Following an unexpected increase in mining taxes by Kazakhstan, the world's largest uranium producer, uranium mining stocks have soared.

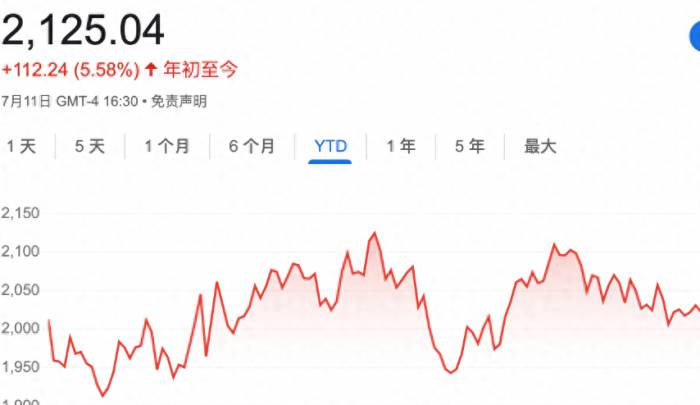

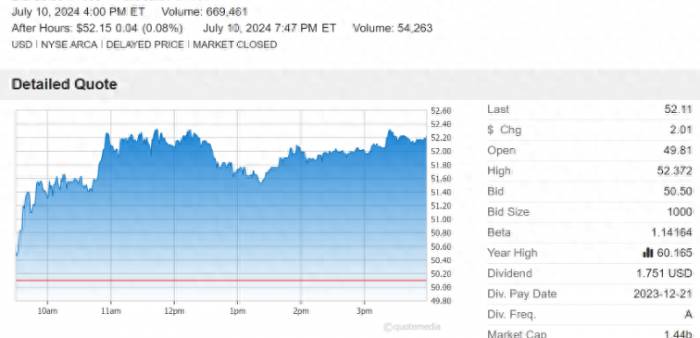

On Thursday, the largest uranium mining ETF, Sprott Uranium Miners, showed strong performance, closing at $52.11 on the US stock market, up $2.01 from the previous day, a 4.01% increase.

Kazakhstan Increases Uranium Mining Tax

The most direct reason for the surge in uranium mining stocks is Kazakhstan's decision to raise taxes on uranium mining. As the world's largest uranium producer, Kazakhstan accounted for as much as 45.96% of the global natural uranium output in 2021.

On the 10th, President Kassym-Jomart Tokayev signed new tax legislation amendments. According to the new regulations, the new mineral extraction tax (MET) will increase from 6% in 2025 to 9%.

However, the most significant change is that, starting from 2026, the government has introduced a two-tier MET calculated based on production and spot uranium prices (see table below).

This move could significantly affect the supply landscape of the uranium market. BMO analyst Alexander Pearce has calculated the potential impact on the cash flow of Samruk-Kazyna's subsidiary Kazatomprom, the world's largest uranium producer:

The new MET could potentially affect Kazatomprom's NPV10% by 5-10%, impact the EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) for 2025 by up to 5%, and from 2026 onwards, the EBITDA impact could be 8-12%.

More importantly, he warns that the new MET provides less incentive for uranium mining companies to increase production, as the impact of the additional tax on corporate profits outweighs the potential benefits of increased production.

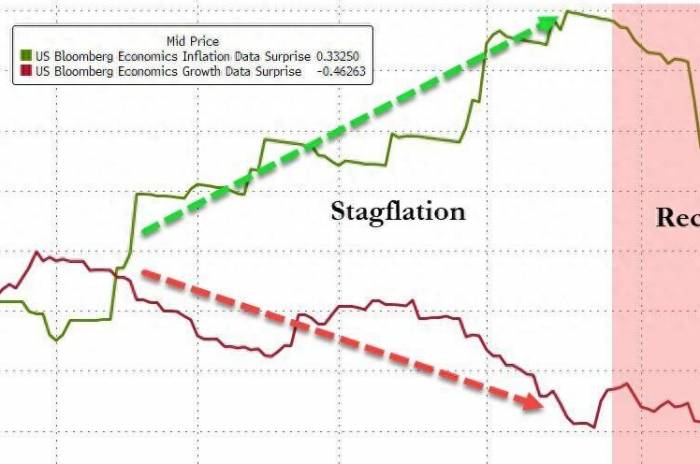

Therefore, this policy may limit the growth of uranium production, thereby supporting the rise in uranium prices.The global distribution of uranium reserves is uneven, and bans by the US and Russia exacerbate supply and demand tensions.

Currently, the global demand for uranium is on the rise. As the primary fuel for nuclear power plants, its clean, stable, and safe characteristics have made it increasingly important in global energy planning. In 2023, the spot price of uranium began to rise rapidly, becoming one of the most outstanding performing energy commodities of the year.

At present, the distribution of global reserves is not uniform, mainly located in countries such as Australia, Kazakhstan, Canada, and Russia. Among them, Kazakhstan's proven uranium mines are dominated by low-cost mining, with uranium mines costing less than $130 accounting for 70% of the country's reserves.

The current instability of the international situation further increases the uncertainty of uranium production and prices, adding risks to the global supply chain. In May 2024, US President Biden officially signed a bill prohibiting the import of unirradiated low-enriched uranium produced in Russia. If Russia takes counter-sanction measures, the global uranium enrichment capacity will face a greater shortage and supply-demand mismatch.

Share Your Experience