Learning about speculative capital, are you learning in the right direction?

The master of traditional Chinese painting, Qi Baishi, once said: "Those who learn from me will live, those who imitate me will die." The secrets of success for many experts actually conceal a "technological moat." When you blindly copy the other party's successful routines, you often end up in a dead end. For example, those who imitate Ji Gong by drinking and eating meat have fallen into the path of evil, and those who learn from large capital to layout and control the market have ended up in a dire situation.

What do small capital investors really need to learn? Xu Xiang once provided a clear answer: follow the trend.

In this "Supreme Commander" series, we will interpret the "follow the trend" philosophy of this top trader based on Xu Xiang's essence speech inside Zexi. Those who want to follow the big players to make a profit and do not want to be "slaughtered" by the big players must read this article carefully!

1. The "follow the trend" logic of the "Supreme Commander".

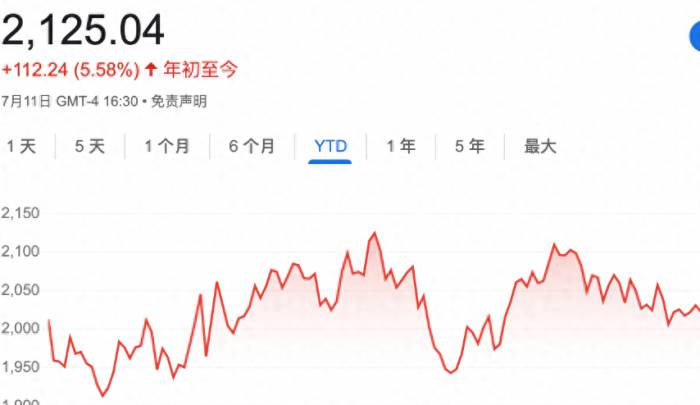

As the "speculative capital macro view" is seen more and more, some novice retail investors often fall into such a trading "misunderstanding": they learn from top speculative capital to try to control the market, seriously interpret the big trend, and invest a small amount of capital to test the market. In the end, after testing, the chips in hand become less and less, and when the real opportunity comes, they can only sigh in the wind.

When deeply discussing the overall trend of stocks, the Supreme Commander Xu Xiang pointed out sharply that no matter the size of the capital, the essence of trading is "following the trend", but the logic of following the trend for large and small capital is fundamentally different.

1. The two key points of large capital following the trend are beyond the reach of retail investors.

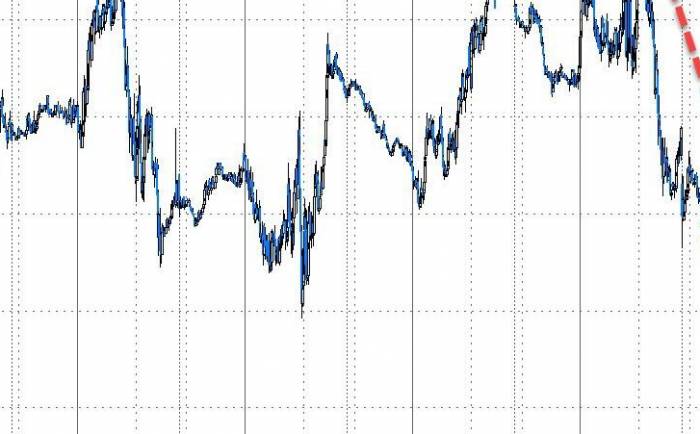

Regarding large capital following the trend, Xu Xiang listed three general steps: first, predict the possible position of the opportunity; the second step is to infiltrate the corresponding sector stocks, try to ignite and lift, and stimulate market sentiment; when the bullish sentiment is aroused, large capital should prepare to sell.

The above steps seem concise and feasible. But why is it said that small capital retail investors will suffer great losses by learning them? Because it has two shortcomings that retail investors are naturally unable to do well.First and foremost, it is the foresight of market trends. This is the top priority for large capital to follow the trend. If the trend is not accurately identified, no matter how much more capital is invested in the subsequent steps, it would be a waste of effort. Experts in detecting market trends often mobilize a significant amount of manpower and resources. There are also those who act alone, but this is limited to a few geniuses with exceptional talents and innate market insight.

Second, the ability to activate market trends. As mentioned in previous articles, the market's reaction to trends is relatively slow. The intention of large capital speculation is to accelerate the market's perception of trends through actions such as lifting and horizontal shaking, and then they can reap the first wave of substantial profits.

2. Small capital should not act prematurely!

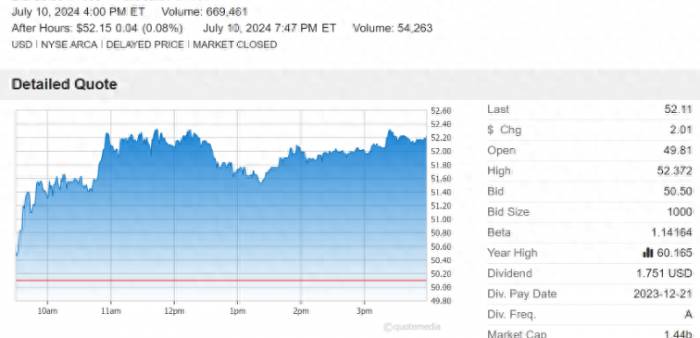

All of the above requires a vast amount of capital and a wide range of information channels. As repeatedly mentioned in previous articles, these are the asymmetric advantages that large capital has over small retail investors. Small capital does not possess these advantages, and thus is destined to be unstable when implementing the aforementioned three steps. So, how should small capital operate? Xu Xiang has provided a clear path: follow the trend.

It is important to note that the "master" refers to following the trend, not buying "trend-following stocks." Instead, it means identifying where the trend is and immediately chasing after it. As soon as the capital position rises slightly, withdraw immediately and wait quietly for the arrival of the next trend.

In summary, omit all the steps that cannot be done or done poorly, concentrate efforts on studying the wisdom of "catching the trend," and to use a common saying: "Do not release the hawk until you see the hare." This is the core method for small capital to seek survival and ensure profitability.

II. The key essence of "going with the flow."

Looking back at the "master's" method of following the trend, do you have new insights into the stock market?

When teaching his disciples, Guiguzi once expressed a similar view: the lower class relies on momentum, the middle class borrows momentum, and the upper class creates momentum. Striving from the bottom up, there is an emphasis on creativity and inspiration, but even more so on rules and thought processes.

If the lower class does not rely on momentum and is unwilling to look up and see where the "momentum" that suits you is, then you will not be able to break through the lower bottleneck; similarly, if the middle class does not borrow momentum and always wants to create their own momentum to ascend, they are also destined to be suppressed by the "strong and heavy" momentum of the upper class.The so-called "going with the flow," what exactly is the "flow" that one should follow? Everyone's algorithm is different, and it must not be casually interchanged. Recognizing what scenery one should observe and which part of the money one should earn is the key essence of "going with the flow."

Finally, a reminder once again, for those with small capital, it is still too early to learn about lurking and strategizing. Focusing on studying established trends and then rushing to take advantage of them—just doing this small thing well is enough to allow you to gradually become stronger and stronger!

Share Your Experience