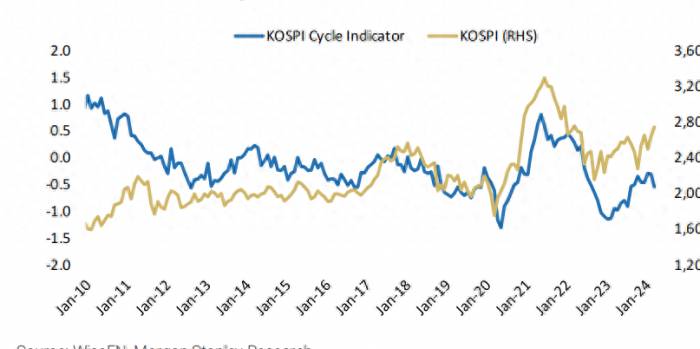

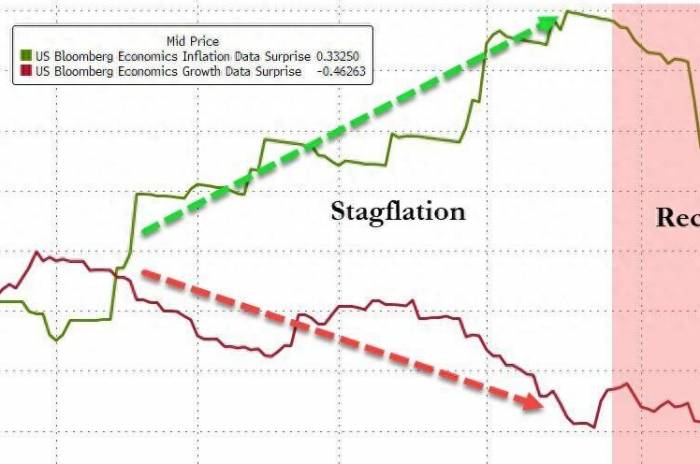

As of Friday's close, Chinese concept stocks continued to decline, and with the news over the weekend, it is reasonable that sentiment was affected. It is necessary for everyone to be prepared for continued market fluctuations and adjustments on Monday. Moreover, looking at the current trend, the index is below all trend lines, indicating a clear downtrend. The white offensive line has not turned upward either, which shows that the downtrend has not changed at all. The trend clearly tells us that we need to remain cautious. Tomorrow, on Monday, it is crucial to focus on whether the market can stand above 3010 points. If it holds, there is a possibility of reversing the current downward trend.

Daily Trend Analysis

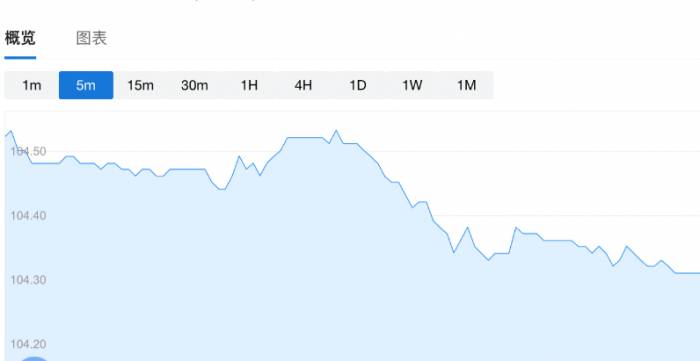

The market also saw some significant changes on Friday, such as a doji at the relative bottom with a trading volume of just over 620 billion, which is more than half of the maximum volume of 1.37 trillion since the bottom rebound. It has basically reached a point where it cannot shrink further. Coupled with the fact that large funds began to re-enter the market on Friday by buying ETFs, according to past experience, when the superpowers intervene, the downside is generally limited. Therefore, even if there is a temporary decline in the market on Monday, there is no need for excessive concern. Once the adjustment is in place, the market will continue to rebound upwards, and surpassing 3174 points should not pose a significant challenge.

Share Your Experience