On Monday, the Japanese stock market opened with a significant drop. The Nikkei 225 index saw its decline expand to 3% at one point, and as of press time, the drop stood at 2.97%. The South Korean stock market also plummeted, with the KOSPI index falling 1.36% as of press time.

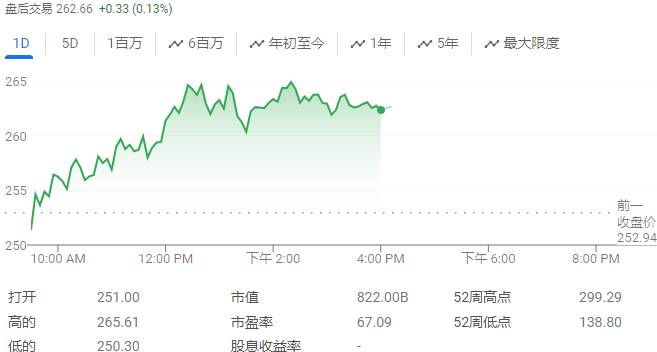

U.S. stocks also experienced a significant decline.

Last Friday, U.S. stocks had already seen a substantial drop.

The Dow Jones Industrial Average fell by 1.01%, the S&P 500 index fell by 1.73%, and the Nasdaq Composite fell by 2.55%. Amazon dropped by 3.65%, and American Express fell by 3.08%, leading the Dow Jones decline. Tesla plummeted by 8.45%, and Nvidia fell by 4.09%. Most Chinese concept stocks declined, with Legend Biotech falling by 10.66%, and Zeekr dropping by 9.78%.

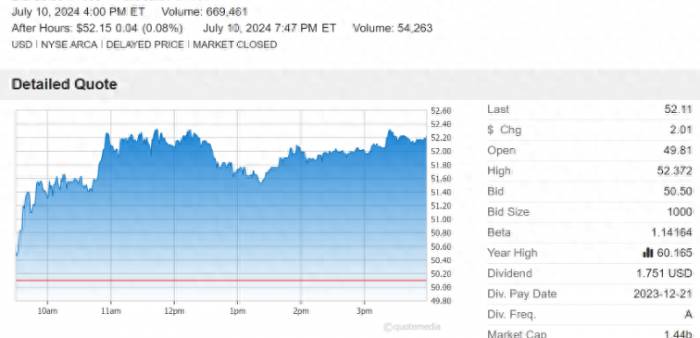

After a significant drop on Friday, gold, silver, and crude oil rebounded slightly at the opening on Monday.

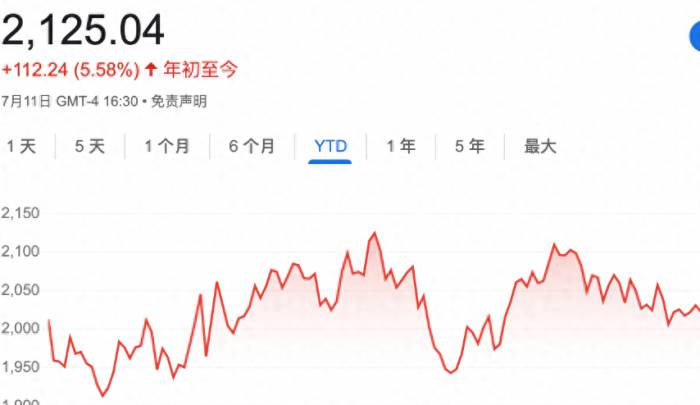

The panic index soared.

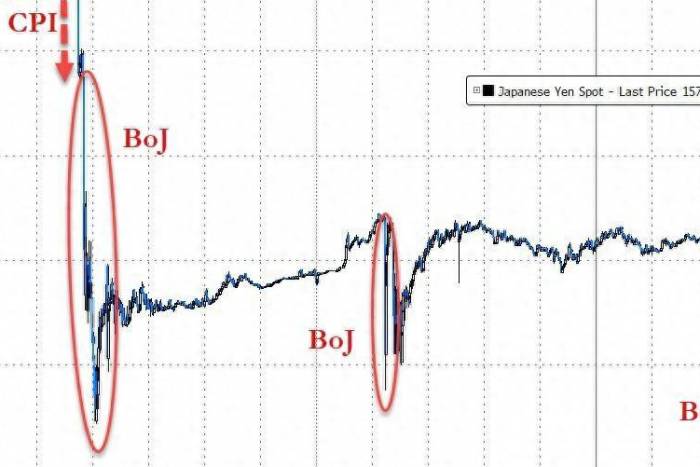

In terms of news, the U.S. non-farm data released does not support a substantial interest rate cut by the Federal Reserve in September, and the Fed remains tight-lipped about the extent of the rate cut; the Bank of Japan also indicated a possibility of raising interest rates; and Warren Buffett has started to sell off a large amount of stocks again. These three pieces of information have led to a surge in the global panic index.

The U.S. released its non-farm data for August, with the Bureau of Labor Statistics showing that the U.S. non-farm payroll employment increased by 142,000 people in August, estimated to increase by 165,000, and the previous value was an increase of 114,000. The employment growth in August is consistent with the average employment growth in recent months but is below the average monthly increase of 202,000 in the previous 12 months.

Federal Reserve "third in command" John Williams stated that it is appropriate to lower the federal funds rate now, expressing more confidence in the sustainable convergence of the inflation rate towards 2%, and that policy can gradually move towards a more neutral direction.

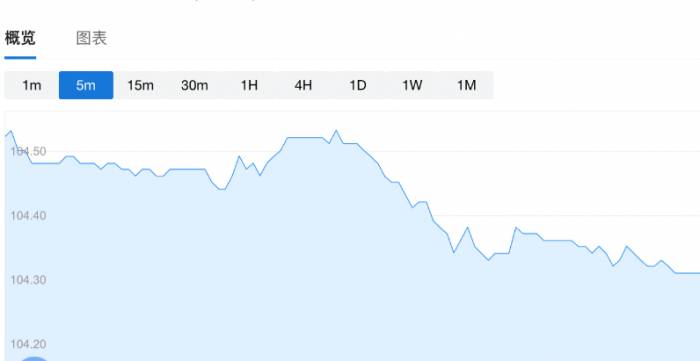

Williams also indicated that the labor market is unlikely to trigger inflationary pressures. However, Williams did not comment on the possible extent of the first interest rate cut.Since September, the Chicago Board Options Exchange Volatility Index (VIX) has surged, spiking approximately 49% last week. As the interest rate decision meeting approaches, it seems that investors need to seek more definitive information and confidence from the economic outlook and the Federal Reserve's monetary policy to determine whether the volatility risks have been fully released.

Buffett Sells More Stocks

Entering September, Buffett's pace of selling Bank of America shares did not slow down. Berkshire Hathaway reduced its holdings in Bank of America shares on September 3rd, 4th, and 5th, 2024, over three consecutive trading days, totaling 18.746 million shares and realizing about $760 million.

According to statistics, since Berkshire began selling Bank of America shares on July 17th, it has realized a total of approximately $6.97 billion.

Judging by Buffett's habits, when he starts selling a stock, he will eventually sell all of his holdings in that stock. Moreover, in recent years, Berkshire has completely sold off shares in several banks, including U.S. Bancorp, Wells Fargo, and BNY Mellon.

Market analyst and TheStreetPro columnist Doug Kass expressed concern about Buffett's stock selling strategy, especially the reduction in holdings of Apple and Bank of America, which were considered to be "permanent holdings."

A-Shares Have Bottom Conditions

In terms of A-shares, many securities analysts believe that the market has bottom conditions, and there is significant room for a rebound in the future market.

Galaxy Securities analysts believe that there is significant room for a rebound in the A-shares market.

The current valuation of the A-shares market is still at a historically low to mid-level, indicating significant room for a rebound. Looking ahead, in terms of A-shares allocation: the 2024 semi-annual report performance shows that the financial sector's performance has improved beyond expectations, and financial stocks have a high dividend rate. The current acceleration of financial mergers and acquisitions is expected to continue outperforming the entire A-share market. In September, new products in the consumer electronics industry will be unveiled, which is expected to drive the outbreak of related thematic market trends. U.S. manufacturing activity remains in a contraction range, and the vitality of the U.S. job market further weakens. The expectation of a rate cut in September is heating up, and the rate-cutting cycle is expected to begin. It is recommended to pay attention to A-share industries that may benefit from the Federal Reserve's rate cuts.CICC's research report indicates that the market is showing many characteristics of a bottom.

The market is exhibiting numerous characteristics of a bottom, yet the restoration of confidence still requires the support of more positive factors. Looking ahead, despite the presence of numerous suppressive factors both internally and externally in the near term, the market itself is within a value range, and attention should be paid to the marginal changes of positive factors during the index adjustment period. Recently, the market has already possessed some characteristics of a bottom: the turnover rate of A-shares, calculated based on free float market value, has dropped to a historically low level of 1.5%; in terms of valuation, the dividend yield of the CSI 300 is 1.1 percentage points higher than the interest rate of 10-year government bonds, and the valuation of the CSI 300 index is near the historical bottom one standard deviation, making the market quite attractive in terms of valuation; the catch-up decline of strong stocks is also a common phenomenon at historical stage bottoms. Subsequently, attention should be paid to the progress of fiscal expenditure and the marginal impact of the Federal Reserve's interest rate cuts on China's monetary policy, exchange rate, and capital market.

In terms of allocation, the dividend sector's attractiveness has increased after adjustment, and it is currently necessary to place greater emphasis on the fundamentals of the molecular end and the sustainability of dividends; since mid-July, consumer electronics, semiconductors, and others have all adjusted by more than 10%, with valuations not being high, coupled with the possibility of more news-driven catalysts in the consumer electronics sector recently, there may be a stage of market activity; focus on the field of technological innovation, especially sectors with industrial autonomy logic; the export chain and globally priced resources have been affected by overseas fluctuations and may experience some differentiation after a short-term correction.

SWHY analysts believe that the market will continue to be weak.

In the short term, economic data verification is weak, and the direction of the second-quarter report performance verification that strengthens the prosperity expectation is very few. Before there is a significant change in policy expectations, the market may continue along its original path. At this stage, the policy statements of the management do not support the fermentation of particularly optimistic policy expectations, and the market's policy game is still cautious. Setting aside all the complex discussions, the short-term environment faced by A-shares is weak fundamentals + vague policy expectations. The original path of the market is weak and volatile.

The third-quarter report for consumer services may more reflect the decline in demand (which was not fully reflected in the second-quarter report), the appreciation of the renminbi, and the export chain's current revenue may face further pressure. Coupled with the high base of the third-quarter report, under the existing path, the profit growth rate of the third-quarter report may further decline. In this situation, to break through the market's original path, there needs to be a significant change in policy expectations, especially in monetary policy. At this stage, the central bank's statements support a loose direction, but the statements related to the magnitude and strength are still restrained. It does not support particularly optimistic policy expectations. The market's policy game is still cautious. In the stage where the fundamentals are weak, and the visibility of policy formulation, implementation, and effectiveness is low, the market will continue to be weak.

Share Your Experience