The short-term "water-squeezing" effect on financial data continues to be released, with the growth rate of China's social financing continuing to decline in June, the decline in M1 money supply further expanding, and the increase in M2 also experiencing a slight retreat.

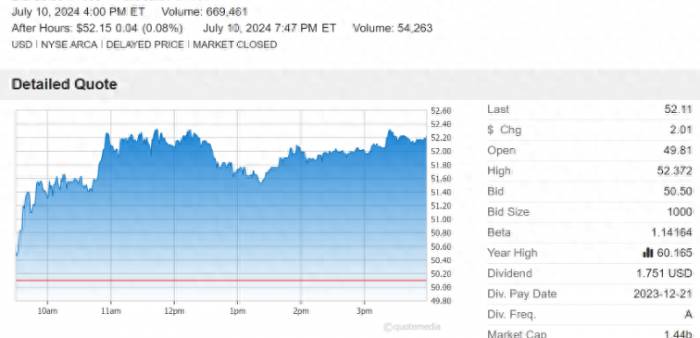

On Friday, July 12th, the People's Bank of China announced data showing that from January to June, China's social financing scale increased by 18.1 trillion yuan, compared to the previous value of 14.8 trillion yuan; new RMB loans increased by 13.27 trillion yuan, compared to the previous value of 11.14 trillion yuan; RMB deposits increased by 11.46 trillion yuan, with the previous value being 9 trillion yuan.

Based on the previous values calculated:

In June alone, new social financing increased by 3.3 trillion yuan, a significant rise from May's 2.07 trillion yuan. At the end of June, the stock of social financing was 395.11 trillion yuan, with the year-on-year growth rate declining to 8.1%.

In June, new RMB loans increased by 2.1 trillion yuan, a significant rise from May's 950 billion yuan.

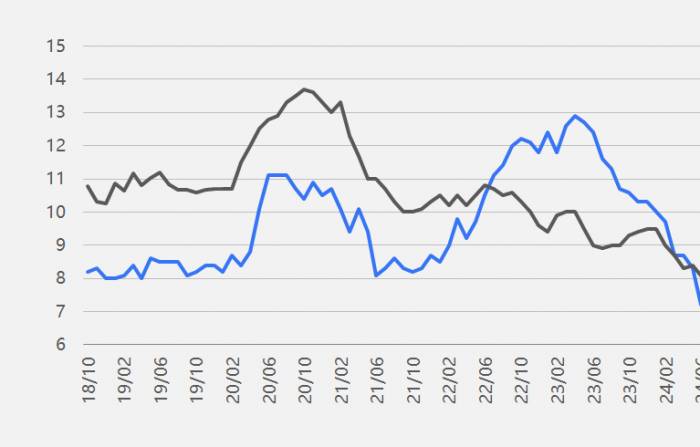

At the end of June, M2 money supply grew by 6.2% year-on-year, down from the previous 7%; M1 money supply fell by 5% year-on-year, down from the previous -4.2%. The M2-M1 spread was 11.2%, essentially flat with May.

Citing authoritative experts, the Securities Times indicated that the current slowdown in the growth rate of financial aggregate indicators should be viewed rationally. This is the result of a combination of factors such as weak effective financing demand, crackdown on capital arbitrage, bond market diversion of deposits, reduced supervision of deposits and loans by local governments, and economic structural transformation. There is a need to gradually reduce focus on financial aggregate indicators and pay more attention to the role of interest rate regulation.

Authoritative experts have stated that the current situation poses challenges for policy regulation. On one hand, there is an abundance of liquidity in the banking system, and on the other hand, there is weak effective credit demand. The large-scale diversion of deposits also significantly disrupts financial data, and monetary policy cannot solve this by simply "flooding" the market with liquidity. Moreover, with long-term bond rates already very low, the space for the central bank to further reduce interest rates to guide the overall financing costs of the real economy downward is also limited.

In June, new social financing of 3.3 trillion yuan was added, with government loans increasing by 850 billion yuan, and the year-on-year growth of social financing stock at 8.1%.

According to preliminary statistics from the central bank, the cumulative increase in social financing scale in the first half of 2024 was 18.1 trillion yuan, 3.45 trillion yuan less than the same period last year. Among them:RMB loans to the real economy increased by 12.46 trillion yuan, a decrease of 3.15 trillion yuan year-on-year;

Foreign currency loans to the real economy, converted into RMB, decreased by 8 billion yuan, a reduction of 162 billion yuan year-on-year;

Entrusted loans decreased by 91.7 billion yuan, an increase of 166 billion yuan year-on-year;

Trust loans increased by 309.8 billion yuan, an increase of 287 billion yuan year-on-year;

Undiscounted bank acceptance bills decreased by 236.5 billion yuan, an increase of 321.9 billion yuan year-on-year;

Net financing of corporate bonds was 1.41 trillion yuan, an increase of 237 billion yuan year-on-year;

Net financing of government bonds was 3.34 trillion yuan, a decrease of 3.93 billion yuan year-on-year;

Domestic equity financing for non-financial corporations was 121.4 billion yuan, a decrease of 338.2 billion yuan year-on-year.

Focusing solely on June, the social financing scale increased by 3.3 trillion yuan, of which, RMB loans to the real economy increased by 2.2 trillion yuan, corporate bonds increased by 210 billion yuan, and government loans increased by 850 billion yuan.

Preliminary statistics from the central bank show that at the end of June 2024, the stock of social financing was 395.11 trillion yuan, a year-on-year increase of 8.1%, with the growth rate slightly lower than that of May. Among them:The balance of Renminbi loans to the real economy was 247.93 trillion yuan, a year-on-year increase of 8.3%; the balance of foreign currency loans to the real economy, converted into Renminbi, was 1.66 trillion yuan, a year-on-year decrease of 12.2%;

The balance of entrusted loans was 11.18 trillion yuan, a year-on-year decrease of 1.3%; the balance of trust loans was 4.21 trillion yuan, a year-on-year increase of 11.8%; the balance of undiscussed bank acceptance bills was 2.25 trillion yuan, a year-on-year decrease of 18.2%;

The balance of corporate bonds was 32.02 trillion yuan, a year-on-year increase of 2.2%; the balance of government bonds was 73.13 trillion yuan, a year-on-year increase of 15%; the balance of non-financial enterprises' domestic stock was 11.55 trillion yuan, a year-on-year increase of 4.1%.

In terms of structure:

At the end of June, the balance of Renminbi loans to the real economy accounted for 62.8% of the stock of social financing at the same period, 0.2 percentage points higher than the same period last year; the balance of foreign currency loans to the real economy, converted into Renminbi, accounted for 0.4%, 0.1 percentage points lower than the same period last year;

The balance of entrusted loans accounted for 2.8%, 0.3 percentage points lower than the same period last year; the balance of trust loans accounted for 1.1%, 0.1 percentage points higher than the same period last year; the balance of undiscussed bank acceptance bills accounted for 0.6%, 0.2 percentage points lower than the same period last year;

The balance of corporate bonds accounted for 8.1%, 0.5 percentage points lower than the same period last year; the balance of government bonds accounted for 18.5%, 1.1 percentage points higher than the same period last year; the balance of non-financial enterprises' domestic stock accounted for 2.9%, 0.1 percentage points lower than the same period last year.

In June, M2 decreased to 6.2%, and the decline of M1 expanded to 5%

At the end of June, the balance of broad money (M2) was 305.02 trillion yuan, a year-on-year increase of 6.2%, down from 7% in May. The balance of narrow money (M1) was 66.06 trillion yuan, a year-on-year decrease of 5%, compared to -4.2% in April.

The M2-M1 spread was 11.2%, basically flat with May.At the end of June, the balance of currency in circulation (M0) was 11.77 trillion yuan, a year-on-year increase of 11.7%.

In the first half of the year, cash was net injected by 429.2 billion yuan.

In the first half of the year, RMB loans increased by 13.3 trillion yuan, with short-term loans increasing by 3.1 trillion yuan.

At the end of June, the balance of local and foreign currency loans was 255.32 trillion yuan, a year-on-year increase of 8.3%. The balance of RMB loans at the end of the month was 250.85 trillion yuan, a year-on-year increase of 8.8%.

In the first half of the year, RMB loans increased by 13.27 trillion yuan. By sector:

Household loans increased by 1.46 trillion yuan, of which, short-term loans increased by 276.4 billion yuan, and long-term loans increased by 1.18 trillion yuan;

Enterprise (institutional) unit loans increased by 11 trillion yuan, of which, short-term loans increased by 3.11 trillion yuan, long-term loans increased by 8.08 trillion yuan, and bill financing decreased by 34.4 billion yuan; non-bank financial institution loans increased by 38.89 billion yuan.

At the end of June, the balance of foreign currency loans was 627.2 billion US dollars, a year-on-year decrease of 12%. In the first half of the year, foreign currency loans decreased by 29.2 billion US dollars.

In the first half of the year, RMB deposits increased by 11.46 trillion yuan, with household deposits increasing by 9.27 trillion yuan.

At the end of June, the balance of local and foreign currency deposits was 301.68 trillion yuan, a year-on-year increase of 6%. The balance of RMB deposits at the end of the month was 295.72 trillion yuan, a year-on-year increase of 6.1%.In the first half of the year, the increase in RMB deposits was 11.46 trillion yuan. Among this, household deposits increased by 9.27 trillion yuan, non-financial corporate deposits decreased by 1.45 trillion yuan, fiscal deposits decreased by 243.4 billion yuan, and deposits of non-banking financial institutions increased by 2.21 trillion yuan.

At the end of June, the balance of foreign currency deposits was 836.5 billion USD, a year-on-year decrease of 0.1%. In the first half of the year, foreign currency deposits increased by 38.7 billion USD.

In June, the monthly weighted average interest rate for interbank RMB market borrowings was 1.87%.

In the first half of the year, the total turnover of the interbank RMB market through borrowing, spot transactions, and repurchase agreements was 1044.8 trillion yuan, with an average daily turnover of 8.49 trillion yuan, a year-on-year increase of 3%. Among this, the average daily turnover of borrowings decreased by 30.8% year-on-year, the average daily turnover of spot transactions increased by 37.9% year-on-year, and the average daily turnover of pledged repurchase transactions decreased by 0.3% year-on-year.

In June, the weighted average interest rate for borrowings was 1.87%, which was 0.02 percentage points higher than the previous month and 0.3 percentage points higher than the same period last year. The weighted average interest rate for pledged repurchase transactions was 1.89%, which was 0.07 percentage points higher than the previous month and 0.22 percentage points higher than the same period last year.

The balance of the country's foreign exchange reserves was 3.22 trillion USD.

At the end of June, the balance of the country's foreign exchange reserves was 3.22 trillion USD. At the end of June, the exchange rate of the RMB was 7.1268 RMB per 1 USD.

In the first half of the year, the amount of cross-border RMB settlement under the current account was 7.71 trillion yuan. In the first half of the year, the amount of cross-border RMB settlement under the current account was 7.71 trillion yuan, of which goods trade, service trade, and other current items were 5.89 trillion yuan and 1.82 trillion yuan, respectively; the amount of cross-border RMB settlement for direct investment was 4.13 trillion yuan, of which outward direct investment and foreign direct investment were 1.43 trillion yuan and 2.7 trillion yuan, respectively.

Share Your Experience